In their recent Q2 2022 Market Commentary, Pzena Investment Management discuss value’s opportunity in uncertain times. Here’s an excerpt from the commentary:

The late John Bogle, founder of The Vanguard Group, suggested a framework for breaking stock market returns into two pieces: fundamental return, the return from dividends and earnings, and speculative return, the return from the change in multiples.

Using this framework, 85% of expensive stocks’ return advantage over the past five and a half years has come from the speculative expansion of multiples, versus the multiple compression of value stocks.

It is important to remember that extreme multiple expansion has never been a reliable and sustainable contributor to long-term performance, accounting for less than 10% of historical market gains.

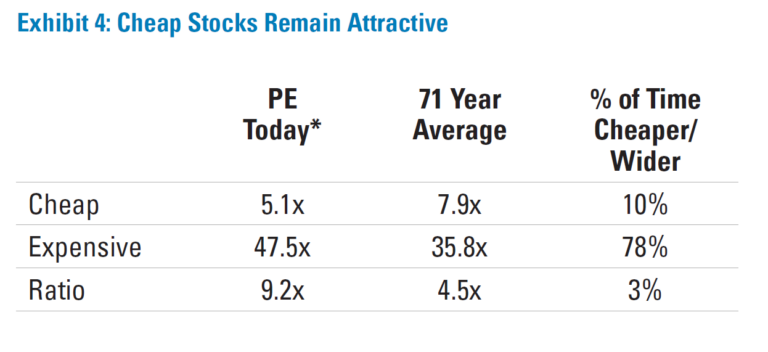

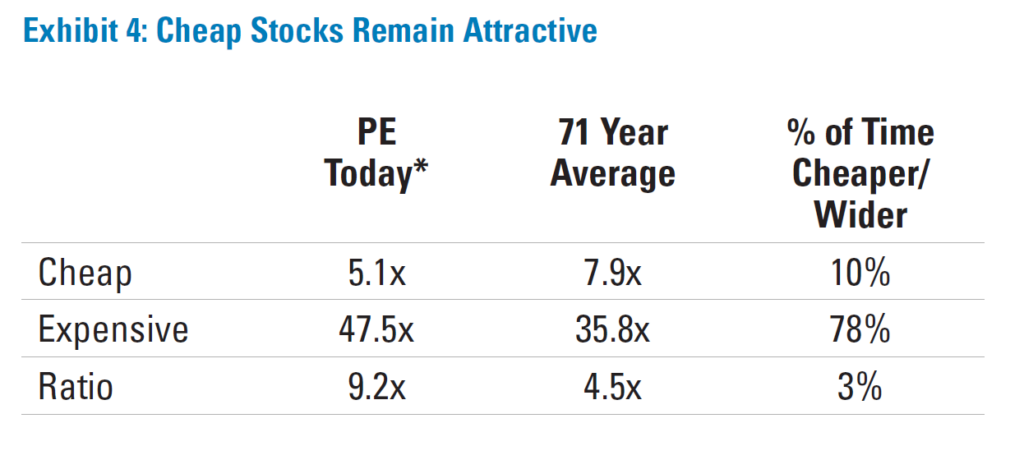

The wide valuation disparity has left cheap stocks extremely attractive relative to expensive stocks. Despite value outperforming the market by 48% in the US since the value cycle turned, the ratio between the cheapest and most expensive stocks remains near historical highs on a price-to-earnings basis, or more than twice the 71-year average (Exhibit 4). That ratio has been wider just 3% of the time over the history of the data.

Source: FactSet, Kenneth R. French, Pzena analysis. P/E ratios for the most expensive and cheapest quintiles of the US market based on price/earnings. 71-Year Average is annual December data from 1950 – 2020. Universe is all NYSE, AMEX, and NASDAQ stocks defined by Kenneth R. French data library. *Based on Russell 3000 Index data as of June 30, 2022 as Kenneth R. French data was only available through December 31, 2020 at the time of analysis.

The valuation disparity is largely driven by expensive stocks, which, despite selling off this year, remain richly valued by historical standards at 47x earnings. Meanwhile, cheap stocks are trading at the low end of the typical 5–10x range observed over the past 71 years.

This presents disciplined value investors with a compelling opportunity to rotate out of the stocks that have provided the outperformance of the past several quarters, and into a diverse new set of bargain names.

While recession fears are understandable, timing market peaks and valleys is extremely difficult and more likely to cost performance than add to it. Indeed, with reported GDP growth turning negative in some regions and markets already down sharply in anticipation of the next recession, it calls into question the risk/reward of maintaining a lower equity allocation at this point, since it has historically represented a good time to invest in the market, and a particularly good time for value stocks.

With the opportunity set we see in value stocks, we believe the runway for a long and enduring value cycle remains intact.

You can read the entire commentary here:

Pzena – Value’s Opportunity In Uncertain Times

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: