We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That Every Investor Should Read Bill … Read More

This Week’s Best Investing Reads 11/30/2018

Here’s a list of this week’s best investing reads: Battling Entropy: Making Order of the Chaos in Our Lives (Farnam Street) My favorite analogy for stocks vs the economy (The Reformed Broker) Why BRK? (The Brooklyn Investor) The Stock Market Doesn’t Care About You (A Wealth of Common Sense) Selfish Writing (Collaboratve Fund) The Nifty Fifty (The Irrelevant Investor) The Fed Warns The … Read More

TAM Stock Screener – Stocks Appearing in Tepper, Greenblatt, Dalio Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Joel Greenblatt: Q3 2018 Top 10 Holdings

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Charles Munger: A Parody About The Great Recession

One of the best articles ever written about the ‘Great Recession’ is Charles Munger’s – Parody Describing The Contributions of Wantmore, Tweakmore, Totalscum, Countwrong, and Obvilious To The Tragic ‘Great Recession’ in Boneheadia and The Thoughts of Some People Relating To The Disaster. While the entire article is six pages … Read More

Howard Marks: Avoiding All Losses Can Render Success Unachievable Almost As Readily As Can The Occurrence Of Too Many Losses

In his 2014 memo – Dare To Be Great, Howard Marks says successful investing includes dealing with some losses saying: “To succeed at any activity involving the pursuit of gain, we have to be able to withstand the possibility of loss. A goal of avoiding all losses can render success … Read More

20 Of The Best Books On Investor Psychology – All Time

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That Every Investor Should Read Bill … Read More

TAM Stock Screener – Stocks Appearing in Soros, Greenblatt, Dalio Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

This Week’s Best Investing Reads 11/22/2018

Here’s a list of this week’s best investing reads: There’s Seldom Any Traffic on the High Road (Farnam Street) Surveying the Damage in Stocks (A Wealth of Common Sense) Yards After Contact (The Reformed Broker) To Succeed In The Markets You Must Become A ‘Second Level Thinker’ (The Felder Report) Humble Exits (Collaborative Fund) Price is set at the margin (csinvesting) … Read More

Aswath Damodaran: The One Thing You Need To Do To More Accurately Value Businesses

Here’s a great presentation with Aswath Damodaran and the team at Google. During the presentation Damodaran reveals the one thing investors need to do to more accurately value businesses. Here’s an excerpt from the presentation: So here’s my final point about valuation. One of my favorite movies of all time is … Read More

Charles Munger: The Trouble With Economists & Economics

Some years ago Shane Parrish at Farnam Street did a podcast in which he read the full text of Charlie Munger’s presentation – Academic Economics: Strengths and Weaknesses, after Considering Interdisciplinary Needs. It’s a must listen to for all investors. Here’s an excerpt from Munger’s presentation: 3) Physics Envy The third … Read More

Seth Klarman: Q3 2018 Top 10 Holdings

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Michael Burry: Measuring Money Managers By ‘Relative Performance’ Harms Their Ability To Invest Intelligently

Seth Klarman has often spoken about the nonsense of measuring fund managers by their ‘relative performance’. That is, measuring the performance of their investments against various market benchmarks. A quick read through Michael Burry’s Scion Capital shareholder letters shows that he’s also not a fan of relative performance as a … Read More

Value Invest New York – December 4th, 2018

Value Invest New York will take place on December 4 View Conference Agenda The line-up for Value Invest New York was announced last week and it will feature speakers who will give insights and investment ideas at the conference – with the presentation titles below. The line-up includes Joel Greenblatt, … Read More

Elon Musk: 8 Books That Every Investor Should Read

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That Every Investor Should Read Bill … Read More

This Week’s Best Investing Reads 11/16/2018

Here’s a list of this week’s best investing reads: How This All Happened (Collaborative Fund) Defensive Decision Making: What IS Best v. What LOOKS Best (Farnam Street) Family Inc. (Humble Dollar) Playing with Fire (The Reformed Broker) What If You Retire At a Stock Market Peak? (A Wealth of Common Sense) Why Warren Buffett Would Be Buying Precious Metals Again Today … Read More

TAM Stock Screener – Stocks Appearing in Cohen, Greenblatt, Griffin Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

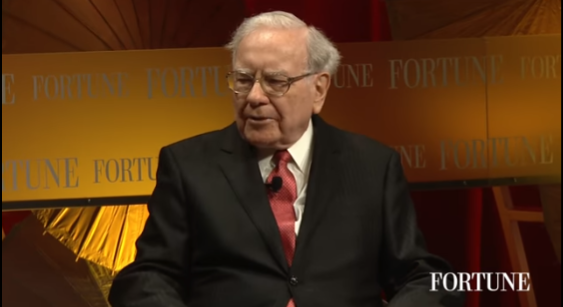

Warren Buffett: “Berkshire Could Be A Rest Home For Activists”

Here’s a great interview with Warren Buffett at Fortune’s Most Powerful Women Conference in which he discusses why he’s not a fan of activists, and the importance of having good communication with your shareholders in the case of an activist surfacing. Here’s an excerpt from the interview: Buffett: Activism is … Read More

David Einhorn: Top 10 Holdings, New Buys, Sold Out Positions

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Stanley Druckenmiller: What Should Investors Do If They’re In A ‘Slump’

Here’s a great interview with investing legend Stanley Druckenmiller at Real Vision in which he discusses the importance of investors knowing whether they’re currently ‘hot’ or ‘cold’ with regards picking investments. He also provides some great insights into what you should do if you find yourself in an investing slump. … Read More