In his latest article titled International Diversification—Still Not Crazy after All These Years, Cliff Asness explains why investors should consider international diversification. Here’s an excerpt from the article: International diversification has hurt US-based investors for over 30 years, but the long-run case for it remains relevant. Both financial theory and … Read More

Cliff Asness: The ‘Two Newspaper’ Investing Strategy

During his recent interview with Barry Ritholz, Cliff Asness discussed his ‘two newspaper’ investing strategy. Here’s an excerpt from the interview: Asness: About half our assets are really traditional, we’re money managers beat.. you know plenty of things don’t let a short, or lever, or any of those hedge fund … Read More

Cliff Asness: The One Lesson Investors Need To Learn Multiple Times

During his recent interview with Bloomberg, Cliff Asness discussed the one lesson investors need to learn multiple times. Here’s an excerpt from the interview: Asness: We started our firm about an hour and a half before the 1999-2000 tech bubble. If your viewers can’t tell I’m pretty old. I know … Read More

Cliff Asness: How To Harness The Power Of Diversification

During his recent interview with Money Talks, Cliff Asness explained how to harness the power of diversification. Here’s an excerpt from the interview: Asness: There are a few things. I probably first leapt into this by responding to a Journal of Portfolio Management article back in the early ninety’s, and … Read More

Cliff Asness: If You Think You’re Right, HODL!

In this interview with Infinite Loops, Cliff Asness explains why if you think you’re right about an investment, you should hold on for dear life (HODL). Here’s an excerpt from the interview: Asness: It does not make all sock companies attractive at any valuation in any financial condition. I don’t … Read More

Cliff Asness: If Great Investing Was Easy, Everyone Would Do It, And The Premium Would Go Away

In his recent interview with Talks At GS, Cliff Asness explains why if great investing was easy, everyone would do it, and the premium would go away. Here’s an excerpt from the interview: Asness: So there is a right side. It makes for an excruciating life because you have to … Read More

Cliff Asness: Is Value Really An Interest Rate Bet?

In his recent article titled – Is Value Just an Interest Rate Bet?, Cliff Asness discusses whether value investing really is an interest rate bet. Here’s an excerpt from the article: Frankly, the assumption of so many pundits who state, when value versus growth has been trading correlated to interest … Read More

Cliff Asness: Common Misconceptions About Buybacks

In his recent interview with CNBC, Cliff Asness discussed some common misconceptions about buybacks. Here’s an excerpt from the interview: Host: President Biden recently saying Exxon makes more money than God, and has criticized Exxon for buying back stock instead of investing in drilling to help Americans. I asked Asness … Read More

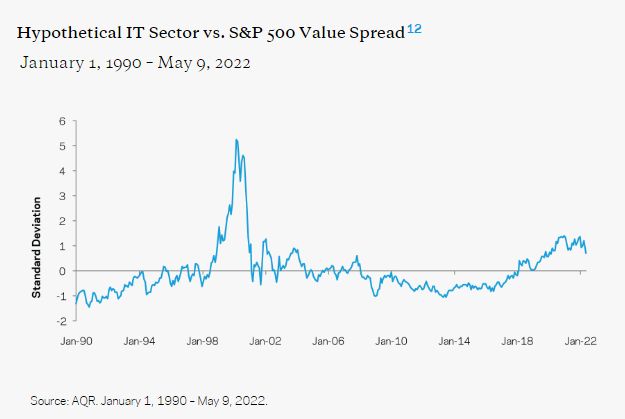

Cliff Asness: A Value Bet Is Not Tech vs The World

In his latest article titled – Value Investing Is Not All About Tech, Cliff Asness explains why his value bet is not tech vs the world. Here’s an excerpt from the article: In other words, there are many different kinds of strategies and bets that are often labeled “value.” Tech … Read More

Cliff Asness: Look For ‘Moneyball’ Stocks

In his latest interview on the Family Investment and Impact Series, Cliff Asness explains how his early life made him focus on ‘Moneyball’ type stocks. Here’s an excerpt from the interview: I think intuitive. I think we did have those experiences, and this came later in life. I was not this … Read More

