In his latest memo titled – Bull Market Rhymes, Howard Marks discusses investing lessons learned from the market trends in 2020-21. Here’s an excerpt from the memo:

As always for students of investing, what matters most isn’t what events transpired in a given period of time, but what we can learn from these events. And there’s a lot to be learned from the trends in 2020-21 that rhymed with those in previous cycles. In bull markets:

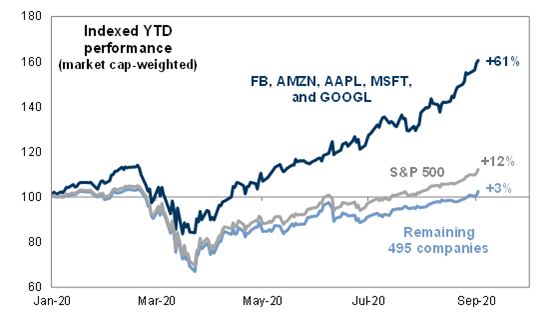

- Optimism builds around the things that are doing spectacularly well.

- The impact is strongest when the upswing arises from a particularly depressed base in terms of psychology and prices.

- Bull market psychology is accompanied by a lack of worry and a high level of risk tolerance, and thus highly aggressive behavior. Risk-bearing is rewarded, and the need for thorough diligence is ignored.

- High returns reinforce belief in the new, the unlikely, and the optimistic. When the crowd becomes convinced of those things’ merit, they tend to conclude “there’s no price too high.”

- These influences cool eventually, after they (and prices) have reached unsustainable levels.

- Elevated markets are vulnerable to exogenous events, like Russia’s invasion of Ukraine.

- The assets that rose the most – and the investors who over-weighted them – often experience painful reversals.

These are themes I’ve seen play out numerous times during my career. None of them relates exclusively to fundamental developments. Rather, their causes are largely psychological, and the way psychology works is unlikely to change. That’s why I’m sure that as long as humans are involved in the investment process, we’ll see them recur time and time again.

And, as a reminder, since the major ups and downs of the markets are primarily driven by psychology, it’s clear that market movements can only be predicted, if ever, when prices are at absurd highs or lows.

You can read the entire memo here:

Howard Marks Memo: Bull Market Rhymes

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: