During the 2013 Berkshire Hathaway Annual Meeting, Warren Buffett discussed the need to pay up for quality businesses. Here’s an excerpt from the meeting: WARREN BUFFETT: Well, we usually — we usually feel we’re paying too much. Isn’t that right, Charlie? (Laughs) But we find the business so compelling, the … Read More

Warren Buffett – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Warren Buffett: Getting New Ideas & Shedding Old Ones

During the 2017 Berkshire Hathaway Annual Meeting, Warren Buffett discussed getting new ideas and shedding old ones. Here’s an excerpt from the meeting: CHARLIE MUNGER: Everywhere you look in Berkshire, somebody is being sensible. And that is a great pleasure. And if you combine that with being very opportunistic so … Read More

Warren Buffett: How Much Time Should You Spend Thinking About Your Portfolio

During the 2007 Berkshire Hathaway Annual Meeting, Warren Buffett discussed how much time you should spend thinking about your portfolio. Here’s an excerpt from the meeting: WARREN BUFFETT: Well, that sort of breaks down into two periods in my life. When I had more ideas than money, I was thinking … Read More

Warren Buffett: Never Read Analysts Reports

During the 2003 Berkshire Annual Meeting, Warren Buffett explained why he never reads analysts reports. Here’s an excerpt from the meeting: WARREN BUFFETT: You want to read lots of financial material as it comes along. And actually, The New York Times has a far better business section than they had … Read More

Warren Buffett: Wonderful Industries Do Not Always Equate To Wonderful Businesses

During the 1999 Berkshire Hathaway Annual Meeting, Warren Buffett explained why wonderful industries do not always equate to wonderful businesses. Here’s an excerpt from the meeting: WARREN BUFFETT: There’s a lot of difference between making money and spotting a wonderful industry. You know, the two most important industries in the … Read More

Warren Buffett: You Don’t Always Need A Large Margin Of Safety

During the 2007 Berkshire Hathaway Annual Meeting, Warren Buffett explained why you can buy businesses that don’t have a large margin of safety. Here’s an excerpt from the meeting: WARREN BUFFETT: We favor the businesses where we really think we know the answer. And, therefore, if a business gets to … Read More

Warren Buffett: How To Determine If Someone Is A Great Capital Allocator

During the 2011 Berkshire Hathaway Annual Meeting, Warren Buffett was asked – how can we determine how good of a job you have done at allocating capital? Here’s an excerpt from the meeting: WARREN BUFFETT: Well, the real test will be whether the earnings progress at a rate that’s commensurate … Read More

Warren Buffett & Charlie Munger: Why We Still Invest In Capital Intensive Businesses

During the 2018 Berkshire Annual Meeting, Warren Buffett and Charlie Munger explained why they still invest in capital intensive businesses. Here’s an excerpt from the meeting: AUDIENCE MEMBER: Mr. Buffett, my name is Daphne Collier Starr (PH). I’m eight years old and live in New York City. I’ve been a … Read More

Warren Buffett: You Cannot Get Rich With A Weather Vane

During the 1994 Berkshire Annual Meeting, Warren Buffett explained why you should not make decisions in securities based on what other people think. Here’s an excerpt from the meeting: WARREN BUFFETT: Yeah, there was an article about a week or so ago in Barron’s. The same fellow wrote an article … Read More

Warren Buffett: Why We Don’t Do More Due Diligence

During the 2016 Berkshire Hathaway Annual Meeting, Warren Buffett and Charles Munger explained why they don’t do more due diligence when buying companies. Here’s an excerpt from the meeting: WARREN BUFFETT: Yeah. I get that question fairly often, sometimes — often from lawyers. In fact, our own — we talked … Read More

Charles Munger: There’s A Lot Of Misery To Be Obtained By Misusing Stocks

During the 2015 Berkshire Hathaway Annual Meeting, Charles Munger and Warren Buffett discussed the benefits of value investing and the misery associated with misusing stocks. Here’s an excerpt from the meeting: WARREN BUFFETT: Yeah. There’s a certain irony, in that we will — we would — do the best, over … Read More

Warren Buffett: How To Overcome Fear When Everyone Else Is Scared

During the 2010 Berkshire Hathaway Annual Meeting, Warren Buffett was asked how to overcome fear when everyone else is scared. Here’s his response: WARREN BUFFETT: The business of being scared, you know, I don’t know what you do about that. If you’re of that — if you have a temperament … Read More

This Is How Charlie Munger Negotiates With Large Insurance Companies

Insurance services play a vital role in protecting individuals and businesses from unexpected financial losses. Whether it’s coverage for property damage, liability claims, or employee dishonesty, insurance policies offer a sense of security and peace of mind. In the world of insurance, companies like Boyd Insurance Brokerage have built a … Read More

Warren Buffett: What Makes Apple Inc Great!

According to his latest Q1 2022 13F, Warren Buffett purchased another 3,787,856 shares in Apple Inc, which means he now owns 890,923,410 shares in the company. This equates to 43% of his entire portfolio. In his 2021 Berkshire Hathaway Annual Meeting he explained why the iPhone, such as a Refurbished … Read More

Warren Buffett: There Is Nothing More Destructive Than Companies Reporting Forecasted Earnings

In his latest 2022 Berkshire Annual Meeting, Warren Buffett explained why there is nothing more destructive than companies reporting forecasted earnings. Here’s an excerpt from the meeting: Buffett: Within GAAP accounting I can play a lot of games with numbers. We have never… we’ve done a lot of dumb things … Read More

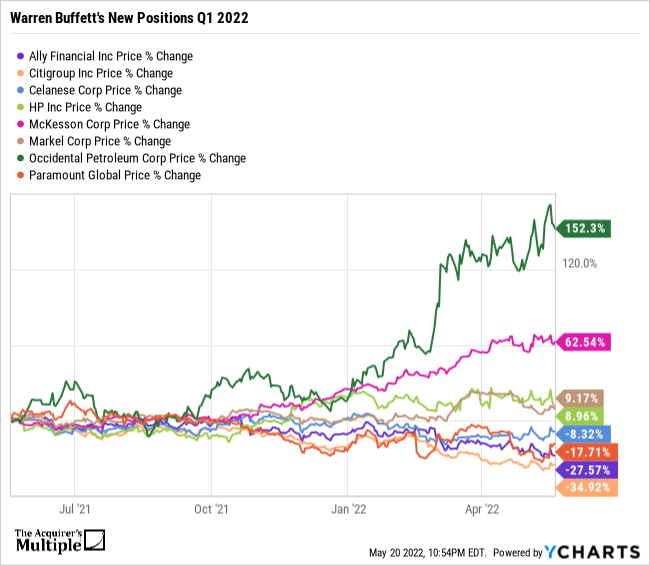

What Does Warren Buffett See In His 8 New Positions (Q1 2022)? @ycharts

According to his latest 13F for Q1 2022, Warren Buffett added 8 new positions. This week we look at how these new positions have performed over the last 12 months. SYM ISSUER NAME VALUE ($000) % SHARES ALLY ALLY FINL INC $389,990 0.10% 8,969,420 C CITIGROUP INC $2,945,319 0.80% 55,155,797 … Read More

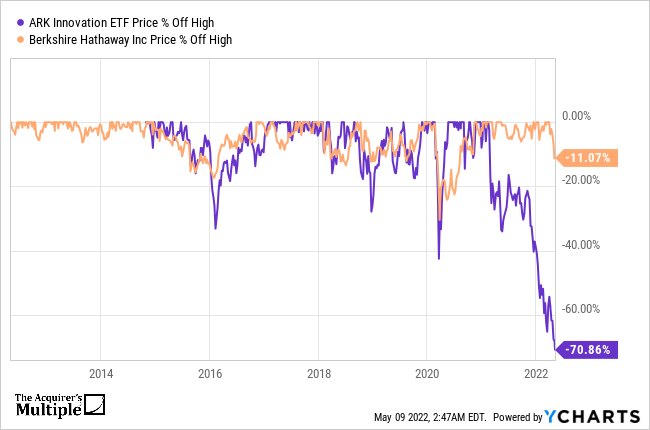

Chart Of The Week: Cathie Wood vs Warren Buffett – Head To Head – Last 10 Years – @ycharts

As part of a new weekly feature here at the Acquirer’s Multiple we’ll be providing some of our favorite charts of the week from @ycharts. This week we’ll take a look at a ‘head to head’ between Cathie Wood vs Warren Buffett over the last 10 years. Current Share Price … Read More

Warren Buffett: Cash Is Like Oxygen, If It Disappears For A Few Minutes It’s All Over

During his recent Berkshire Hathaway Annual Meeting, Warren Buffett explains why he always holds cash. Here’s an excerpt from the meeting: Buffett: Going back to Q2 is we will always have a lot of cash on hand. And when I say cash I don’t mean commercial paper. When 2008 and … Read More

Warren Buffett: Looking Back, We Have Bought At Some Really Dumb Times

In his latest Berkshire Hathaway Annual Meeting, Warren Buffett discusses how looking back, they have bought during some really dumb times. Here’s an excerpt from the meeting: Buffett: The interesting thing is you know obviously we haven’t the faintest idea what the stock market is going to do when it … Read More