Summary In this episode of The Acquirer’s Podcast Tobias chats with Benn Eifert. He is a Stanford undergrad, Cal PhD, and CIO at QVR Advisors. QVR is a boutique SEC-registered investment advisor managing quantitatively-driven, options-and volatility-focused strategies across absolute return, risk premium and hedging needs. During the interview Benn provided … Read More

The Micro-Cap Universe Provides The Best Opportunities To Find Multi-Baggers

https://www.youtube.com/watch?v=fHdKAzxnRnI?start=2316 During his recent interview with Tobias, Ian Cassel, Founder of MicroCapClub and Intelligent Fanatics Capital Management, discusses how the micro-cap universe provides investors with the best opportunities to find multi-baggers, saying: Tobias Carlisle: Do you find opportunities harder to come by in a market that is, you know, we’re … Read More

Avoid Selling Too Early – Investors Need To Allow Their Stock Positions To Exceed Their Expectations

https://www.youtube.com/watch?v=fHdKAzxnRnI?start=1780 During his recent interview with Tobias, Ian Cassel, Founder of MicroCapClub and Intelligent Fanatics Capital Management, discusses avoid selling stocks too early by letting the stocks that you own exceed your expectations, saying: Tobias Carlisle: It’s very clever. On the Monster Beverage Hansen’s, do you think, is it luck … Read More

Investors Can Generate Outsized Returns Using The Three Buckets of Micro-Cap Investing

https://www.youtube.com/watch?v=fHdKAzxnRnI?start=690 During his recent interview with Tobias, Ian Cassel, Founder of MicroCapClub and Intelligent Fanatics Capital Management, discusses his three buckets of successful micro-cap investing saying: Ian Cassel: I wouldn’t characterize myself as a value investor. I would say it’s more of a situational type investor, this has evolved over … Read More

(Ep.25) The Acquirers Podcast: Ian Cassel – Intelligent Fanatic, A Masterclass In Microcap Investing

Summary In this episode of The Acquirer’s Podcast Tobias chats with Ian Cassel. Ian is the Founder of MicroCapClub and Intelligent Fanatics Capital Management. He specialises in micro-cap investing, and believes that the key to outsized returns is finding great companies early, because all great companies started as small companies. … Read More

The Secret To An Outstanding Growth Strategy Is To Prune Those Growth Ideas That Are Not Working Out

https://www.youtube.com/watch?v=dmEMWylsmb8?start=2668 During his recent interview with Tobias, Daniel Grioli, the Managing Partner at Guisgard Capital, discusses the secret to developing an outstanding growth strategy that will outperform. Here’s an excerpt from the interview: Daniel Grioli: And then there’s obviously the risk that you have with growth stocks where some disappoint, you … Read More

Concentrated Investing – The Successful One Stock Portfolio

https://www.youtube.com/watch?v=dmEMWylsmb8?start=2084 During his recent interview with Tobias, Daniel Grioli, the Managing Partner at Guisgard Capital, demonstrates how very concentrated portfolios can be successful, using a real-life example. Here’s an excerpt from the interview: Tobias Carlisle: So, when you’re looking for the value managers, you’re looking for that more traditional Buffet style … Read More

Investors Could Be Missing Out On Some Big Gains By Selling A Stock That Reaches Its ‘Target Price’

https://www.youtube.com/watch?v=dmEMWylsmb8?start=2987 During his recent interview with Tobias, Daniel Grioli, the Managing Partner at Guisgard Capital, provides a real-life example of how investors can miss out on big gains by selling a stock that reaches its ‘target price’. Here’s an excerpt from the interview: Daniel Grioli: Definitely. So, I’ll add a couple … Read More

The Single Best Metric In Investing Is…

https://www.youtube.com/watch?v=ybA8Wge5Xz4?start=1445 During his recent interview with Tobias, Eddy Elfenbein, who owns the popular investing blog Crossing Wall Street Blog, discusses the most important metrics that investors should consider when determining what a business is worth. Here’s an excerpt from the interview: Tobias Carlisle: One of the more popular posts on … Read More

Investors Should Look For Companies That Have A Pseudo-Monolopy

https://www.youtube.com/watch?v=ybA8Wge5Xz4?start=3056 During his recent interview with Tobias, Eddy Elfenbein, who owns the popular investing blog Crossing Wall Street Blog, discusses why investors should look for companies that have a pseudo-monopoly. Here’s an excerpt from the interview: Tobias Carlisle: Let’s talk about some individual names on your Buy List. One is … Read More

Finding High Quality Stocks Starts With The World’s Simplest Valuation Measure

https://www.youtube.com/watch?v=ybA8Wge5Xz4?start=803 During his recent interview with Tobias, Eddy Elfenbein, who owns the popular investing blog Crossing Wall Street Blog, discusses how investors can find high quality stocks using the world’s simplest valuation metric. Here’s an excerpt from the interview: Tobias Carlisle: So while you don’t describe yourself as a value … Read More

Investors Should Consider Permanently Allocating 5-10% Of Their Portfolio Into Gold

https://www.youtube.com/watch?v=Fthp2PYU0WI?start=3522 During his recent interview with Tobias, Zach Abraham, who runs Bulwark Capital Management and has a radio show called Know Your Risk Radio, discusses why investors should consider permanently allocating 5-10% of their portfolio to gold. Here’s an excerpt from the interview: Tobias Carlisle: Well, let’s talk a little … Read More

