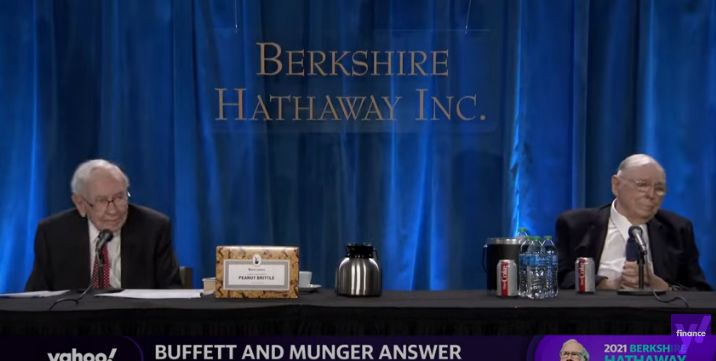

In his latest 2021 Berkshire Annual Meeting, Warren Buffett reiterated what he has been saying for many years, and that is that the average person cannot pick stocks and should consider investment in the S&P 500, or Berkshire. Here’s an excerpt from the meeting:

Buffett: I do not think the average person can pick stocks.

We happen to have a large group of people that didn’t pick stocks but they picked Charlie and me to manage money for them 50, 60 years ago.

We have a very unusual group of shareholders I think who look at Berkshire as a lifetime savings vehicle and one they don’t have to think about and one that they’ll… if they don’t look at it again for 10 or 20 years that will have taken care of the money reasonably well. I wouldn’t argue the S&P 500 over time.

I like Berkshire but I… I think that the person who doesn’t know anything about the stocks at all and doesn’t have any special feelings about Berkshire, I think they ought to buy the S&P 500 index.

You can watch the entire meeting here:

https://youtu.be/gx-OzwHpM9k

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: