In this shareholder meeting, Warren Buffett explains why Ben Graham would not have adopted his strategy. Here’s an excerpt from the meeting: We’ve tried to put in the annual report pretty much how we approach securities and book value is not a consideration, virtually not a consideration at all, and … Read More

Warren Buffett: How To Trade Derivatives

While Warren Buffett is famous for calling derivatives ‘financial weapons of mass destruction’, in his 2008 Shareholder Letter he explained his strategy for trading derivatives. Here is an excerpt from the letter which covers put options: Considering the ruin I’ve pictured, you may wonder why Berkshire is a party to … Read More

Charlie Munger: When You Make A Mistake, Act Quickly To Get Out

In their recent interview with CNBC, Charles Munger and Warren Buffett discussed what to do when you know that you’ve made a mistake. Here’s an excerpt from the interview: BUFFETT: Now, if the department store had succeeded, we’d have a nice little business then. Send us a nice little check, … Read More

Warren Buffett: Selling Your Successful Investments Is Akin To The Bulls Trading MJ Because He’s Become Too Important To The Team

In his 1996 Chairman’s Letter, Warren Buffett provides a great example of why you should never sell portions of your most successful investments. Here’s an excerpt from the letter: Our portfolio shows little change: We continue to make more money when snoring than when active. Inactivity strikes us as intelligent … Read More

Warren Buffett: The 5 Risk Factors That An Investor Must Assess

In his 1993 Annual Shareholder Letter, Warren Buffett outlined the five risk factors that an investor must assess before making any investment. Here’s an excerpt from the letter: In our opinion, the real risk that an investor must assess is whether his aggregate after-tax receipts from an investment (including those … Read More

Charlie Munger: Easy Money Is With Crooks And Fools

In their latest interview with CNBC, Warren Buffett and Charlie Munger discussed a number of topics including the deal between Credit Suisse and Archegos Capital Management. Here’s an excerpt from the interview: QUICK: We asked Munger and Buffett their thoughts on some of the latest headlines in the business world, … Read More

Warren Buffett Comments On His Annual Contribution Of Berkshire Hathaway Shares To Five Foundations

Warren Buffett recently contributed another $4.1 Billion to five foundations. Following are his comments on philanthropy and philanthropists: Today is a milestone for me. In 2006, I pledged to distribute all of my Berkshire Hathaway shares – more than 99% of my net worth – to philanthropy. With today’s $4.1 … Read More

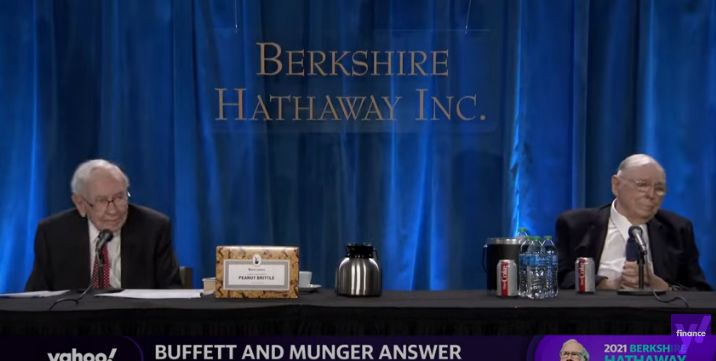

Warren Buffett: I Do Not Think The Average Person Can Pick Stocks

In his latest 2021 Berkshire Annual Meeting, Warren Buffett reiterated what he has been saying for many years, and that is that the average person cannot pick stocks and should consider investment in the S&P 500, or Berkshire. Here’s an excerpt from the meeting: Buffett: I do not think the … Read More

Buffett & Munger On The Evolution Of Value Investing

In Robert Hagstrom’s book – Warren Buffett: Inside the Ultimate Money Mind, there’s a great passage on the evolution of value investing, which includes thoughts from Warren Buffett and Charles Munger on why investors need to change their thinking on traditional value investing, as originally defined by Ben Graham. Here’s an … Read More

Warren Buffett: “PCC Is Far From My First Error Of That Sort. But It’s A Big One”

A recent article from Reuters reported Warren Buffett admitted that he “paid too much” for Precision Castparts, and “PCC is far from my first error of that sort. But it’s a big one.” Here’s an excerpt from the article: (Reuters) – Warren Buffett makes mistakes too. The 90-year-old billionaire on … Read More

Warren Buffett: “I’ll Pay You $10,000 For Your Dog By Giving You Two Of My $5,000 Cats”)

In his most recent Berkshire Hathaway 2020 Annual Report, Warren Buffett discussed a number of topics including why Berkshire is different to the prototype conglomerate, and the shenanigans around paying for overpriced acquisitions. Here’s an excerpt from that report Berkshire is often labeled a conglomerate, a negative term applied to … Read More