Here’s Why Fixed Indexed Annuities Should Be Considered As An Alternative To Bonds

https://www.youtube.com/watch?v=Fthp2PYU0WI?start=2557 During his recent interview with Tobias, Zach Abraham, who runs Bulwark Capital Management and has a radio show called Know Your Risk Radio, discusses why investors should consider fixed indexed annuities as an alternative to bonds saying: Zach Abraham: Now, we still use fixed income and we have as … Read More

To Infinity and Beyond Meat – Keep Your Head When All About You Are Losing Theirs

https://www.youtube.com/watch?v=Fthp2PYU0WI?start=409 During his recent interview with Tobias, Zach Abraham, who runs Bulwark Capital Management and has a radio show called Know Your Risk Radio, discussed the importance of keeping your head while investing when all about you are losing theirs saying: Zach Abraham: Yeah, I think you and I talked … Read More

(Ep.22) The Acquirers Podcast: Zach Abraham – Known Risks, Value, Activism And 60/40 Bond Alternatives

Summary In this episode of The Acquirer’s Podcast Tobias chats with Zach Abraham who runs Bulwark Capital Management and has a radio show called Know Your Risk Radio. During the interview Zach provided some great insights into: – What Was It Like To Grow Up In A Brokerage Firm – … Read More

(Ep.21) The Acquirers Podcast: Tim Melvin – Financial Value, Graham And Schloss Meets Kravis In Financials

Summary In this episode of The Acquirer’s Podcast Tobias chats with Tim Melvin who is a 31 year veteran of the financial services industry, as a broker, advisor, and a portfolio manager. During the interview Tim provided some great insights into: – How Does A High School Drop-Out Get Started … Read More

(Ep.20) The Acquirers Podcast: Adam Butler – Adaptive Assets, The Philosophy Of Robust Quant

Summary In this episode of The Acquirer’s Podcast Tobias chats with Adam Butler, CIO of ReSolve Asset Management. Adam has developed a number of adaptive strategies that are designed to strive in changing environments and he is the author of Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good … Read More

Investors Can Find Some Of The Best Opportunities In The Smallest Listed Companies

https://www.youtube.com/watch?v=CLqepjONgtk?start=2669 During his recent interview with Tobias, Adrian Saville, CEO and founder of Cannon Asset Managers in South Africa, discusses how investors can find some of the best opportunities in the smallest listed companies. Here’s an excerpt from the interview: Tobias Carlisle: So, tell us a little bit about Indequity, … Read More

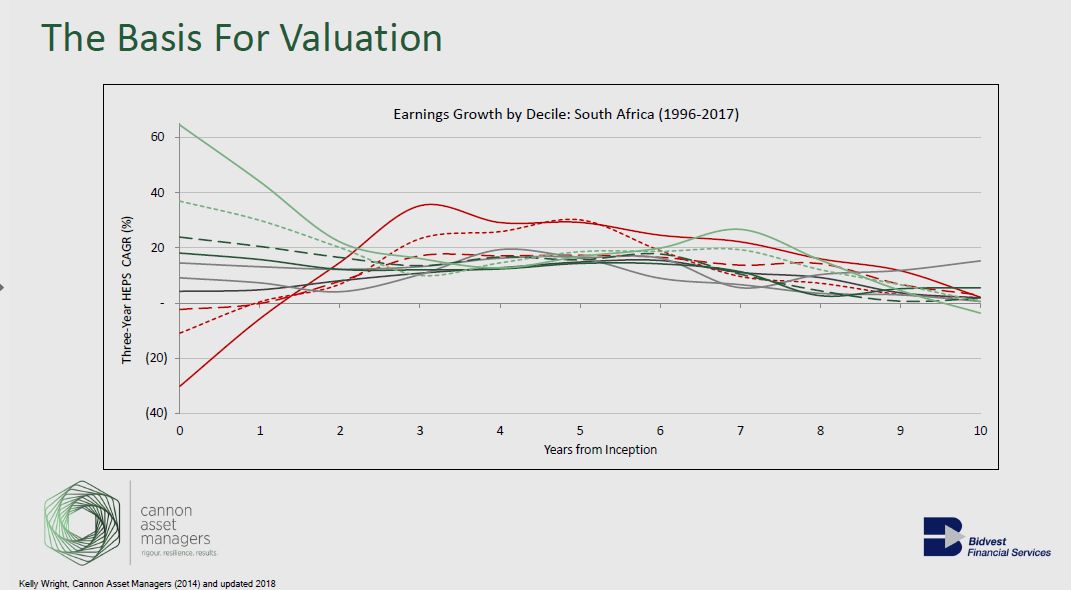

The One Reason Mean Reversion Is So Powerful – This Too Shall Pass!

https://www.youtube.com/watch?v=CLqepjONgtk?start=2896 During his recent interview with Tobias, Adrian Saville, CEO and founder of Cannon Asset Managers in South Africa, discusses why mean reversion is such an important factor in investing. Here’s an excerpt from the interview: Tobias Carlisle: And, some of that marketing collateral you sent through to me, just … Read More

What Are The Four Attributes Necessary To Create A Successful ‘SuperDogs’ Portfolio

https://www.youtube.com/watch?v=CLqepjONgtk?start=454 During his recent interview with Tobias, Adrian Saville, CEO and founder of Cannon Asset Managers in South Africa, discusses the four attributes necessary to create a successful ‘SuperDogs’ portfolio. Here’s an excerpt from the interview: Adrian Saville: Sure, so the first attribute is to look for value in an … Read More