During this interview with Schroders, James Montier explains why value investing provides behavioral self-defence. Here’s an excerpt from the interview: Montier: That value approach is inherently long-term and it gives you a margin of safety – and then whether you meet company managements or not is up to you. But … Read More

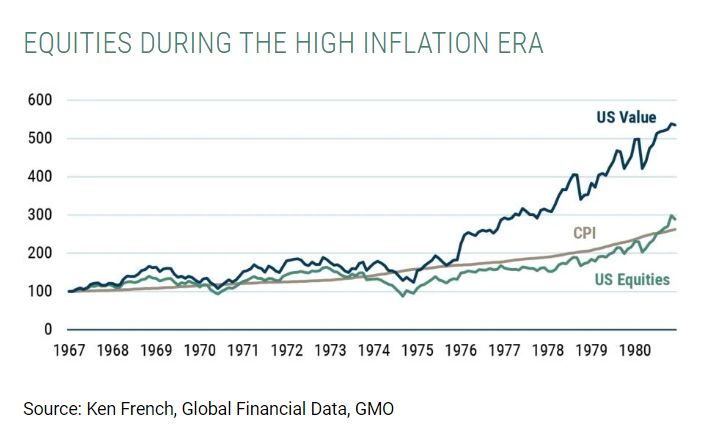

James Montier: Value Stocks Are Like Free Inflation Insurance

A staggering 77% of Americans fear soaring inflation. James Montier has a more sanguine view of inflationary risks. In this session at the GMO Fall Conference, James explored some of the tall tales and true causes of inflation. He also explained what investors can do from a portfolio perspective if … Read More

James Montier: Growth Stocks Are The Attractive Defendants Of The Finance World

In his book – Value Investing: Tools and Techniques for Intelligent Investment, James Montier provides a great illustration of the human bias towards growth/glamour stocks. Here’s an excerpt from the book: Interestingly a recent psychology study may well relate to these findings. Taylor and Butcher (2007) gave 96 students identical accounts … Read More

James Montier: The Dangers Of Diversification

In his book – Value Investing: Tools and Techniques for Intelligent Investment, James Montier discusses the dangers of diversification. Here’s an excerpt from the book: If religion has been the cause of most wars, then ‘diversification’ lies close to the heart of many financial disasters. All too often, too narrow … Read More

James Montier: Investors Sell More Winners Than Losers

In his book – The Little Book of Behavioral Investing, James Montier discloses that investors sell more winners than losers. Here’s an excerpt from the book: Putting the dislike of losses and the willingness to gamble in the face of potential losses together gives us some powerful insights into investors’ … Read More

James Montier: Anyone Can Create Their Own Currency

In his latest white paper titled – Part 2: What to Do in the Case of Sustained Inflation, James Montier discusses hedges against sustained inflation. He also discusses a simple thought experiment on the difficulties of creating your own currency, digital or otherwise. Here’s an excerpt from the paper: There … Read More

