In their latest market commentary, Pzena Investment Management explain why today’s darling stocks become tomorrow’s value stocks. Here’s an excerpt from the commentary:

As disciplined value investors, we are open-minded to investment opportunities, while never compromising by overpaying. Thus, we have no issue purchasing mega-cap and/or technology stocks as long as they are trading at prices that we believe will earn a handsome return for our risk. However, we don’t believe that is the case today.

With 27 years of experience in all types of markets, we have seen similar market conditions in the past and were very well rewarded for maintaining our value discipline. The last time we saw concentrated indices like this was in 1999. This was a challenging period for our then-three-year-old firm; we trailed the market by 6,000 basis points, which still stands as the largest underperformance we’ve experienced as a firm. However, we maintained our discipline, didn’t buy any of the index giants, and were eventually well rewarded for it. One thing we did not predict was that we would eventually own nine of the ten largest stocks of that time, which we purchased at future dates at steeply discounted prices.

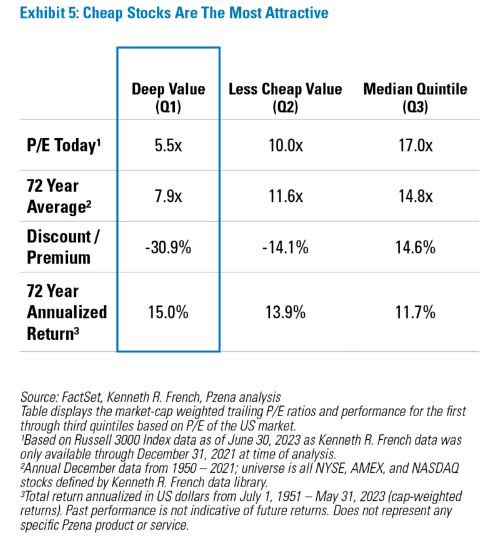

With our extensive history as disciplined, patient value investors, we are once again comfortable eschewing the mega-cap growth darlings. Instead, we are finding good companies among the cheapest quintile, which have delivered significantly better returns over the long term and are trading at a 31% discount to their long-term average. Less cheap stocks are trading at a significantly smaller discount, while the median quintile is trading at a 14% premium (Exhibit 5).

You can read the entire commentary here:

Pzena Q2 2023 Market Commentary

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: