In his 1987 Chairman’s Letter, Warren Buffett explained how investors make the mistake of choosing exotic-sounding businesses over the less exotic, boring ones. Here’s an excerpt from the letter: Gypsy Rose Lee announced on one of her later birthdays: “I have everything I had last year; it’s just that it’s … Read More

Warren Buffett: How To Make Money From ‘Work-Out’ Investments (1957)

In his 1957 Partnership Letter, Warren Buffett explained how he made money from ‘work-out’ investments. Here’s an excerpt from the letter: The market decline has created greater opportunity among undervalued situations so that, generally, our portfolio is heavier in undervalued situations relative to work-outs than it was last year. Perhaps … Read More

Warren Buffett: The Stock Market Is The Most Obliging, Money-Making Place In The World

During the 2012 Berkshire Hathaway Annual Meeting, Warren Buffett explained why the stock market is the most obliging, money-making place in the world. Here’s an excerpt from the meeting: WARREN BUFFETT: Yeah. We’ve run Berkshire now for 47 years. There have been several times — oh, four or five times … Read More

Warren Buffett: Starting Over – What I Would Have Done Differently

During the 2012 Berkshire Hathaway Annual Meeting, Warren Buffett discussed what he would have done differently if he had the chance to start over. Here’s an excerpt from the meeting: WARREN BUFFETT: Oh, I think you have all kinds of opportunities. I would probably do very much what I have … Read More

Warren Buffett: You Need To Pay Up For Quality Businesses

During the 2013 Berkshire Hathaway Annual Meeting, Warren Buffett discussed the need to pay up for quality businesses. Here’s an excerpt from the meeting: WARREN BUFFETT: Well, we usually — we usually feel we’re paying too much. Isn’t that right, Charlie? (Laughs) But we find the business so compelling, the … Read More

Warren Buffett – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Warren Buffett: Getting New Ideas & Shedding Old Ones

During the 2017 Berkshire Hathaway Annual Meeting, Warren Buffett discussed getting new ideas and shedding old ones. Here’s an excerpt from the meeting: CHARLIE MUNGER: Everywhere you look in Berkshire, somebody is being sensible. And that is a great pleasure. And if you combine that with being very opportunistic so … Read More

Warren Buffett: How Much Time Should You Spend Thinking About Your Portfolio

During the 2007 Berkshire Hathaway Annual Meeting, Warren Buffett discussed how much time you should spend thinking about your portfolio. Here’s an excerpt from the meeting: WARREN BUFFETT: Well, that sort of breaks down into two periods in my life. When I had more ideas than money, I was thinking … Read More

Warren Buffett: Never Read Analysts Reports

During the 2003 Berkshire Annual Meeting, Warren Buffett explained why he never reads analysts reports. Here’s an excerpt from the meeting: WARREN BUFFETT: You want to read lots of financial material as it comes along. And actually, The New York Times has a far better business section than they had … Read More

Warren Buffett: Wonderful Industries Do Not Always Equate To Wonderful Businesses

During the 1999 Berkshire Hathaway Annual Meeting, Warren Buffett explained why wonderful industries do not always equate to wonderful businesses. Here’s an excerpt from the meeting: WARREN BUFFETT: There’s a lot of difference between making money and spotting a wonderful industry. You know, the two most important industries in the … Read More

Warren Buffett: You Don’t Always Need A Large Margin Of Safety

During the 2007 Berkshire Hathaway Annual Meeting, Warren Buffett explained why you can buy businesses that don’t have a large margin of safety. Here’s an excerpt from the meeting: WARREN BUFFETT: We favor the businesses where we really think we know the answer. And, therefore, if a business gets to … Read More

Warren Buffett: How To Determine If Someone Is A Great Capital Allocator

During the 2011 Berkshire Hathaway Annual Meeting, Warren Buffett was asked – how can we determine how good of a job you have done at allocating capital? Here’s an excerpt from the meeting: WARREN BUFFETT: Well, the real test will be whether the earnings progress at a rate that’s commensurate … Read More

Warren Buffett & Charlie Munger: Why We Still Invest In Capital Intensive Businesses

