We’ve launched a new investment firm called Acquirers Funds® to help you put the acquirer’s multiple into action. Acquirers Funds® Our investment process begins with The Acquirer’s Multiple®, the measure used by activists and buyout firms to identify potential targets. We believe deeply undervalued, and out-of-favor stocks offer asymmetric returns, with … Read More

Meta Platforms Inc (META) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Meta Platforms Inc (META). Profile Meta is the world’s … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (05/17/2024)

This week’s best investing news: Bill Ackman – An activist investor on challenging the status quo (TED) Jim Simons, Math Genius Who Conquered Wall Street, Dies at 86 (Dealbook) Warren Buffett’s Berkshire Reveals Its Mystery Stock: Chubb (WSJ) Sizing PE Allocations (Verdad) Mohnish Pabrai’s Session at The Investor’s Podcast (MP) … Read More

Why Procter & Gamble Co (PG) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Procter & Gamble Co (PG) Since its founding in 1837, Procter … Read More

Waiting for Value: The Art of Holding for Long-Term Returns

During their recent episode, Taylor, Carlisle, and Cunningham discussed Waiting for Value: The Art of Holding for Long-Term Returns, here’s an excerpt from the episode: Jake: No. I think it was like somebody’s last name was Stein. I can’t remember. But anyway, the point being that you can’t just go … Read More

George Soros: How Market Action Shapes Investment Decisions

In his book – The Alchemy of Finance, George Soros argues that his approach to financial markets, which emphasizes the perspective of a participant rather than a purely scientific method, is validated. Scientific methods lead to the random walk theory, which fails to account for the trial-and-error process participants experience. … Read More

Mohnish Pabrai: Why Successful Investing Feels Like Watching Paint Dry

During this interview with The Investor’s Podcast, Mohnish Pabrai discusses the importance of maintaining a spreadsheet to track the intrinsic value of his investments. He emphasizes that while market values fluctuate, understanding the true value of a business is crucial, especially during volatile times like the financial crisis. Pabrai highlights … Read More

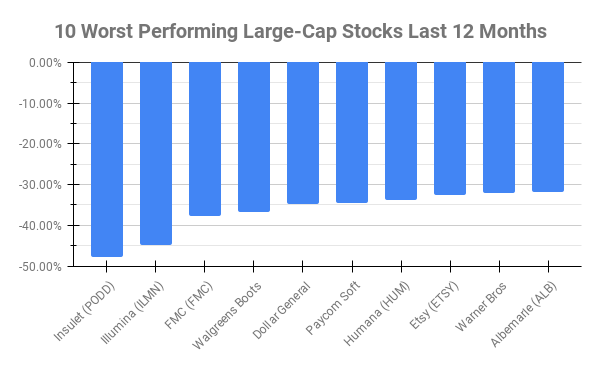

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Insulet (PODD) -47.83% Illumina (ILMN) -44.74% FMC (FMC) -37.81% Walgreens Boots Alliance (WBA) -36.79% Dollar General (DG) -34.79% Paycom … Read More

This Acquirers Multiple Stock Is Undervalued, According to Marks, Simons, Pzena

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Exploring Telic and Atelic Activities in Investing

During their recent episode, Taylor, Carlisle, and Cunningham discussed Exploring Telic and Atelic Activities in Investing, here’s an excerpt from the episode: Tobias: We’ve come up to the top of the hour. JT, you’ve done a lot of travel. Do you have a veggies? Victor: Here you go. [laughs] Tobias: … Read More

Howard Marks: The True Measure of Good Decision-Making: Logic Over Luck

In his book – The Most Important Thing, Howard Marks highlights a fundamental lesson about decision-making: outcomes do not necessarily reflect the quality of decisions. He learned early at Wharton that external factors, often unpredictable, can determine the success or failure of decisions. This concept was further emphasized by Nassim … Read More

Warren Buffett: Sophistication In Global Finance Will Provide Investing Opportunities

During the recent 2024 Berkshire Annual Meeting, Warren Buffett reflected on past experiences, acknowledging he’d gained wisdom. He anticipates future challenges, expecting crises akin to 2008 but not identical. He emphasizes the need for quick access to substantial funds, foreseeing crises occurring every 5-10 years due to increasing global complexity. … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Value Investing Insights: The Role of NAV Discounts in Outperforming Stocks

During their recent episode, Taylor, Carlisle, and Cunningham discussed Value Investing Insights: The Role of NAV Discounts in Outperforming Stocks, here’s an excerpt from the episode: Jake: That’s interesting. [Tobias laughs] Toby, I think you did some research around this, didn’t you, on net-nets? Obviously, Vic’s talking a little bit … Read More

Warren Buffett: Turning Economic Dark Clouds into Investor Gold

In his 2016 Berkshire Hathaway Annual Letter, Warren Buffett discusses how he and Charlie Munger strive for yearly growth in normalized earnings per share, despite potential economic downturns or industry-specific challenges. Retaining all earnings, they reinvest significantly more than competitors, prioritizing long-term growth. While recognizing occasional minor gains, they stress … Read More

Cliff Asness: Fighting Human Nature for Greater Rewards

During his recent interview with Capital Allocators, Cliff Asness discusses his struggle with emotional responses to market fluctuations despite his long-term investment philosophy. He highlights the natural cyclical growth and shrinkage of asset management firms and stresses the importance of steadfastness and openness in strategy reassessment during tough times, acknowledging … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Best Lines From The 2024 Berkshire Meeting

During their recent episode, Taylor, Carlisle, and Cunningham discussed Best Lines From The 2024 Berkshire Meeting, here’s an excerpt from the episode: Tobias: One of the great lines from Charlie when they– I wish I knew the interview that it had come from, but he was sitting in a chair … Read More

Bill Ackman: Value Investing: Lessons from Warren Buffett and Michael Porter

In this fireside chat at USB, Bill Ackman discusses the value of understanding the predictable nature of businesses, akin to bonds with varying coupons and no fixed maturity, emphasizing the higher worth of early years in a discounted cash flow analysis. Ackman, influenced by Warren Buffett, prioritizes investments in businesses … Read More

Bill Nygren: Why You Shouldn’t Sell After The S&P500 Records New Highs

In his latest Q1 2024 commentary, Bill Nygren explains why investors shouldn’t sell after the S&P500 records new highs. An investor selling at each new high would have missed substantial gains, as holding throughout would have multiplied an investment over 200 times. Here’s an excerpt from the commentary: Nygren: In … Read More

Carl Icahn – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More