One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

ROIC, Returns, And Nose-Bleed Valuations

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed ROIC, Returns, And Nose-Bleed Valuations. Here’s an excerpt from the episode: Bill: This is probably a reasonable time to do the ROIC and return comments. Tobias: Yeah. Bill: Look, we have gone too far with this discussion. I … Read More

Should Value Investors Double Down?

During his recent interview with Tobias, Mikhail Samonov, Founder and CEO of Two Centuries Investments discussed Should Value Investors Double Down?. Here’s an excerpt from the interview: Tobias: So, the last thing that you discuss in that paper, you say that there are a number of reasons why people think … Read More

Lakewood Capital: Investors Are Overlooking Out-Of-Favor Value Stocks That Lack A Good ‘Story’

Value investing firm Lakewood Capital Management recently released its Q2 2020 saying – a mentality has firmly set in that if a company has prospects for growth, you simply can’t lose. The higher the price of the stock, the more appeal it seems to have. Conversely, it seems no matter … Read More

Seth Klarman: Q2 2020 – 8 Changes To The Future As We Know It

In his latest letter to investors, Seth Klarman discussed the possible longer-term ramifications of the COVID-19 Pandemic and included a list of eight changes to the future as we know it saying: For most of the last century, a reasonable approach to assessing a company’s future prospects was to expect … Read More

(Ep.78) The Acquirers Podcast: Mikhail Samonov – Two Centuries, Value Backtest To 1825, Excess Returns And Drawdowns From Two Centuries Of Value

In this episode of The Acquirers Podcast Tobias chats with Mikhail Samonov. He’s the Founder and CEO of Two Centuries Investments, and has extended the value backtest all the way back to 1825. During the interview Mikhail provided some great insights into: Value Investors Should Double Down Studying Historical Markets … Read More

Superinvestor Rich Pzena: Top 10 Holdings (Q2 2020), Plus Top Buys NRG, AIG, DOW

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

This Week’s Best Investing Articles, Research, Podcasts 7/31/2020

Here’s a list of this week’s best investing reads: The Grifters, chapter 1 – Kodak (Epsilon Theory) The Four Quadrants of Conformism (Paul Graham) Sad State (Reformed Broker) The Ugly Scramble (Collaborative Fund) Seth Klarman Says Fed Is Infantilizing Investors in ‘Surreal’ Market (Bloomberg) Corp Governance “Dark Arts”: Part 5 (Non-GAAP) Stranger Things (Verdad) Financial Contraptions … Read More

Stock In Focus – TAM Stock Screener – Taylor Devices, Inc. (NASDAQ: TAYD)

As part of a new series here at The Acquirer’s Multiple, we’re providing a new feature called ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is Taylor Devices, Inc. (NASDAQ: TAYD). Taylor Devices Inc is engaged … Read More

Asimov’s Foundation

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Asimov’s Foundation. Here’s an excerpt from the episode: Jake: All right. Let’s jump into it. I’m going to start off with a quote from Isaac Asimov. He says, “The individual molecules of a gas move … Read More

Value After Hours Podcast Was The Inspiration Behind The New MOI Podcast Featuring Bloomstran, Ordway, And Turner

MOI recently released its yet to be named podcast hosted by John Mihaljevic and featuring Chris Bloomstran, Phil Ordway, and Elliot Turner. Turns out the inspiration for this new podcast was the Value After Hours Podcast featuring our very own Tobias Carlisle, Bill Brewster, and Jake Taylor. Here’s an excerpt … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

First Eagle: Now Is The Time For Patience And Fortitude

Value investing firm First Eagle Investment Management recently released his Q2 2020 Market Commentary in which they discuss the importance of patience and fortitude at a time when investors are being drawn to the tech stock market darlings. Here’s an excerpt from the letter: The current equity market rally has … Read More

Cliff Asness: “An Open Mind Is A Great Thing, But Not So Open That Your Brains Fall Out!”

