One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena: Value Investing: Finding Undervalued Stocks While Side-Stepping Value Traps

During his recent interview with The Inside Adviser, Richard Pzena discusses his way of assessing a company’s intrinsic value by estimating its ‘normalized earnings’, which is what the company is expected to earn over the long term. He also discloses how to deal with the risk of investing in value … Read More

Richard Pzena – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena: Value Investors Have Had A Very Good Year

During his recent 2023 Mid Year Outlook, Rich Pzena explained why value investors have had a very good year. Here’s an excerpt from the presentation: Pzena: Real reversal and so much of what Miklos talked about happened in that three-month period. And then it looks like it’s turned again. June … Read More

Pzena: Today’s Darling Stocks Become Tomorrow’s Value Stocks

In their latest market commentary, Pzena Investment Management explain why today’s darling stocks become tomorrow’s value stocks. Here’s an excerpt from the commentary: As disciplined value investors, we are open-minded to investment opportunities, while never compromising by overpaying. Thus, we have no issue purchasing mega-cap and/or technology stocks as long … Read More

Pzena: The Stage Is Set For Another Powerful Value Cycle

In their latest Q4 2022 Market Commentary, Pzena explain why the stage is set for another powerful value cycle. Here’s an excerpt from the letter: Equity market performance in periods of high inflation and slow or negative GDP growth has been top of mind for many of our clients. While … Read More

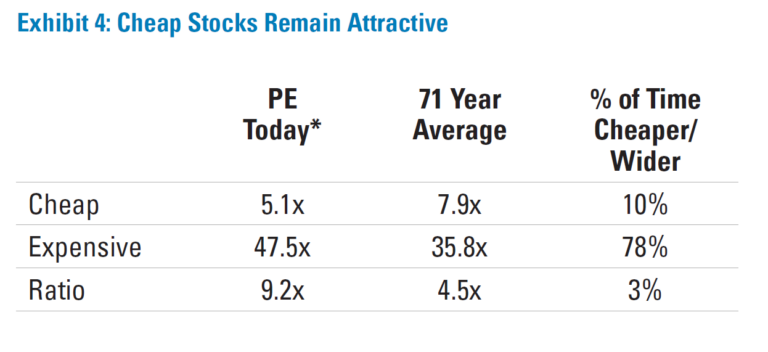

Pzena: The Value Opportunity Is Compelling

In their latest Q4 2022 Letter, Pzena Investment Management explain why the value opportunity is compelling. Here’s an excerpt from the letter: Despite recession, inflation, and geopolitical fears, we believe the value opportunity is compelling, even after its best relative performance in more than two decades. Macroeconomic and geopolitical fears … Read More

Rich Pzena – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena – Top 10 Holdings – Q2 2022 – New Buys SSNC, C, BMY, TCOM, GIL

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Pzena: Value’s Opportunity In Uncertain Times

In their recent Q2 2022 Market Commentary, Pzena Investment Management discuss value’s opportunity in uncertain times. Here’s an excerpt from the commentary: The late John Bogle, founder of The Vanguard Group, suggested a framework for breaking stock market returns into two pieces: fundamental return, the return from dividends and earnings, … Read More

Rich Pzena: Why Value Investing Continues To Work

In his Q1 2022 Earnings Call, Rich Pzena explained why value investing continues to work. Here’s an excerpt from the call: I’ve been saying the same thing about value investing for my entire life. It just works. It works because people are emotional and not analytical. It works because people … Read More

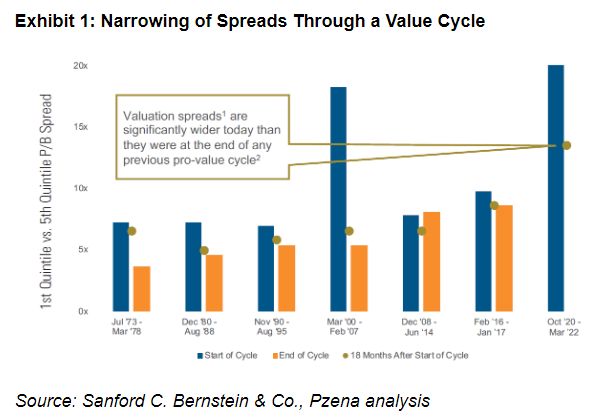

Pzena Investment Management: Fundamentals Point To An Enduring Value Cycle

In their lastest Q1 2022 Market Commentary, Pzena Investment Management explain why fundamentals point to an enduring value cycle. Here’s an excerpt from the commentary: We commonly hear two questions at opposite ends of the value cycle: “Is value dead?” and “Is the value cycle over?” The psychology behind these … Read More

Pzena: Fundamentals Support The Case For An Enduring Value Cycle

In their latest Q1 2022 Market Commentary, Pzena Investment Management explain why fundamentals support the case for an enduring value cycle. Here’s an excerpt from the commentary: We commonly hear two questions at opposite ends of the value cycle: “Is value dead?” and “Is the value cycle over?” The psychology … Read More

Rich Pzena Top 10 Holdings (Q4 2021) – Latest 13F, Buys CTSH, GE, EIX, AIG, LEA

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena: The Danger Of Becoming Anchored In Investing

In his latest Q4 2021 Earnings Call, Rich Pzena discusses the danger of becoming anchored in investing. Here’s an excerpt from the call: If a client asked me as 2009 began, just after the peak of the global financial crisis, what I thought our strategy would earn over the next … Read More

Pzena: Value Investing Opportunities Don’t Have To Be Optically Cheap Junk

In their latest educational video, Pzena Investment Management discuss why value investing opportunities don’t have to be optically cheap junk. Here’s an excerpt from the video: There are two important things to keep in mind. The first is we’re looking to buy good businesses. I think sometimes when people hear … Read More

Rich Pzena: There’s Something Wrong With The Arithmetic In Today’s Valuations

In his latest presentation, Rich Pzena explains why there’s something wrong with the arithmetic in today’s valuations. Here’s an excerpt from the presentation: I’m going to start with a little story from 1999. Probably one of the most influential discussions I had as an investor, but to set the stage, … Read More

Rich Pzena: Cheap Stocks Can Be Quality Stocks Too!

In his latest Q3 Earnings Call, Rich Pzena provides some research that shows that cheap stocks can be quality stocks too. Here’s an excerpt from the call: We human beings are irrational decision makers. It’s not just my opinion. Decades of behavioral economics research and several Nobel Prizes have been … Read More

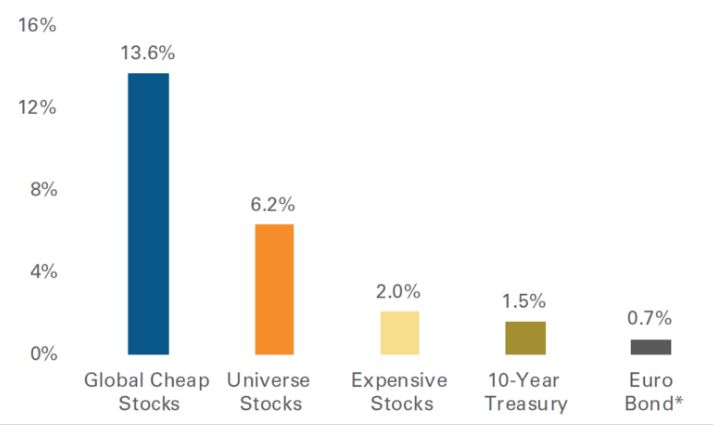

Pzena: The Opportunity In Value Stocks Is Compelling

In their latest Q3 2021 Market Commentary, Pzena discuss the compelling opportunity in value stocks. Here’s an excerpt from the commentary: We have argued for some time that the opportunity in value stocks is compelling: valuations are cheap, operating metrics are strong, and they offer high single-digit to low double-digit … Read More