In his recent interview with the Market Mind Hypothesis Symposium, Howard Marks explained why there is no ‘economic machine’. Here’s an excerpt from the interview: Marks: In your last sentence about the two episodes [in history]… would limit me too much so if you don’t mind I’m gonna go way … Read More

Howard Marks: The Most Likely Result Will Be A Recession

In his interview earlier this year with Nikkei Money, Howard Marks explained why the most likely result will be a recession. Here’s an excerpt from the interview: Marks: The easy money policies of the central banks over the last global financial crisis have created strong economic growth in many parts … Read More

Howard Marks: Investors Should Never Wait For The Market To Get Cheaper

In his recent interview with Bloomberg, Howard Marks explains why investors should never wait for the market to get cheaper. Here’s an excerpt from the interview: Marks: One of the six tenets of Oaktree’s investment philosophy, which we established when we started in April of ’95 and have never changed … Read More

Howard Marks: Investing Lessons Learned From The Market Trends In 2020-21

In his latest memo titled – Bull Market Rhymes, Howard Marks discusses investing lessons learned from the market trends in 2020-21. Here’s an excerpt from the memo: As always for students of investing, what matters most isn’t what events transpired in a given period of time, but what we can learn … Read More

Howard Marks Top 10 Holdings – Q1 2022, Buys SBLK, CBL, VALE, ITUB, PBR

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Howard Marks: You Only Find Out Who The Good Investors Are During Bad Times

In his recent presentation to the Wharton School, Howard Marks explains why you only find out who the good investors are during bad times. Here’s an excerpt from the presentation: Marks: I also believe that risk is hidden and deceptive. This is really important. Loss is what happens when risk, … Read More

Howard Marks: Proof That Risk Is Counter-Intuitive

In his recent presentation at The Wharton School, Howard Marks provides some great examples of proof that risk is counter-intuitve. Here’s an excerpt from the presentation: Marks: Now, let’s talk a little more about risk. I believe that risk is counter-intuitive. So they did an experiment in the town of … Read More

Howard Marks: U.S Onshoring Investment Opportunities

In his latest interview on the Wharton School Podcast, Howard Marks discussed U.S investment opportunities if the trend moves from globalization to dependable onshoring, as he believes it will. Here’s an excerpt from the interview: Marks: I think that if people want to create their own raw materials, or intermediate … Read More

Howard Marks: The Pendulum Has Swung From Globalization To Onshoring

In his latest memo titled – The Pendulum in International Affairs, Howard Marks’s connects two seemingly unrelated trends – Europe’s energy dependence and U.S. offshoring – to explain why the pendulum of companies’ and countries’ behavior may be swinging away from globalization and toward onshoring. Here’s an excerpt from the … Read More

Howard Marks: “The Great Investors I Know Are Unemotional About Their Investing”

In his recent interview on the Richer, Wiser, Happier Podcast, Howard Marks explains why the great investors he knows are unemotional about investing. Here’s an excerpt from the interview: Marks: Emotion is the greatest enemy of superior investing. If you take a look at most people in what they call … Read More

Howard Marks: Understand Everything About 20 Companies Rather Than The Slightest Bit About 400

In his latest interview on the Youth Finance Summit, Howard Marks explains why its better to understand everything about 20 companies than the slightest bit about 400. Here’s an excerpt from the interview: Marks: Everything I’ve done has been on that basis and for the most part at Oaktree we … Read More

Howard Marks: Find An Asset, Or An Asset Class, That Looks Scary From The Outside

In his recent discussion on OakTree’s The Rewind Podcast, Howard Marks reflects on his memo titled – It’s All a Big Mistake, which was originally published on June 20, 2012. Here’s an excerpt from the podcast: Marks: Bob says so many interesting things that I sit here wanting to jump in … Read More

Howard Marks Top 10 Holdings (Q4 2021) – Buys GTX, HTZ, RWAY, WFRD, SPY

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Howard Marks: The Art Of Selling

In his latest memo titled – Selling Out, Howard Marks provides a comprehensive discussion on the art of selling stocks. Here’s an excerpt from the memo: Aphorisms like “no one ever went broke taking a profit” may be relevant to people who invest part-time for themselves, but they should have … Read More

Howard Marks: Invest Early, Invest Heavily, And Stay In The Market

In his latest interview with InfoMoney, Howard Marks recommends that investors invest early, invest heavily, and stay in the market. Here’s an excerpt from the interview: I think the most important thing that I would stress for your listeners, or readers, or whoever they’re going to be is… the most … Read More

Howard Marks: There’s A New World Order

In his latest memo titled – The Winds of Change, Howard Marks discusses the changing environment for investing and the new world order. Here’s an excerpt from the memo: As I’ve written before, the world I remember of 50, 60 and 70 years ago was a pretty static place. Things … Read More

Howard Marks: The Problem With Paying Up For A Popular Stock

In his book – The Most Important Thing, Howard Marks discusses the problem with paying up for a popular stock. Here’s an excerpt from the book: If you make cars and want to sell more of them over the long term—that is, take permanent market share from your competitors— you’ll … Read More

Howard Marks: This Latest Cycle Was Like A Meteor Hitting Earth From Outer Space

In his latest interview at The Milken Institute Global Conference, Howard Marks described this latest cycle like a meteor hitting earth from outer space. Here’s an excerpt from the interview: Marks: We’re in an unusual circumstance. First of all the cycle we’ve gone through in the last 18 months of … Read More

Howard Marks: The Impact Of Investor Psychology On Markets

In Howard Marks’ Book – Mastering The Market Cycle, he provides some great statistical data that shows just how much investor psychology impacts markets. Here’s an excerpt from the book: Putting it all together, fluctuations in attitudes and behavior combine to make the stock market the ultimate pendulum. In my … Read More

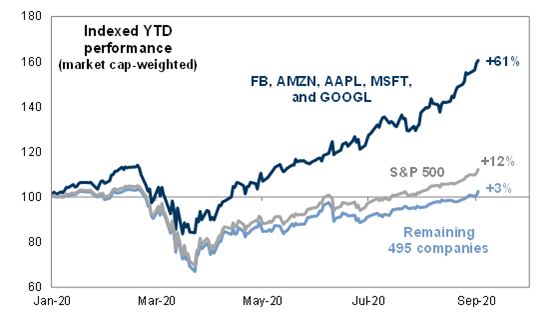

Howard Marks: There Are No Sure Things In Investing

In his recent interview on The Investors Podcast, Howard Marks discussed comparisons between the Nifty 50 and the FAANG stocks of today, and why there are no sure things in investing. Here’s an excerpt from the interview: In every market cycle we get to the point where people say you … Read More