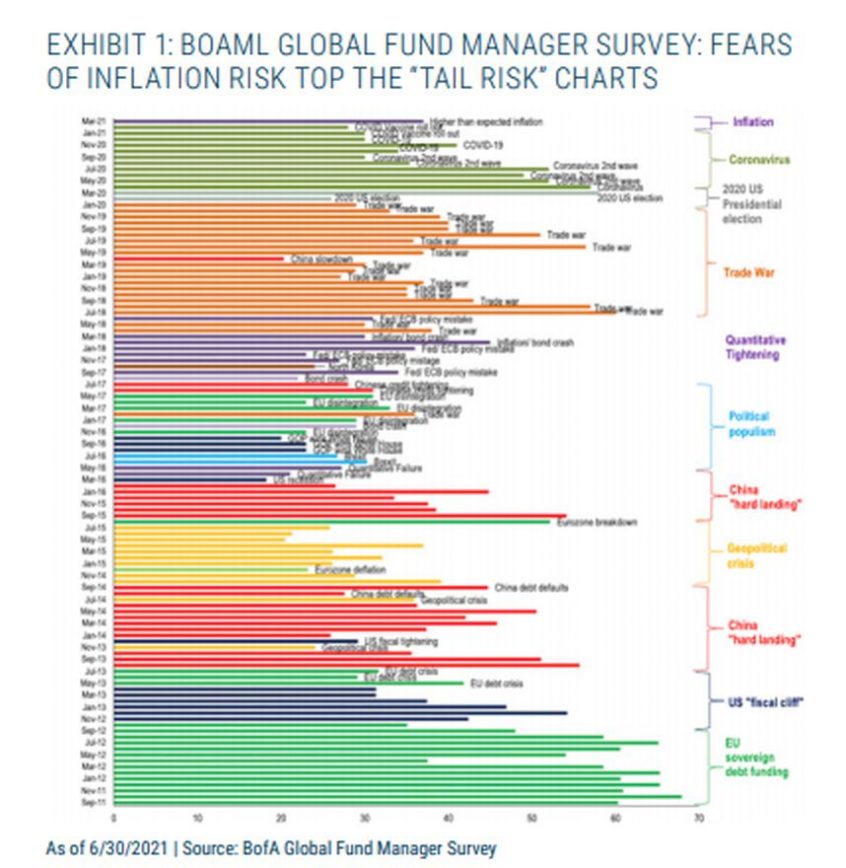

James Montier: Upsurge In Inflation Angst Is Much Ado About Nothing

In his latest paper titled – Part 1: Inflation – Tall Tales And True Cases – Much Ado About Nothing, James Montier discusses why the upsurge in inflation angst is much ado about nothing. Here’s an excerpt from the paper: Inflation is often a poorly understood concept, with monotheistic explanations … Read More

James Montier: Dare To Be Different – Value Stocks In Emerging Markets

James Montier recently wrote a great memo titled – Dare To Be Different, in which he discusses the idea of focusing on value stocks in emerging markets to generate outsized returns. Here’s an excerpt from the memo: The conventional 60/40 portfolio of today is not going to generate the kind … Read More

James Montier: Why Does Everyone Hate MMT?

James Montier recently released a great paper titled – Why Does Everyone Hate MMT?, Groupthink in Economics. In the paper he argues that MMT is misunderstood by the ‘great and the good’ such as Rogoff, Krugman, and Summers, saying: Modern Monetary Theory (MMT) seems to provoke a visceral reaction amongst … Read More

James Montier: How To Protect Yourself From Wall Street’s ‘Self-Serving’ Biases

In his book – The Little Book of Behavioral Investing, James Montier wrote a great passage on how investors can identify and protect themselves from becoming victims of Wall Street’s self-serving biases. Here’s an excerpt from that book: So much for nature. Nurture also helps to generate the generally rose-tinted … Read More

James Montier – The World’s Dumbest Idea – Shareholder Value Maximization

Some years ago, James Montier wrote a great paper called – The World’s Dumbest Idea, that explored the problems surrounding the concept of shareholder value and its maximization saying: “Before you dismiss me as a raving “red under the bed,” you might be surprised to know that I am not … Read More

James Montier: You Can Turn Behavioral Biases Into An Advantage Using A Valuation-Based Framework

We’ve just been listening to a great interview with James Montier on Meb Faber’s podcast. During the interview Montier provides some great insights to help investors protect themselves from their behavioral biases. Montier says that you can actually turn behavioral biases, like anchoring, into an advantage using a valuation-based framework. … Read More

James Montier: “Finance Has Turned The Art Of Transforming The Simple Into The Perplexing Into An Industry”

Some years ago James Montier wrote a great paper called – Was It All Just A Bad Dream? Or, Ten Lessons Not Learnt. Montier’s states that we can learn a great deal about investing by looking back at the mistakes that gave rise to the worst period in markets since the Great Depression … Read More

James Montier – Here’s How Soros Successfully Safeguards Against Making Recurring Mistakes

As investors we all pat ourselves on the back, telling ourselves how smart we are when a stock that we picked outperforms. At the same time we can find dozens of reasons, excluding our own poor judgement, when another stock pick gets hammered. The reason in behavioral investing terms is … Read More

Successful Investing Means Living With Discomfort – Montier, Mauboussin

There is no question that the life of a successful investor can be an uncomfortable and solitary one. Hence the reason why so many investors underperform by picking the ‘good news’ stocks and following the crowd. For some reason we find it easier to accept a mistake if we invest … Read More

If You’re Having Trouble Finding Undervalued Stocks Today, Here’s One Reason Why – GMO

GMO recently released a white paper titled The S&P 500: Just Say No, by Matt Kadnar and James Montier. The paper questions the validity of throwing in the towel and simply indexing all of our equity exposure to the S&P 500. Of particular interest to us here at The Acquirer’s Multiple is Montier’s … Read More

James Montier – There Are No Silver Bullets In Investing (Just Old Snake Oil In New Bottles)

According to the Cambridge dictionary a snake oil salesman is: someone who deceives people in order to get money from them: He was dubbed a “modern day snake oil salesman” after he ripped off thousands of internet customers. So why is it that so many investors are continually happy to … Read More

James Montier: Markets Are Behaving Like The White Queen (Alice In Wonderland)

James Montier of GMO recently wrote a great paper called Six Impossible Things Before Breakfast, in which he discusses current market conditions and how we can make sense of today’s pricing. It’s a must read for all investors. Here’s an excerpt from that paper: I believe the markets are behaving … Read More

James Montier – This Is The Time To Sit There And Do A Winnie the Pooh. Here’s Why.

One of the firms we like to watch closely is Boston-based asset manager GMO, and one member of its asset management team, James Montier. Montier recently did an interview with Finanz und Wirtschaft (Finance and Economic) in which he discusses the current over-valuation in U.S. equity markets saying, “Equities are currently … Read More