Warren Buffett: 1959 Activist

In Alice Schroeder’s book – The Snowball, she recounts a great story about Warren Buffett, the twenty nine year old activist, who was fed up with Sanborn Board members refusing to distribute the company’s investments to its shareholders, and instead wasting shareholders money on cigars. It’s also an early illustration … Read More

Warren Buffett: How Fisher’s Scuttlebutt Method Changed My Life

During the 1998 Berkshire Hathaway meeting, Warren Buffett was asked about his use of Fisher’s scuttlebutt method: ” When you’ve identified a business that you consider to warrant further investigation — more intense investigation — how much time do you spend commonly, both in terms of total hours and in … Read More

Warren Buffett: Appointing Ethical Leaders Using ‘The Newspaper Test’

In 2005 Bill Gates and Warren Buffett did a Q&A session with students from the University of Nebraska–Lincoln to discuss a number of topics including how to instil ethical leadership into their businesses. Here’s an excerpt from the session: How do you instil ethical leadership throughout your organization and to … Read More

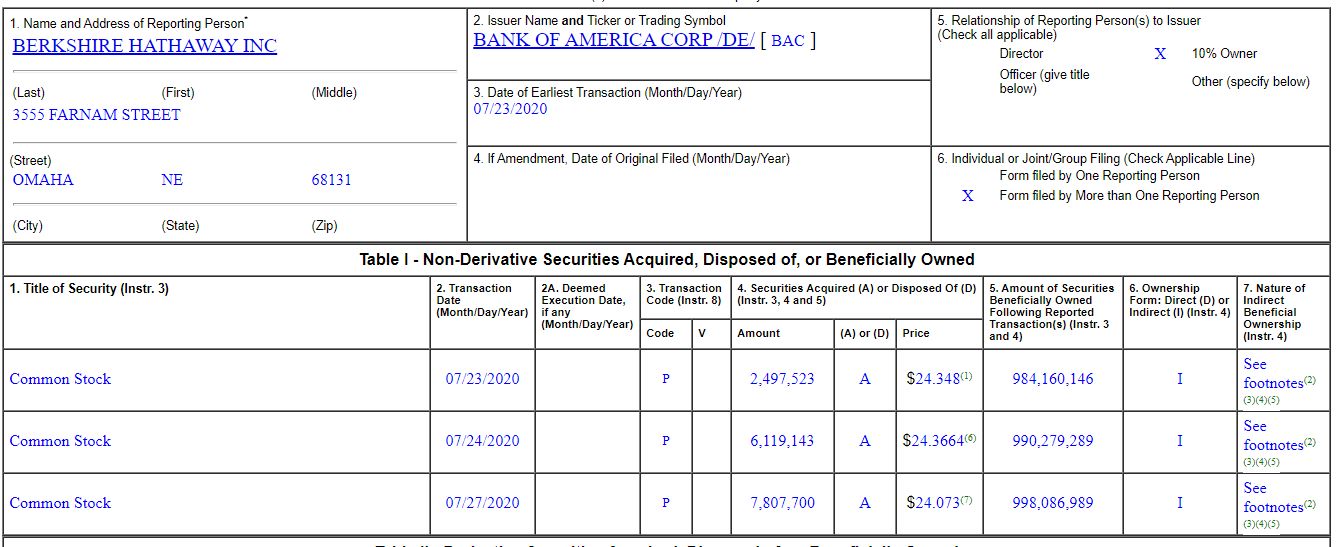

Warren Buffett Further Increases His Stake In Bank Of America Corp ($BAC)

According to his latest Form 4, dated 07/27/2020, Warren Buffett has further increased his stake in Bank of America by 7,807,700 shares, at an average price of $24.073, totalling $187,954,762. This takes his total position in Bank of America to 998,086,989 shares.

Warren Buffett: Why Utility Businesses Make Good Investments

It’s no surprise that Warren Buffett recently agreed to buy Dominion Energy’s natural gas assets in a $10 billion deal. Back in 1998, in a lecture at the University of Florida School of Business, he was asked specifically about his thoughts on utility businesses. Here’s his response: Well I’ve thought … Read More

Warren Buffett: Top 10 Holdings (Q1 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Warren Buffett: Investors Think Stocks Are Different To Other Investments Because They Can Make Decisions Every Second On Stocks

During his recent CNBC interview with Becky Quick, Warren Buffett explained that the reason investors treat stocks differently to other investments is because they can make decisions every second with stocks. Here’s an excerpt from the interview: In 1932 General Motors had 19,000 dealers. That’s more than all the auto … Read More

Warren Buffett: Top Buys, Top Sells

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Warren Buffett: Top 10 Holdings (Q4 2019)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More