During his recent interview with Corey Hoffstein on the Flirting With Models Podcast, Cliff Asness discussed the importance of investors having an open mind to new ideas, but not so open that you would trash a strategy that has worked successfully for a long time. Here’s an excerpt from the … Read More

Generating Outsized Returns In Japanese Net-Nets

During his recent interview with Tobias, Nate Tobik, founder of CompleteBankData and author of The Bank Investor’s Handbook discussed Generating Outsized Returns In Japanese Net-Nets. Here’s an excerpt from the interview: Nate: So, I just decided I’m going to just research a couple of hours every night. And I started Oddball Stocks because– I’m … Read More

VALUE: After Hours (S02 E30): Asimov’s Foundation, $WFC And Buffett’s Miss, And Blackrock’s Fade Value

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about: Asimov’s Foundation ROIC, Returns, And Nose-Bleed Valuations BlackRock Quant Sees Stock Valuation a Mystery Not Worth Solving Buffett’s Miss $WFC Down 51% YTD The Counter-Argument To Buying Berkshire Which Is The Best FAATMAN Stock To … Read More

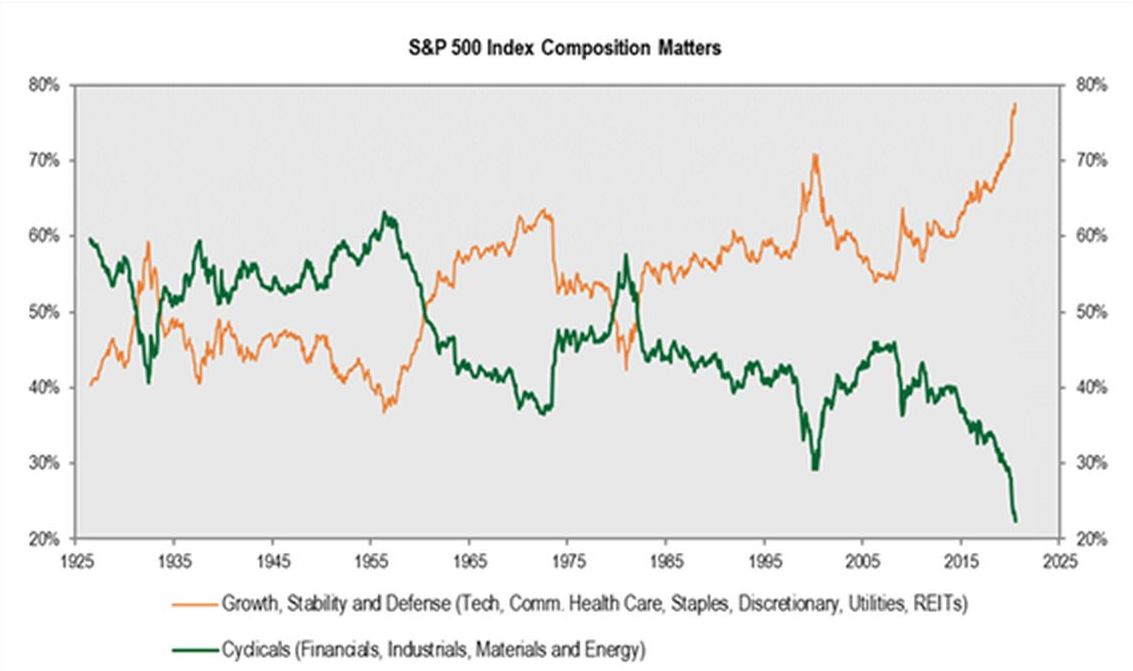

Miller Value Partners: Get Set For A Comeback In Very Attractive Long-Term Returns For Value

The latest article from Miller Value Partners titled – Don’t Forget Value – makes a very strong case for a comeback in very attractive long-term returns for value investors based on the history of valuation spreads. Here’s an excerpt from the article: In our last quarterly letter, we highlighted a piece … Read More

Seth Klarman Increases His Stake In Viasat Inc $VSAT

According to his latest Form 4, filed 07/27/2020, Seth Klarman has further increased his stake in Viasat Inc by 2,556,891 shares, at an average price of $39.11, totalling $100,000,007. This takes his total position in Viasat Inc to 16,288,959 shares.

TAM Stocks Appearing In Dalio, Fisher, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

David Einhorn: Before and After

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed David Einhorn: Before and After. Here’s an excerpt from the episode: Tobias: How do you think about historical track records? Seems like folks with long-term returns like Tepper, Ackman, Buffett, Klarman have long periods of … Read More