In his recent presentation, Ken Fisher debunks the myth – one bear market and you’re done. Here’s an excerpt from the presentation: Fisher: On June 13th we officially entered a bear market by closing below 20% off the highs in January. In that a lot of people say boy oh … Read More

Ken Fisher: We’re In A ‘Ghost-Busters’ Bear Market

In his recent interview with Fox News, Ken Fisher explained why we’re in a ‘ghost-busters’ bear market. Here’s and excerpt from the interview: Fisher: Sometimes we don’t have capitulation with the bottom. And I’m increasingly coming to the view that this is a period that will not have capitulation. Partly … Read More

Ken Fisher: How To Position Your Portfolio For A Rebound

During his recent webcast, Ken Fisher explained how to position your portfolio for a rebound. Here’s an excerpt from the webcast: Fisher: But the fact of the matter is all this year the data points reinforce a simple notion, said very simply that if the market was going up Tech … Read More

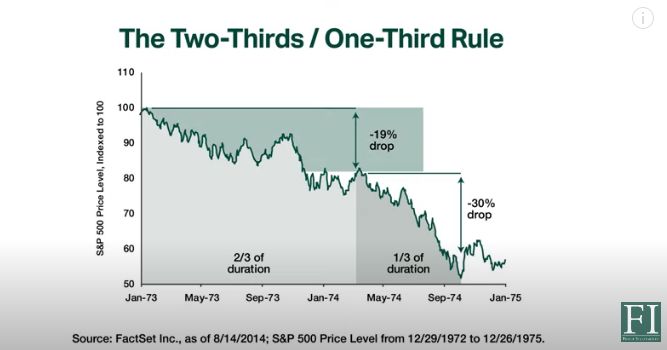

Ken Fisher: How Bear Markets Hornswoggle The Last Greater Fool Into Stocks

In his latest video titled, The Difference Between a Correction and a Bear Market, Ken Fisher explains how bear markets hornswoggle the last greater fool into stocks. Here’s an excerpt from the video: The first three months of a real bear market, a conventional bear market, tend to be relatively … Read More

Ken Fisher Top 10 Holdings (Q4 2021) – Latest 13F, Buys AAPL, AMD, MSFT, INTU, UBER

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Ken Fisher: Investors Overlooking The Most Important Metric – GOPM

In his latest article on Linkedin titled – When Excess Fat Is GOPM Great for You, Ken Fisher discussed why Gross Operating Profit Margins (GOPM) are so much more important than net profit margins. Here’s an excerpt from the article: Earnings, earnings, earnings! Often, that is all pundits dissect. How … Read More

Ken Fisher Top 10 Holdings (Q2 2021)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Ken Fisher: Success Has A Thousand Fathers, But Failure Is A Bastard

Earlier in the week we provided 4 book recommendations from Michael Burry, one of which was Super Stocks by investing legend Ken Fisher. In the book Super Stocks Fisher provides a great illustration of how investors mislead themselves in a section titled – Success has a thousand fathers, but failure … Read More

Ken Fisher: Don’t Mistake A Company’s Current Valuation As A Predictor Of Its Price In The Future

In his latest commentary on whether technology stocks are overvalued, Ken Fisher says that investors should flip their PE’s into EP’s to get a better understanding of their true value. He also makes the point that investors commonly make the mistake of thinking that valuations somehow are predictive of what … Read More

Ken Fisher Top 10 Holdings (Q4 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Ken Fisher Answers Growth vs. Value: Which is Better?

In this short video presentation by Ken Fisher he answers the question of Growth vs Value: Which Is Better? Here’s an excerpt from the presentation: Let me just make one more point and I’ll do this very quickly. Some people are just better at doing value stocks and some people … Read More

Ken Fisher: Value Isn’t Dead, But No Sector Is Ever ‘Due’ For a Rally

In his recent article on RealClear Markets Ken Fisher provided some great insights into why value investing isn’t dead, but added that no sector is ever ‘due’ for a rally. Here’s some excerpts from the article: Depending on who you ask, value stocks are set to soar….or dead as a … Read More

Ken Fisher’s Top 10 Holdings (Q2 2020) – Plus Top Buys & Sells

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Ken Fisher: The Reason Warren Buffett’s Been Inactive Is Due To His Age

In a recent interview with CNBC-TV18 famed investor Ken Fisher discussed his thoughts on Warren Buffett’s inactivity during the COVID crisis based on his own experience with his father Philip Fisher saying: Because of my father, when I was young I got to meet some great investors. The reality of … Read More

Ken Fisher: Time In The Market Beats Timing The Market – Almost Always

Ken Fisher, founder of Fisher Investments, wrote a great article in USA Today which illustrates the importance of spending time in the market as opposed to trying to time the market, in order to achieve outstanding results. Here’s an excerpt from that article: Riding all of the stock market’s ups … Read More