Cliff Asness: FOMO Means Investors Can’t Tell You About Their Losers

In his recent interview in the All Else Equal Podcast, Cliff Asness explains why FOMO means investors can’t tell you about their losers. Here’s an excerpt from the interview: Asness: So by the way, this is not different than fear of missing out, FOMO on Facebook. They tell us there’s … Read More

Cliff Asness: Shorting The Bad Guys

In his latest article titled – Shorting Counts, Cliff Asness responds to the recent Man Group article titled – “Short-selling does not count as a carbon offset. Here’s an excerpt from his response: What does that mean? It’s instructive to back up and examine how the more traditional non-shorting ESG … Read More

Cliff Asness: Everything Is Extremely Expensive Versus History

In his latest interview on the FEG Insight Bridge Podcast, Cliff Asness explains why everything is extremely expensive versus history. Here’s an excerpt from the interview: So by and large, a stock and a bond portfolio, call it U.S. 60/40. You could do a million different versions of this, right? And … Read More

Cliff Asness: AQR Positioned For One Of The Most Robust Recoveries For Factor Investing Since The Tech Bubble Of 1999

In a recent article at the Financial Times, Cliff Asness explains why his firm is positioned for one of the most robust recoveries for factor investing since the tech bubble of 1999. Here’s an excerpt from the article: A computer-powered investment fund run by AQR posted double-digit gains in the … Read More

Cliff Asness: Unless Human Nature Has Changed We Will Continue With Our Strategy

In this interview on Bloomberg, Cliff Asness was asked if he will continue to follow his investing strategy which has underperformed recently. Here’s an excerpt from the interview: Asness: We try very hard to approach that question with a very open mind. My mother-in-law’s fond of saying – you want … Read More

Cliff Asness: Shorting Your Way to a Greener Tomorrow

In his latest insight titled – Shorting Your Way To A Greener Tomorrow, Cliff Asness examines the use of shorting in an ESG context. Here’s an excerpt from the insight: My colleagues (and even I) have written extensively on responsible investment, as in the use of ESG factors in investment … Read More

Cliff Asness: The Confusion Around Value Investing

In this interview on The Bogleheads Podcast, Cliff Asness discussed his time with Gene Fama, and the confusion around value investing. Here’s an excerpt from the interview: Rick Ferri: Well let me ask just a couple of questions on what you just said. Did Fama ever call what he did … Read More

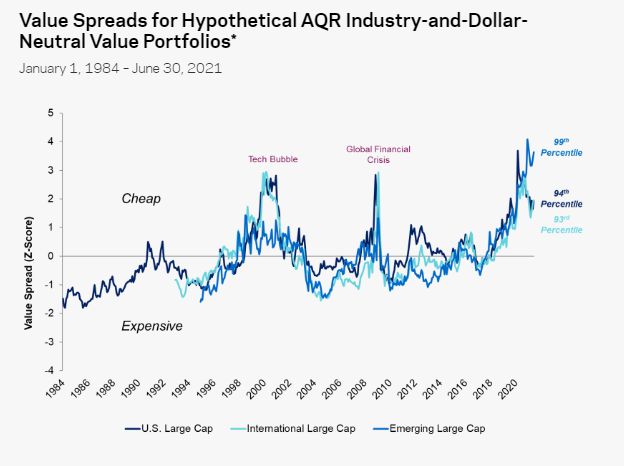

Cliff Asness: Are Value Stocks Cheap for a Fundamental Reason?

In his latest commentary titled – Are Value Stocks Cheap for a Fundamental Reason?, Cliff Asness discusses why the current high value spread is forecasting high expected returns, not lower than usual fundamental growth rates for cheap versus expensive stocks. Here’s an excerpt from the commentary: We have been discussing … Read More

Cliff Asness: Sticking With Your Strategy When It Gets Really Hard

During the latest Management Conference ’21: Keynote Conversation with Cliff Asness, David Booth, and Eugene F. Fama, AQR’s Cliff Asness discusses the important of sticking with your strategy, especially when it becomes really hard. Here’s an excerpt from the conference: Asness: This is a little depressing and a little wonderful … Read More

Cliff Asness: Run Your Process Like A Vulcan

In a recent interview with Front Row, Cliff Asness discussed the difficulty of sticking with your process, keeping staff and clients, and controlling your emotions, when your strategy is underperforming. Here’s an excerpt from the interview: Asness: I am very proud of the fact that as much as I can … Read More