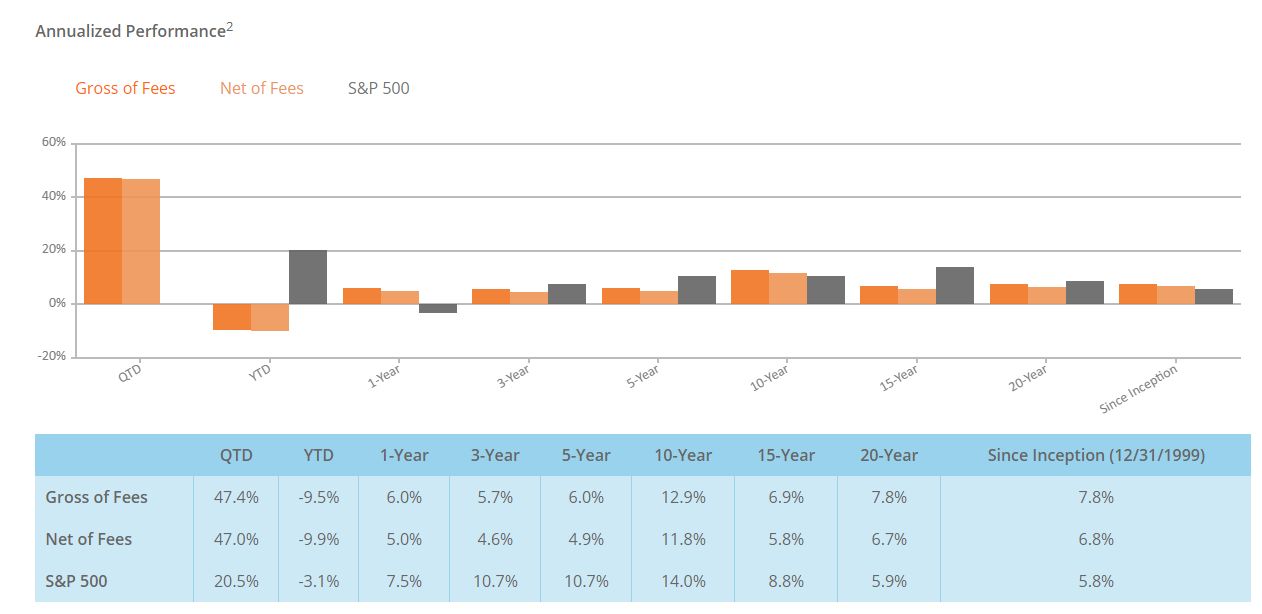

This week Miller Value reported in their Q2 2020 Letter that the Miller Opportunity Equity Portfolio returned +47.0% (net of fees) saying:

“It was the best of times, it was the worst of times…” I’m pleased to report we just had our very best quarter of performance in the history of the Miller Opportunity Equity, returning +47.0% (net of fees). We’ve come nearly full circle (we still have some ground to make up) since last quarter when I wrote about one of our worst quarters on record. As I wrote then, significant drawdowns have historically been great buying opportunities. Poor returns often lead to better performance because mean reversion is a real thing in markets. Market values tend to move much more than underlying business values. But the reversal rarely happens so quickly and intensely.

While I’m glad it did, these extreme market moves leave lasting wounds, both psychologically and financially. A few weeks ago, the WSJ ran an article($) about the large number of investors who moved to cash during February and March. The article noted that those who did the same during the 2009 financial crisis often never got back in and missed the entire decade-long bull market. This time around, the S&P 500 has already recouped all of March’s losses, and 82% of total losses. When will those sellers re-enter?

In markets as elsewhere, sins of omission (not investing) can cost you as much as sins of commission (buying/selling at the wrong time), but worst of all is when you compound your error by doing both (selling at the wrong time and then never getting back in). Buying or selling systematically (a little every month) makes the most sense and avoids trying fruitlessly to time the market. During tumultuous times, being disciplined about adhering to your investment philosophy helps you avoid expensive mistakes, and also helps keep you sane!

You can read the entire Q2 2020 Letter here:

Extreme Times Call for Nothing Extreme at All

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: