Jamie Catherwood at O’Shaughnessy Asset Management recently wrote a comprehensive piece on why the momentum factor will continue to deliver outperformance saying: There are no certainties in investing, but one can be very confident that human nature will not be changing any time soon. Since shares first traded on the … Read More

Stanley Druckenmiller: Never, Ever Invest In The Present

Here’s a great except from Stanley Druckenmiller’s 2015 Speech at the Lost Tree Club. Druckenmiller provides some great insights into why investors should never, ever invest in the present, saying: Now, I told you it was kind of dumb luck how I fell into this. Ken Langone knows my first … Read More

Joel Greenblatt: Investors Should Search For Companies That Achieve A High Return On Capital

Here’s a great excerpt from Joel Greenblatt’s book – The Little Book That Beats The Market, in which he discusses the importance of finding businesses that can achieve a high return on capital, saying: But here’s the thing. If capitalism is such a tough system, how does the magic formula … Read More

Warren Buffett: The Investor’s Misery Index

Here’s a great excerpt from Warren Buffett’s 1979 Berkshire Hathaway Shareholder Letter in which he illustrates the impact that inflation can have on an investor’s returns, using what he calls – “the investor’s misery index”, saying: If we should continue to achieve a 20% compounded gain – not an easy … Read More

Warren Buffett: Investing Is Much Like Reporting – Writing The Right Story

Here’s a great excerpt from an interview that Warren Buffett did with BizNews in 2017 in which he illustrates how investing is much like reporting. Buffett was asked the following question: When you’re doing these analyses, then and now, do you have computers that help you, or how did you … Read More

Seth Klarman Protégé – David Abrams – Investors Need To Use A Multi-Path Approach To Business Valuation And Analysis

We’ve just been listening to a great interview with Seth Klarman’s protégé David Abrams on the Value Investing With Legends podcast in which Abrams discusses why investors need to use a multi-path approach to business valuation and analysis. Here’s an extract from the interview: David Abrams: The first question we … Read More

Michael Burry: Don’t Try To Dig Your Way Out

Following is an excerpt from Michael Burry’s MSN Case Studies in which he provides some great advice for investors who are tempted to take increased risks in order to dig themselves out of a hole. A key phenomenon driving the recent stock market advance is the need for so many fund … Read More

Walter Schloss: When You Find Great Stocks, Keep Them A Secret

We’ve just been reading through a great interview that Walter and Edwin Schloss did with OID back in 1989. During the interview Walter Schloss explains one of the reasons why he always kept the holdings in his portfolio a secret, saying: Walter Schloss: Apropos of that, while I was at … Read More

Warren Buffett: Sometimes Buying A Basket Of Stocks In An Industry Is Better Than Picking Individual Stocks

During the 2002 Berkshire Hathaway Annual Meeting Warren Buffett provided some great insights into why buying a basket of stocks in an industry is better than picking individual stocks. Here’s an excerpt from the meeting: AUDIENCE MEMBER: Hi, my name is Jennifer Pearlman from Toronto, Canada. Mr. Buffett, in 1998, … Read More

Charlie Munger: Focus Investing – One Way To Beat The Market

One of our favorite investing books is Poor Charlie’s Almanack by Peter Kaufman, and there’s one passage in the book in which Charlie Munger explains how he and Buffett use ‘focus investing’ to beat the market, saying: “Our investment style has been given a name-focus investing-which implies ten holdings, not … Read More

Warren Buffett: You Don’t Want To Buy Stock In The Company That Has To Do Everything Right

Here’s a great recent interview with Warren Buffett speaking to Becky Quick at CNBC. During the interview Buffett, while speaking about Apple, provides some great insights into why investors should not buy stocks in companies that have to do everything right, saying: Apple, I’d love to see them succeed. That’s … Read More

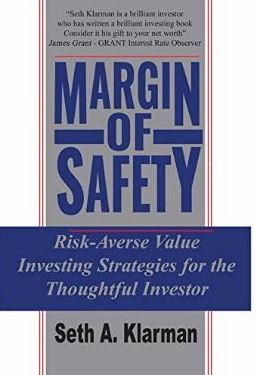

Seth Klarman – Unsuccessful Investors Are Dominated By Emotion

One of the best books ever written on investing is Margin of Safety, by Seth Klarman. There’s one passage in particular in which Klarman discusses behaviors to avoid in order to achieve success in investing, saying: Unsuccessful investors are dominated by emotion. Rather than responding coolly and rationally to market … Read More

John Rogers: ‘Cheap Orphan’ Stocks Appear During High Volatility Markets

Here’s a great interview with John Rogers of Ariel Investments speaking with Business Insider. During the interview Rogers shares some great insights into how ‘Cheap Orphan’ stocks appear in high volatility environments, saying: We try to make volatility our friend. And when we see stocks that are gapping down on … Read More

Aswath Damodaran: Do Not Invest In Companies That Try To Achieve Growth Through Acquisition

Here’s a great article by Aswath Damodaran in which he warns investors who are considering investing in companies that use acquisitions as part of their growth strategy, saying: “If you look at the collective evidence across acquisitions, this is the most value destructive action a company can take.” Here’s an … Read More

Joel Greenblatt – If You Do Good Valuation Work The Market Will Agree With You Eventually

Here’s a great recent interview with Joel Greenblatt at CNBC discussing value investing and the one promise that he makes to his new value investing students at Columbia University, saying: We value businesses like we’re a private equity firm. That’s what stocks are. They’re not pieces of paper that bounce … Read More

Warren Buffett: Stocks – What Else In The World Don’t You Like To Buy Cheaper Than You’re Paying The Day Before?

Here’s a great recent interview with Warren Buffett at CNBC discussing a number of topics including his value investing mindset. Here’s an excerpt from the interview: BECKY QUICK: I know you’re like Dr. Spock. You’re completely emotionless, when it comes to dealing with market moves. But is there any part … Read More

Charles Munger: Here’s Why Investing Is So Much Tougher Today

Here’s a great recent interview with CNBC’s Becky Quick and Charles Munger discussing the difficulty of being an investor today, compared to when he and Warren started. Here’s an excerpt from the interview: Becky Quick: Charlie thank you very much for taking the time to sit down with us today. … Read More

Charles Munger: The Most Important Investing Trick I Learnt From My Grandfather

We’ve just been watching Charlie Munger at the latest Daily Journal meeting in which he recounts the most important investing trick he learnt from his grandfather, saying: I had a grandfather who was very useful to me. My mother’s grandfather. He was a pioneer. He came out to Iowa with … Read More

Seth Klarman: The Proper Wiring for a Long-Term Investor

In Seth Klarmans’ latest shareholder letter he writes successful investing is like being a successful relief pitcher, saying: Consider the plight of a relief pitcher. Historically undervalued, unappreciated, often used interchangeably with other relievers, and, until recently, low on the major league pay scale. Required to be ready throughout most … Read More

Warren Buffett: How’s That For A Strategic Plan?

In the 1984 Berkshire Hathaway Shareholder Letter, Warren Buffett describes his and Munger’s suprising strategic plan for finding their big investment ideas, saying: “Using my academic voice, I have told you in the past of the drag that a mushrooming capital base exerts upon rates of return. Unfortunately, my academic voice is … Read More