During the 2018 Berkshire Annual Meeting, Warren Buffett and Charlie Munger explained why they still invest in capital intensive businesses. Here’s an excerpt from the meeting: AUDIENCE MEMBER: Mr. Buffett, my name is Daphne Collier Starr (PH). I’m eight years old and live in New York City. I’ve been a … Read More

Warren Buffett: You Cannot Get Rich With A Weather Vane

During the 1994 Berkshire Annual Meeting, Warren Buffett explained why you should not make decisions in securities based on what other people think. Here’s an excerpt from the meeting: WARREN BUFFETT: Yeah, there was an article about a week or so ago in Barron’s. The same fellow wrote an article … Read More

Warren Buffett: Why We Don’t Do More Due Diligence

During the 2016 Berkshire Hathaway Annual Meeting, Warren Buffett and Charles Munger explained why they don’t do more due diligence when buying companies. Here’s an excerpt from the meeting: WARREN BUFFETT: Yeah. I get that question fairly often, sometimes — often from lawyers. In fact, our own — we talked … Read More

Charles Munger: There’s A Lot Of Misery To Be Obtained By Misusing Stocks

During the 2015 Berkshire Hathaway Annual Meeting, Charles Munger and Warren Buffett discussed the benefits of value investing and the misery associated with misusing stocks. Here’s an excerpt from the meeting: WARREN BUFFETT: Yeah. There’s a certain irony, in that we will — we would — do the best, over … Read More

Warren Buffett: How To Overcome Fear When Everyone Else Is Scared

During the 2010 Berkshire Hathaway Annual Meeting, Warren Buffett was asked how to overcome fear when everyone else is scared. Here’s his response: WARREN BUFFETT: The business of being scared, you know, I don’t know what you do about that. If you’re of that — if you have a temperament … Read More

This Is How Charlie Munger Negotiates With Large Insurance Companies

Insurance services play a vital role in protecting individuals and businesses from unexpected financial losses. Whether it’s coverage for property damage, liability claims, or employee dishonesty, insurance policies offer a sense of security and peace of mind. In the world of insurance, companies like Boyd Insurance Brokerage have built a … Read More

Warren Buffett: There Is Nothing More Destructive Than Companies Reporting Forecasted Earnings

In his latest 2022 Berkshire Annual Meeting, Warren Buffett explained why there is nothing more destructive than companies reporting forecasted earnings. Here’s an excerpt from the meeting: Buffett: Within GAAP accounting I can play a lot of games with numbers. We have never… we’ve done a lot of dumb things … Read More

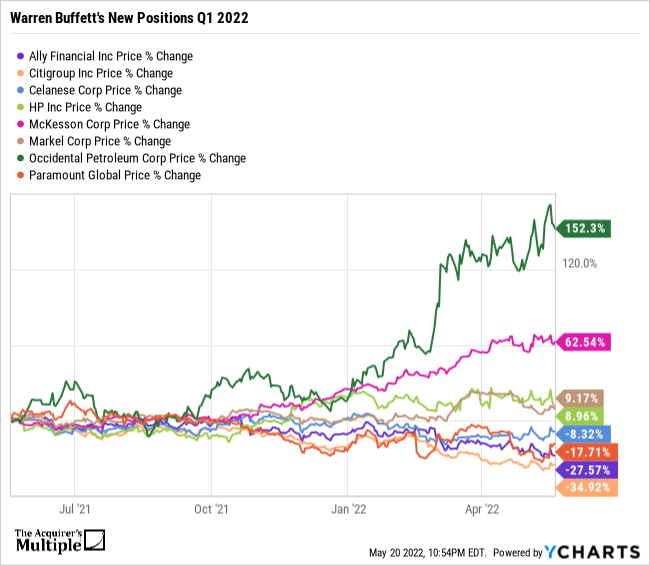

What Does Warren Buffett See In His 8 New Positions (Q1 2022)? @ycharts

According to his latest 13F for Q1 2022, Warren Buffett added 8 new positions. This week we look at how these new positions have performed over the last 12 months. SYM ISSUER NAME VALUE ($000) % SHARES ALLY ALLY FINL INC $389,990 0.10% 8,969,420 C CITIGROUP INC $2,945,319 0.80% 55,155,797 … Read More