In his recent interview on ValueWalk, Rich Pzena discussed why earnings growth rates are higher for value stocks than growth stocks for the next two years. Here’s an excerpt from the interview (H/T Forbes): “A typical value cycle that’s tied to an economic cycle lasts for quite some time,” Pzena … Read More

Rich Pzena: Why Returns Deteriorate As You Grow

In his recent interview on the ValueWalk Podcast, Rich Pzena discusses why returns deteriorate as you grow. Here’s an excerpt from the interview: This is one of those businesses where the bigger that you get the harder it is to win. It’s almost the opposite of every other business which … Read More

Rich Pzena: The One Thing Joel Greenblatt Taught Me To Achieve Outstanding Results

In this interview on the [i3] Podcast, Rich Pzena discusses the one thing that Joel Greenblatt taught him which helped him to achieve outstanding results. Here’s an excerpt from the interview: Pzena: He had one view right, he said to me I don’t believe in pure value investing. I think … Read More

Rich Pzena Top 10 Holdings (Q2 2021)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena: No One Believes Value Will Work Until it Already Has

In his recent Q2 2021 Earnings Call, Rich Pzena discussed the current climate for value investors saying, “Almost no one believes value will work until it already has”. Here’s an excerpt from the call: Pzena: I’ve been a value investor my entire life. Someone asked me recently, how I came … Read More

Pzena: Value Doesn’t Need Inflation To Work

In their latest Q2 2021 Market Commentary, Pzena discuss inflation, value investing, and the performance of cheap vs expensive stocks across inflationary environments. Here’s an excerpt from the commentary: Inflation, its effect on the market, and its implications for our portfolios have been frequent topics in recent client conversations. Whether … Read More

Rich Pzena: 4 Factors That Could Provide A Spectacular Decade For Value

In his recent interview on the Gaining Perspective Podcast, Rich Pzena discussed four factors that could provide a spectacular decade for value. Here’s an excerpt from the interview: Pzena: I think there are four factors that will potentially make this a good period for value. 1. We’re In The Middle … Read More

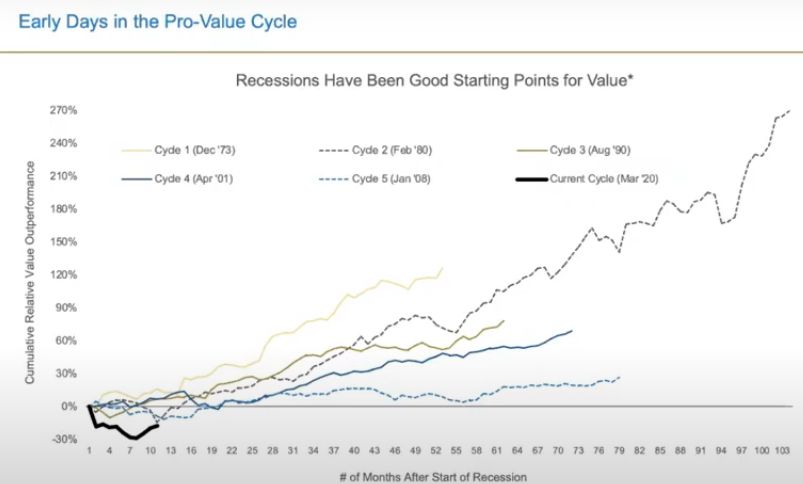

Rich Pzena: This Is The Beginning Of A Long Pro-Value Cycle

In his latest Q1 2021 Earnings Call, Rich Pzena explained why this is beginning of a long pro-value cycle. Here’s an excerpt from the call: Last quarter in these remarks, I observed the clients were asking us what are the fourth quarter’s big value run. Was the start of a … Read More

Pzena: 4 Reasons Why We’re Entering Into A Powerful Period For Value Outperformance

In their latest Q1 2021 Market Commentary, Pzena Investsment Management provide four reasons why we’re entering into a powerful period of value outperformance. Here’s an excerpt from the commentary: This represents the value approach in a nutshell: having the fundamental research and discipline to buy good businesses when their path … Read More

Value Investing Masterclass: Greenblatt & Pzena – Excess Financial Leverage And Value Investing are Not Good Bedfellows

In their recent Value Investing Masterclass, Rich Pzena and Joel Greenblatt discuss all things value investing including their days spent worked together on a Ben Graham paper in college. During the interview Rich Pzena also discusses his thoughts on why value investing and excess financial leverage are not good bedfellows. … Read More

Rich Pzena: The Beginning Of The Great Rotation To Value?

In his latest webinar titled – The Beginning Of The Great Rotation To Value?, Rich Pzena provides his thesis on why we could be at the beginning of another great rotation to value, based on historical indicators. Here’s an excerpt from the webinar: Pzena: This is really a perfect time … Read More

Rich Pzena: Momentum Is With Value

In their latest Q4 2020 Market Commentary titled Momentum Is With Value, Pzena Investment Management discussed why they believe we are in the early stages of a value cycle due to an earnings recovery that will favor value stocks. Here’s an excerpt from the commentary: Companies reacted to the operational … Read More

Rich Pzena: Why We Stick With Value Investing – Not Value Factors

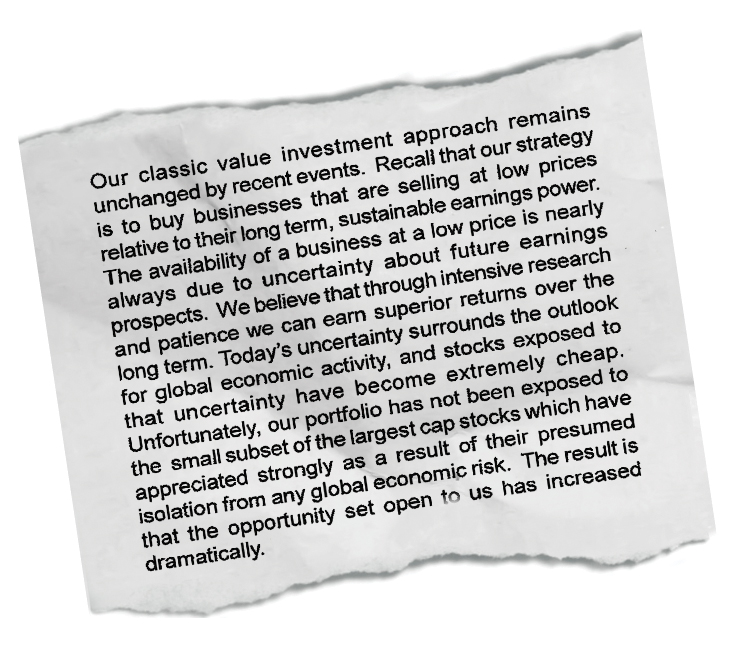

In this discussion with Rich Pzena and Pzena President Bill Lipsey, Pzena explains why they choose to stay the course with their value investing strategy, and why value investing requires discipline in periods where prices become so far detached from fundamental value. One of the question’s his firm regularly gets … Read More

Rich Pzena’s Top 10 Holdings (Q3 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena: The Day Is Coming For Value Investing

In his latest Q3 2020 earnings call, Pzena Asset Management CEO Rich Pzena outlined his reasons why the day is coming for value investing. Here’s an excerpt from that call: Pzena: Thank you, Jessica. Ride the winners. That’s always been obvious investment strategy favored at the end of every cycle. … Read More

Superinvestor Rich Pzena: Top 10 Holdings (Q2 2020), Plus Top Buys NRG, AIG, DOW

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena: The True Performance Of Value Investing Should Be Measured Over A Variety Of Endpoints

In his latest Q2 2020 Market Commentary Rich Pzena urges investors to consider the performance of value investing over a variety of endpoints, rather than just the recent past, as a better representation of the strategy’s efficacy. Here’s some excerpts from his commentary: The extreme volatility in the first quarter … Read More

Rich Pzena: Top Buys, Top Sells (Q1 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena: Top 10 Holdings

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Richard Pzena: “The Longer And Deeper The Anti-Value Cycle, The Greater The Recovery For Undervalued Stocks When Markets Eventually Normalize.”

Richard Pzena has just released his firm’s Q3 2019 Commentary, in which he discusses the similarities between today’s extended bull market, and the period leading up to 1998, and what that means for value investors, saying: “History has demonstrated that the longer and deeper the anti-value cycle, the greater the … Read More