In his latest commentary titled – Are Value Stocks Cheap for a Fundamental Reason?, Cliff Asness discusses why the current high value spread is forecasting high expected returns, not lower than usual fundamental growth rates for cheap versus expensive stocks. Here’s an excerpt from the commentary:

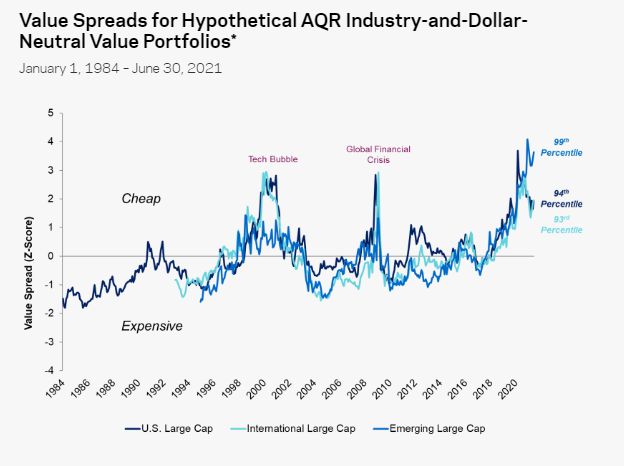

We have been discussing the attractiveness of the value factor for many months based on the unusually high value spread, which compares the valuation multiples of expensive stocks to cheap stocks. This metric is still extremely cheap… 90th+ percentile cheap across all regions.

We think this signals an unusually attractive forward-looking return for the value factor, but some investors have wondered if value is cheap for a reason. Maybe the fundamental prospects for value stocks are unusually poor today, justifying the high value spread? This is by far the most popular question we get from skeptics. And, yes, we have an answer that doesn’t require a four-hour time commitment nor a PhD (though finance PhDs may also be able to follow along).

In a recent webisode (Are Value Stocks Cheap For A Fundamental Reason) we explain why we look at the value spread, and why the current high value spread is forecasting high expected returns, not lower than usual fundamental growth rates for cheap versus expensive stocks.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: