Here’s a list of this week’s best investing reads: How Not to Be Stupid (Farnam Street) 10 Things Investors Can Expect in 2019 (A Wealth of Common Sense) The Art of the Deal, 2019 (The Reformed Broker) Wild Expectations (Collaborative Fund) Seven Big Ideas from Fooled by Randomness (Safal Niveshak) A History of Bear Market Bottoms (The Irrelevant Investor) ‘You Have To Know … Read More

TAM Stock Screener – Stocks Appearing in Tepper, Griffin, Grantham Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Bill Ackman: Top 10 Holdings

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Steve Romick – Value Investing Has Morphed From The Days Of Graham and Dodd

We’ve just been listening to a great interview by Meb Faber with one of our favorite value investor’s – Steve Romick, Portfolio Manager for the FPA Crescent Fund. During the interview Romick explains how value investing has morphed from the days of Graham and Dodd. Excerpt: Steve: Value investing is, … Read More

Joel Greenblatt – Great Value Investors Need To Be Cold Hearted JellyBean Counters

Here’s a great video with Joel Greenblatt at the CFA’s Distinguished Speaker Series. During the presentation Greenblatt recounts the story of how he was able to explain the stock market and value investing to a ninth grade class, using a big jar of jellybeans. Greenblatt says: I have a friend … Read More

Charles Munger – I Frequently Sit In A Room And Converse With Dead People While The People Around Me Are Irritated

Here’s a great compilation on reading habits and books by Warren Buffett and Charles Munger. Our favorite quote from the video is when Munger is asked how he was able to concentrate and balance his reading with so many children around when his family was younger. His response is: “I … Read More

Happy Holidays

Tobias and I would like to wish all of our readers and subscribers a very Merry Christmas and a Happy New Year. We’re going to take a break from publishing articles on the blog for a couple of weeks over the holidays, but Tobias will still be posting on his … Read More

This Week’s Best Investing Reads 12/21/2018

Here’s a list of this week’s best investing reads: The Spacing Effect: How to Improve Learning and Maximize Retention (Farnam Street) Prediction vs. Preparation (A Wealth of Common Sense) Unforced Errors (The Reformed Broker) Did The Fed Just Make Another Mistake? (The Felder Report) Why Value Investing Is Making A Comeback (US News) Surveying the Damage (The Irrelevant Investor) 30 … Read More

TAM Stock Screener – Stocks Appearing in Wachenheim, Dalio, Miller Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Stanley Druckenmiller: What Characteristics Do You Need To Be A Great Investor

Here’s a great interview with Stanley Druckenmiller speaking to Bloomberg’s Erik Schatzker in which Druckenmiller provides his thoughts on the economy, stocks, bonds, trump, algos, and the Fed. Druckenmiller was asked what sort of personality you have to have to be a successful investor. He says: “I think you have to … Read More

David Einhorn: Q3 2018 Top 10 Holdings

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Charles Munger: Investing In Shares Is Much Easier Than Investing In Real Estate, Here’s Why

Here’s a great little video in which Charles Munger is discussing why investing in shares is better than investing in real estate. Munger says: “The trouble with real estate is that everybody else understands it, and the people who you’re dealing with and competed with, they’ve specialized in a little … Read More

Forbes: Contrary To Popular Belief, Value Investing Is Not Dead

Here’s a great article at Forbes discussing the recent performance of value investing saying: “However, a hundred years worth of data says value investing works. One cycle doesn’t change that.” Here’s an excerpt from that article: Many people think value investing is dead. It’s not. Style leadership rotates across cycles. Also, adjusting … Read More

Peter Lynch: 27 Timeless Investing Lessons

We’ve just been re-reading Peter Lynch’s classic book – One Up On Wall Street. In it, Lynch provides 27 timeless investing lessons. Here’s an excerpt from the book: Sometime in the next month, year, or three years, the market will decline sharply Market declines are great opportunities to buy stocks in … Read More

Jeremy Grantham: 4 Books That Every Investor Should Read

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Our Book Recommendations for Investors Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That … Read More

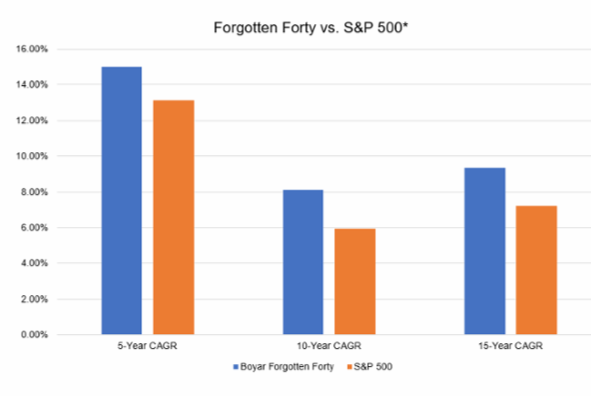

$500 Off Boyar’s Forgotten Forty Report: Special Offer for Acquirers Multiple Readers

Each year, Boyar Research publishes their Forgotten Forty Report featuring the forty stocks that they believe have the greatest potential for capital appreciation in the year ahead due to a catalyst they see on the horizon. To give you an example, Boyar have provided our readers with sample reports from … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Price, Griffin Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

This Week’s Best Investing Reads 12/14/2018

Here’s a list of this week’s best investing reads: Why Small Habits Make a Big Difference (Farnam Street) Normal Accidents in the Stock Market (A Wealth of Common Sense) Mind the Gap (Humble Dollar) CNBC’s full interview with Paul Tudor Jones (CNBC) Asset Owners Are Falling Out of Love With Index Funds (Institutional Investor) Rational vs. Reasonable (Collaborative … Read More

Charlie Munger: I Made Four Or Five Hundred Million Dollars From Two Decisions, With Almost No Risk

In this short interview Charles Munger explains how he made four or five hundred million dollars from just two decisions: “I talked about patience. I read Barron’s for fifty years. In fifty years I found one investment opportunity in Barron’s. I made about $80 Million, with almost no risk. I … Read More

Shareholder Activism Is On The Rise: Caution Required

Here’s a great article at Forbes about a new generation of activist shareholders: Historically, large institutional investors pursued purely financial strategies and kept a low profile in governance. This may no longer be the case. In a manner vaguely reminiscent of the corporate raiders of the 1980s, a new generation … Read More