One of the best resources for value investors are the Value Investor Insight Newsletters. The VII newsletter is a value investment publication full of value investing nuggets and interviews with some of the best value investing firms. The newsletter was created by money manager Whitney Tilson and media executive John Heins.

There Are Now More Indexes Than Stocks – Here’s Why

According to a recent Bloomberg article, the number of market indexes now exceeds the number of U.S. stocks. Here’s an excerpt from that article:

John Huber – Short-Termism Provides Value Investors With A Significant Sustainable Advantage

One of the value investors we like to follow closely at The Acquirer’s Multiple is John Huber at Saber Capital Management LLC. Huber writes some of the best shareholder letters for his clients. In his latest 2016 investor letter he wrote a great piece that provides some awesome value investing … Read More

George Athanassakos: The Shift Towards Passive Investing Is Creating An Opportunity For Active Investors

One of the academics we like to follow closely at The Acquirer’s Multiple is George Athanassakos. Athanassakos is the Director of the Ben Graham Centre for Value Investing Ivey Business School. He recently wrote a great article that makes the case for why the market needs stockpickers now more than ever. The … Read More

Pzena Investment Management: Investing In The Cheapest Stocks Provides Superior Investment Performance Over The Long Term

One of the investors we follow closely at The Acquirer’s Multiple is Rich Pzena at Pzena Investment Management (Pzena). Pzena recently released its Q1 2017 commentary in which they demonstrate how investing in the cheapest stocks provides superior investment performance over the long term. Here’s an excerpt from the Q1 … Read More

Value Investing Nuggets – Graham & Doddsville Newsletter – Spring 2017

One of the best resources for value investors are the Graham & Doddsville Newsletters. The G&D newsletter is an investment publication from Columbia Business School (CBS) full of value investing nuggets and is co-sponsored by the Heilbrunn Center for Graham & Dodd Investing and the Columbia Student Investment Management Association … Read More

David Wallack (T. Rowe Price) – How Be A Successful Contrarian Investor

David Wallack is the portfolio manager of the T. Rowe Price Mid-Cap Value Fund and was recently named by Morningstar as the 2016 U.S. Domestic-Stock Fund Manager of the Year. Wallack is known as a contrarian value investor. He recently did a great interview with WealthTrack in which he discusses his contrarian … Read More

Meb Faber – Here’s Why Investors Are Missing Out By Ignoring Total Shareholder Yield

One of the blogs that we follow closely here at The Acquirer’s Multiple is mebfaber.com. Meb provides a lot of great investing insights in his articles. Earlier this year he wrote a great piece on the importance of looking at total shareholder yield instead of simply looking at dividend yield when … Read More

Jeremy Grantham: The Rules Have Changed for Value Investors

GMO Co-founder Jeremy Grantham recently did an interview with Wealthmanagement.com in which he discusses how the world has changed for value investors. He says, “Since 2000, it’s become much more complicated. The rules have shifted. We used to say that this time is never different. I think what has happened … Read More

TAM Deep Value Stock Portfolio Up 12.25%, Outpacing Russell 3000 Index by 1.55%

The TAM Deep Value Stock Portfolio is up 12.25% today outpacing the Russell 3000 Index by 1.55%, since inception. The portfolio has been boosted by the recent Q1 2017 earnings results of Bridgepoint Education Inc (NYSE:BPI), which had a 200% turnaround in Q1 earnings compared to the previous corresponding period, … Read More

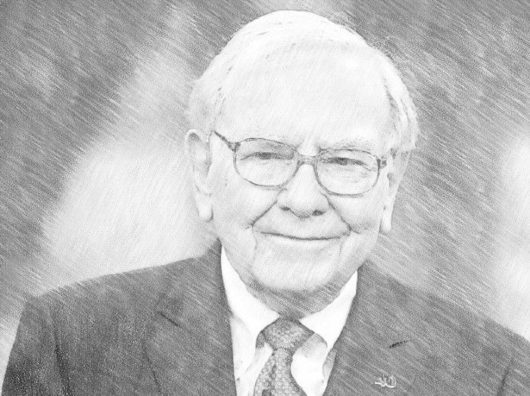

Warren Buffett: It’s A Huge Bargain To Buy Stocks Now If Interest Rates Stay Where They Are, Here’s Why

In a recent CNBC interview Warren Buffett said, “The most important item, over time, in valuation is interest rates”. He added, “It’s a huge bargain to buy stocks now if you knew interest rates would stay at this level”. In terms of investing in bonds Buffett said, “Anybody that prefers … Read More

Michael Mauboussin: The Incredible Shrinking Universe of Stocks – The Causes and Consequences of Fewer U.S. Equities

Michael Mauboussin and the team at Credit Suisse Global Financial Strategies recently published a report on The Incredible Shrinking Universe of Stocks – The Causes and Consequences of Fewer U.S. Equities. It’s a fascinating read. The report states: There has been a sharp fall in the number of listed stocks in … Read More

Charles Munger: The Investing World Is Just A Morass Of Wrong Incentives, Crazy Reporting, And A Fair Amount Of Delusion

During Saturday’s annual Berkshire Hathaway pilgrimage, Warren Buffett and Charlie Munger once again challenged the value of hedge funds and their managers. During the meeting Buffett said, “The huge money [in hedge funds] is in selling people the idea that you can do something magical for them”. Munger added, “The investing … Read More

Jason Zweig: Investors Expectations Are So Far-Fetched They Border On Fantasy

One of our favorite columnists here at The Acquirer’s Multiple is Jason Zweig. Zweig recently wrote a great article on investor expectations saying, “[Investors] expectations are so far-fetched they border on fantasy”. He also says, “many investors believe in magic”, and “investors check the value of their financial assets much … Read More

Third Point LLC – This Environment Is Undoubtedly Better For Active Investing. Here’s Why

One of our favorite investors here at The Acquirer’s Multiple is Dan Loeb at Third Point LLC. Loeb founded Third Point, the asset management firm headquartered in New York, in 1995. Third Point employs an event-driven, value-oriented investment style. One of the best resources for investors are the Third Point … Read More

Value Investing Nuggets – Graham & Doddsville Newsletter – Winter 2017

One of the best resources for value investors are the Graham & Doddsville Newsletters. The G&D newsletter is an investment publication from Columbia Business School (CBS) full of value investing nuggets and is co-sponsored by the Heilbrunn Center for Graham & Dodd Investing and the Columbia Student Investment Management Association … Read More

Damodaran Credits Apple For Ignoring The ‘Advice’ From Wall Street Analysts

One of the financial academics that we follow closely here at The Acquirer’s Multiple is Aswath Damodaran. Damodaran was recently interviewed by CNBC about Apple’s current cash hoard and credited the company with ignoring the ‘advice’ from Wall Street analysts. It’s a must read for all investors. Here’s an excerpt from … Read More

Bruce Berkowitz – ETF’s Occasionally Swing To Illogical Extremes – We Prefer Unpopular, Underpriced, and Underweighted

Bruce Berkowitz recently released The Fairholme Funds 2016 Annual Report in which he discusses the current trend towards ETF investing and he provides the following warning for investors: Exchange-traded index funds (“ETFs”) are all the rage these days for their straightforward, low-cost replication of broad indexes. While it is a … Read More

Bridgepoint Education Soars 22% – Total Gain 124% To Date

Bridgepoint Education (NYSE:BPI) (Bridgepoint) reported its Q1 2017 results yesterday and the stock price soared 22%. Bridgepoint is a provider of post-secondary education services and owns two academic institutions – Ashford University and University of the Rockies. This is a stock that I added to my Acquirer’s Multiple – Deep … Read More

Shiller vs Siegel: The Bull & The Bear On Current Market Valuations

Two Finance Professors that we follow closely here at The Acquirer’s Multiple are Yale Professor of Economics, Robert Shiller and Wharton Professor of Finance, Jeremy Siegel. Both were interviewed recently by CNBC regarding their outlook on current market valuations. Shiller says, “Current market conditions make the market look dangerous”. While Siegel says, … Read More