https://www.youtube.com/watch?v=ybA8Wge5Xz4?start=3056 During his recent interview with Tobias, Eddy Elfenbein, who owns the popular investing blog Crossing Wall Street Blog, discusses why investors should look for companies that have a pseudo-monopoly. Here’s an excerpt from the interview: Tobias Carlisle: Let’s talk about some individual names on your Buy List. One is … Read More

Finding High Quality Stocks Starts With The World’s Simplest Valuation Measure

https://www.youtube.com/watch?v=ybA8Wge5Xz4?start=803 During his recent interview with Tobias, Eddy Elfenbein, who owns the popular investing blog Crossing Wall Street Blog, discusses how investors can find high quality stocks using the world’s simplest valuation metric. Here’s an excerpt from the interview: Tobias Carlisle: So while you don’t describe yourself as a value … Read More

(Ep.23) The Acquirers Podcast: Eddy Elfenbein – Buy List, Fundamentally Sound, High Earnings Quality

Summary In this episode of The Acquirer’s Podcast Tobias chats with Eddy Elfenbein. He is proprietor of the popular investing blog Crossing Wall Street Blog, and he’s also the portfolio manager for the CWS ETF. During the interview Eddy provided some great insights into: – How To Construct A Buy List – … Read More

Investors Should Consider Permanently Allocating 5-10% Of Their Portfolio Into Gold

https://www.youtube.com/watch?v=Fthp2PYU0WI?start=3522 During his recent interview with Tobias, Zach Abraham, who runs Bulwark Capital Management and has a radio show called Know Your Risk Radio, discusses why investors should consider permanently allocating 5-10% of their portfolio to gold. Here’s an excerpt from the interview: Tobias Carlisle: Well, let’s talk a little … Read More

Here’s Why Fixed Indexed Annuities Should Be Considered As An Alternative To Bonds

https://www.youtube.com/watch?v=Fthp2PYU0WI?start=2557 During his recent interview with Tobias, Zach Abraham, who runs Bulwark Capital Management and has a radio show called Know Your Risk Radio, discusses why investors should consider fixed indexed annuities as an alternative to bonds saying: Zach Abraham: Now, we still use fixed income and we have as … Read More

(Ep.1) Acquirers Active: $IRTC Short, Kerrisdale’s Short Thesis On Irhythm Technologies

Summary In this episode of Acquirer’s Active Tobias chats with Sahm Adrangi and David Cohen of Kerrisdale Capital about their short thesis on Irhythm Technologies Inc (NASDAQ: IRTC). iRhythm Technologies Inc is a commercial-stage digital healthcare company redefining the way cardiac arrhythmias are clinically diagnosed by combining wearable biosensing technology … Read More

To Infinity and Beyond Meat – Keep Your Head When All About You Are Losing Theirs

https://www.youtube.com/watch?v=Fthp2PYU0WI?start=409 During his recent interview with Tobias, Zach Abraham, who runs Bulwark Capital Management and has a radio show called Know Your Risk Radio, discussed the importance of keeping your head while investing when all about you are losing theirs saying: Zach Abraham: Yeah, I think you and I talked … Read More

(Ep.22) The Acquirers Podcast: Zach Abraham – Known Risks, Value, Activism And 60/40 Bond Alternatives

Summary In this episode of The Acquirer’s Podcast Tobias chats with Zach Abraham who runs Bulwark Capital Management and has a radio show called Know Your Risk Radio. During the interview Zach provided some great insights into: – What Was It Like To Grow Up In A Brokerage Firm – … Read More

The Graham Two Factor Model Still Provides Great Returns Today

https://www.youtube.com/watch?v=gJoyXVvvbdc?start=2178 During his recent interview with Tobias, Tim Melvin, who is a 31 year veteran of the financial services industry, discusses how the Graham Two Factor Model still provides great returns today. Here’s an excerpt from the interview: Tobias Carlisle: Right. Got it. Talk to us about the Graham two … Read More

The Best Returns Can Be Found In Small Illiquid Value Stocks

https://www.youtube.com/watch?v=gJoyXVvvbdc?start=1786 During his recent interview with Tobias, Tim Melvin, who is a 31 year veteran of the financial services industry, discusses how the best returns can be found in small illiquid stocks. Here’s an excerpt from the interview: Tobias Carlisle: A lot of the positions we’ve been discussing so far … Read More

There’s Two Places In The Market Where Book Value Is Still The Best Metric For Valuation

https://www.youtube.com/watch?v=gJoyXVvvbdc?start=1161 During his recent interview with Tobias, Tim Melvin, who is a 31 year veteran of the financial services industry, discusses the two places in the market where book value is still the best metric. Here’s an excerpt from the interview: Tobias Carlisle: That’s spoken like a true deep value investor. … Read More

(Ep.21) The Acquirers Podcast: Tim Melvin – Financial Value, Graham And Schloss Meets Kravis In Financials

Summary In this episode of The Acquirer’s Podcast Tobias chats with Tim Melvin who is a 31 year veteran of the financial services industry, as a broker, advisor, and a portfolio manager. During the interview Tim provided some great insights into: – How Does A High School Drop-Out Get Started … Read More

Investors Can Bundle Multiple Trend Strategies To Smooth Out Returns And Reduce Volatility

https://www.youtube.com/watch?v=pEX-UlEfEBU?start=3272 In his recent interview with Tobias, Adam Butler, CIO of ReSolve Asset Management discusses how investors can bundle multiple trend strategies to smooth out earnings and reduce volatility over time. Here’s an excerpt from the interview: Tobias Carlisle: So then how do you then work out how much you … Read More

Why Do Investors, That Are Given Proven Strategies That Work, Still Underperform

https://www.youtube.com/watch?v=pEX-UlEfEBU?start=1452 In his recent interview with Tobias, Adam Butler, CIO of ReSolve Asset Management discusses why investors that are given proven strategies that work, still underperform. Here’s an excerpt from the interview: Adam Butler: Absolutely. And I just love the story of … Oh, what was his name? Greenblatt, right? … Read More

(Ep.20) The Acquirers Podcast: Adam Butler – Adaptive Assets, The Philosophy Of Robust Quant

Summary In this episode of The Acquirer’s Podcast Tobias chats with Adam Butler, CIO of ReSolve Asset Management. Adam has developed a number of adaptive strategies that are designed to strive in changing environments and he is the author of Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good … Read More

Investors Can Find Some Of The Best Opportunities In The Smallest Listed Companies

https://www.youtube.com/watch?v=CLqepjONgtk?start=2669 During his recent interview with Tobias, Adrian Saville, CEO and founder of Cannon Asset Managers in South Africa, discusses how investors can find some of the best opportunities in the smallest listed companies. Here’s an excerpt from the interview: Tobias Carlisle: So, tell us a little bit about Indequity, … Read More

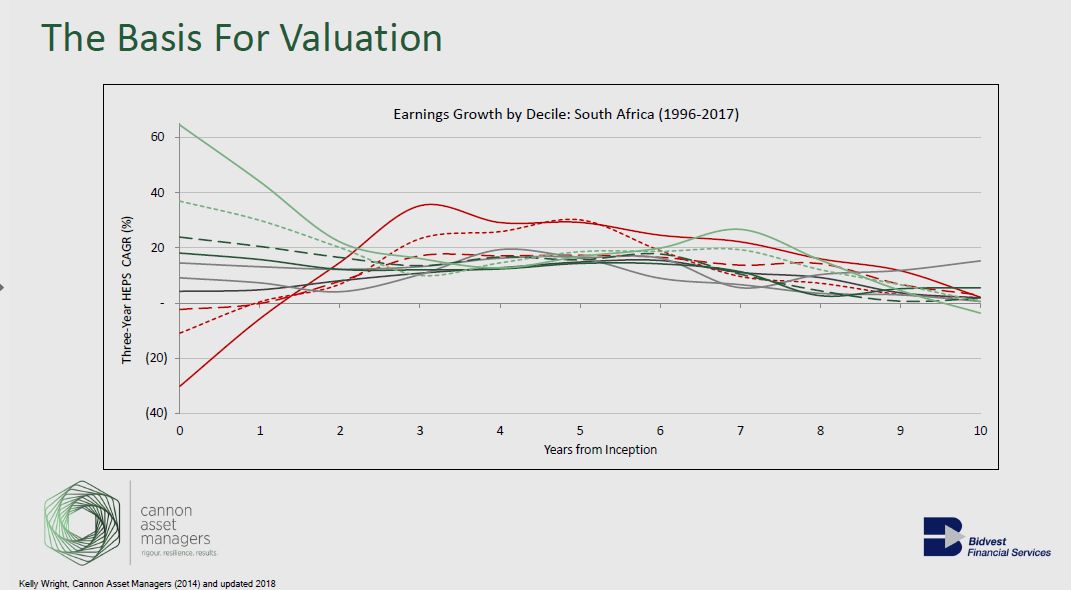

The One Reason Mean Reversion Is So Powerful – This Too Shall Pass!

https://www.youtube.com/watch?v=CLqepjONgtk?start=2896 During his recent interview with Tobias, Adrian Saville, CEO and founder of Cannon Asset Managers in South Africa, discusses why mean reversion is such an important factor in investing. Here’s an excerpt from the interview: Tobias Carlisle: And, some of that marketing collateral you sent through to me, just … Read More

What Are The Four Attributes Necessary To Create A Successful ‘SuperDogs’ Portfolio

https://www.youtube.com/watch?v=CLqepjONgtk?start=454 During his recent interview with Tobias, Adrian Saville, CEO and founder of Cannon Asset Managers in South Africa, discusses the four attributes necessary to create a successful ‘SuperDogs’ portfolio. Here’s an excerpt from the interview: Adrian Saville: Sure, so the first attribute is to look for value in an … Read More

(Ep.19) The Acquirers Podcast: Adrian Saville – SuperDogs, Deep Value Investing In South Africa

Summary In this episode of The Acquirer’s Podcast Tobias chats with Adrian Saville, who is the CEO and founder of Cannon Asset Managers in South Africa. Since the mid-1990’s Adrian has been running portfolios full of unloved but good businesses which have returned an average of 19.8%. During the interview he … Read More

How To Find Great Investment Opportunities In Closely Held Micro-Caps

https://www.youtube.com/watch?v=ZyKCjW_Q5vs?start=763 During his recent interview with Tobias, small cap value manager Eric Cinnamond discusses how investors can find great investment opportunities in closely held micro-caps. Here’s an excerpt from the interview: Tobias Carlisle: What sort of industries are you finding opportunities in? What sort of companies, can you talk about … Read More