Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

Vale SA (VALE)

Vale is a large global miner and the world’s largest producer of iron ore and pellets. In recent years the company has sold noncore assets such as its fertilizer, coal, and steel operations to concentrate on iron ore, nickel, and copper. Earnings are dominated by the bulk materials division, primarily iron ore and iron ore pellets. The base metals division is much smaller, consisting of nickel mines and smelters along with copper mines producing copper in concentrate. Vale has agreed to sell a minority 13% stake in energy transition metals, its base metals business, which is expected to become effective in 2024, and which is likely the first step in separating base metals and iron ore.

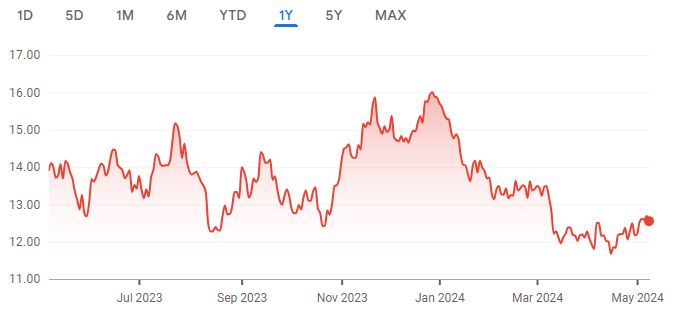

A quick look at the price chart below shows us that the stock is down 9.71% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 4.60 which means that it remains undervalued.

Source: Google Finance

(Shares)

Ken Fisher – 18,162,145

Howard Marks – 9,399,887

Israel Englander – 2,275,917

Ken Griffin – 1,686,969

Steve Cohen – 1,581,451

Cliff Asness – 1,057,398

Rich Pzena – 229,345

Jim Simons – 131,659

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: