During his recent interview with Patient Capital Management, Bill Miller explained how Peter Lynch helped him 50x on one investment. Here’s an excerpt from the interview: Miller: So when I got in the business I had someone who knew Peter Lynch. Got me to talk to Peter and said yeah … Read More

Bill Miller: This Is A John Templeton Market

During his recent interview with CNBC, Bill Miller explained why this is a John Templeton market. Here’s an excerpt from the interview: Miller: Well, the market’s like a giant Rorschach test, everybody sees what they want to see in it. For us. I think it’s a lot like… for me … Read More

Bill Miller: 6 Reasons This Market Is Not Like 2008

In his recent article titled, Is it 2008 All Over Again? Not in the US, Bill Miller explained why this market is not like 2008. Here’s an excerpt from the article: The media and investors are understandably nervous, as home prices in the United States almost never decline; the last … Read More

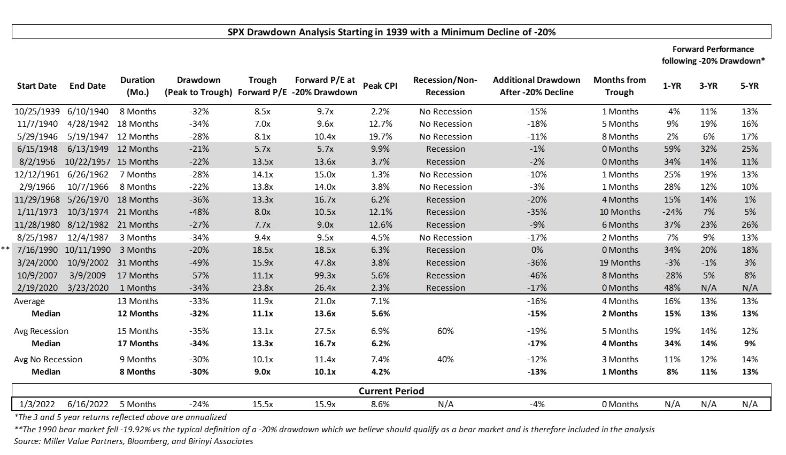

Miller Value: Longer Term Returns Are Historically Strong Following A 20% Drawdown

In their recent article titled Plea(sing) For The Long Term, Miller Value illustrate why longer term returns are historically strong following a 20% drawdown. Here’s an excerpt from the article: We’ve officially entered bear market territory! Investor angst has rarely been greater. It’s nearly impossible to find someone with a … Read More

Bill Miller: If You Can’t Buy When Prices Are Falling You Can’t Buy At All

In his recent interview on the Richer, Wiser, Happier Podcast, Bill Miller explains why if you can’t buy when prices are falling you can’t buy at all. Here’s an excerpt from the interview: Miller: The other thing that I’ve said is that nobody can predict these things, the future, no … Read More

Miller Value: How To Exploit Short-Term Volatility

In their latest Q1 2022 Letter titled, Exploiting Volatility to Outmaneuver the Market, Miller Value explain how to exploit short-term volatility. Here’s an excerpt from the article: We have great conviction in our process, which is both time-tested and unique. We are patient, long-term value investors. We value businesses and think like … Read More

Bill Miller: Rotation To Value Has Begun

In his latest 2022 Market Perspective, Bill Miller says the rotation to value has begun. Here’s an excerpt from the perspective: Where does all that leave us? Even after last week’s move, stock prices remain down year-to-date, and I believe there are many good values in the market. I also … Read More

Bill Miller: How To Find Value In Companies That Are Not Making A Profit

In his recent interview on WealthTrack, Bill Miller explained how to find value in companies that are not making a profit. Here’s an excerpt from the interview: Miller: What the theoretical literature and what the value investing, empirical literature taught and concluded that… that those accounting based metrics were as … Read More

Bill Miller: Most Of The Big Name Stocks Offer Good Value

In his recent interview on WealthTrack, Bill Miller explained why most of the so called growth stocks offer good value. Here’s an excerpt from the interview: I don’t think this market is terribly expensive. There’s some names in the very high growth sphere, cloud computing, software services, things like that. … Read More

Bill Miller: Forget The Headlines And Focus On Stocks

In his latest and final market commentary, Bill Miller discusses why investors should forget headlines and focus on stocks. Here’s an excerpt from the commentary: When I am asked what I worry about in the market, the answer usually is “nothing”, because everyone else in the market seems to spend … Read More

Bill Miller: The Absurdity Of Forecasts

In his latest Q2 2021 Market Letter, Bill Miller highlights how absurd it is to try and forecast the future of markets, and includes recent forecasts by some well known investors. Here’s an excerpt from the letter: In the spirit of Justice Oliver Wendell Holmes’ remark that people need to … Read More

Bill Miller: The Rotation To Value Is Underway

In his recent Q4 2020 Market Commentary, Bill Miller discusses his thoughts on market forecasting, bitcoin, and why he believes the rotation to value is underway. Here’s an excerpt from the commentary: As Sir John Templeton said, “Bull markets are born in pessimism, grow on skepticism, mature on optimism, and … Read More

Bill Miller: Value Investing In High-Tech Growth Companies

Here’s a piece from Janet Lowe’s book – The Man Who Beats The S&P, in which Bill Miller provides some great insights into valuing high-tech growth companies. Here’s an excerpt from the book: “We buy businesses that sell at large discounts to our assessment of their underlying value,” he explains. … Read More

Bill Miller: Traditional Value Names Set To Take Off

In his latest interview with CNBC, value investor Bill Miller discusses why he believes traditional value names are set to take off. Here’s an excerpt from the interview: Question: Are you one of the people who thinks that the long long awaited overdue kind of shift to value is here … Read More

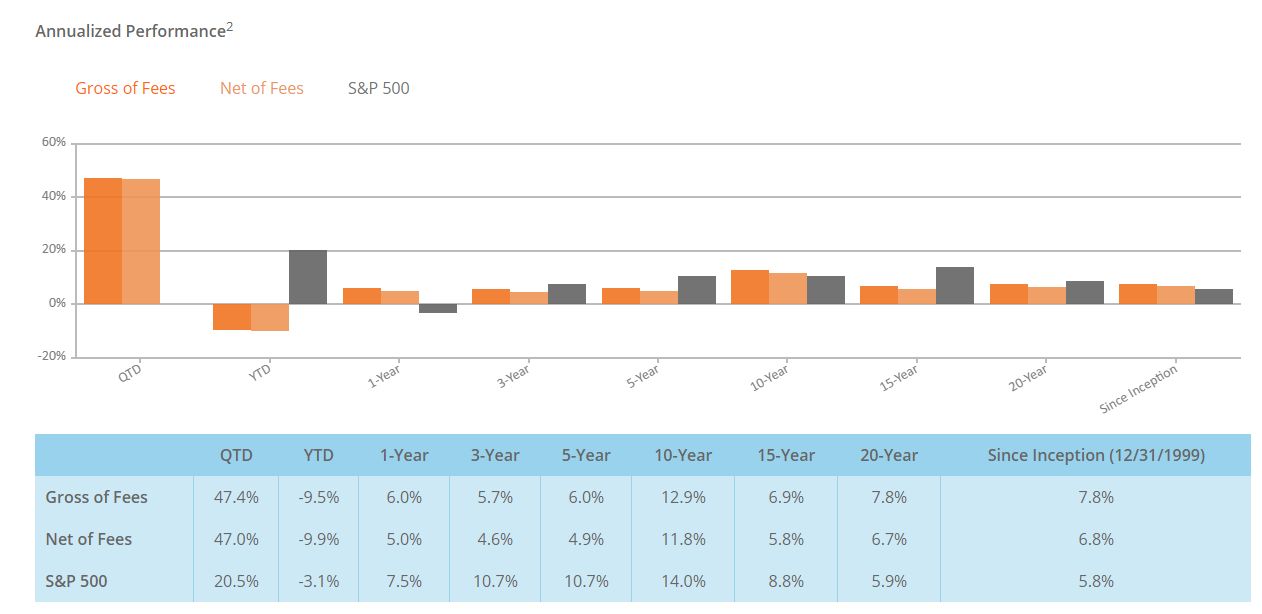

Bill Miller: Opportunity Equity Portfolio – Best Quarter Ever – Up 47% (Net of Fees)

This week Miller Value reported in their Q2 2020 Letter that the Miller Opportunity Equity Portfolio returned +47.0% (net of fees) saying: “It was the best of times, it was the worst of times…” I’m pleased to report we just had our very best quarter of performance in the history … Read More

Bill Miller: A Lesson From George Soros On The So-Called ‘Disconnect’ Between Current Stock Levels And The Real Economy

In his Q2 2020 Market Commentary Bill Miller discussed the so-called ‘disconnect’ between current stock levels and the real economy saying there is no evidence to support such a view based on historical evidence, and citing a lesson he learnt from George Soros back in 2008. Here’s an excerpt from … Read More

Bill Miller: There Are Signposts (As In The Twilight Zone) That We Could Be On The Cusp Of A Regime Change Towards Value

In his Q3 2019 Market Comentary, Bill Miller, of value investing firm Miller Value Partners say’s there are signposts (as in the Twilight Zone) that we could be on the cusp of a regime change that will favor value investors. Here’s an excerpt from the letter: The first few weeks … Read More

Bill Miller: No One Knows What The Market Is Going To Do Over Any Time Horizon Short Enough To Be Of Interest To The Typical Investor

One of the investors we like to follow closely here at The Acquirer’s Multiple is Bill Miller, Chairman and Chief Investment Office of Miller Value Partners. In his latest Q2 2018 shareholder letter Miller provides some great insights on market forecasts, and market forecasters saying: “Portfolio managers often write a “market … Read More

Bill Miller Reveals The Biggest Mistake Value Investors Are Making Now

Here’s a interesting article about value investing legend Bill Miller at CNBC which discusses how Miller has modified his value investing approach over the years. It also highlights the biggest mistake that value investors are making today by excluding FAANG stocks: It happens late in nearly every bull market: Complaints … Read More

The Three Most Important Investing Lessons For Young Investors – Bill Miller

Back in 2015, legendary investor and LMM Chairman and CIO Bill Miller, shared his three most important investing lessons for student investors at the Engage conference. The lessons are applicable to all investors, not just the young.

- Page 1 of 2

- 1

- 2