In their lastest Q1 2022 Market Commentary, Pzena Investment Management explain why fundamentals point to an enduring value cycle. Here’s an excerpt from the commentary:

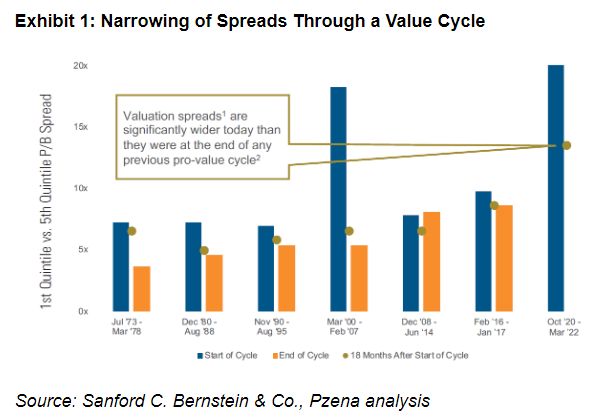

We commonly hear two questions at opposite ends of the value cycle: “Is value dead?” and “Is the value cycle over?” The psychology behind these questions is what drives enduring value cycles and creates the opportunity for long-term alpha. Not long after the pro-value cycle started in October 2020, we started hearing the latter question.

Recent concerns relate to the impact of supply chain issues, rising inflation, and, more recently, Russia’s invasion of Ukraine. Higher prices, particularly for energy, and concerns about a Fed-induced recession are leading to talk of stagflation, something markets have not seen in more than four decades.

It is certainly hard to ignore the daily news flow without imagining the possible negative implications to equities. It is also impossible to predict whether there will be temporary interruptions in the value cycle caused by some of these events.

However, we believe the lesson from history is clear: In the face of geopolitical fears, investors should stay the course in value because the market’s reaction typically doesn’t last long, and the recovery is powerful and enduring. Even after a period of significant outperformance, we believe the outlook for value remains strong given the solid post-recession fundamentals for cheap stocks.

You can read the entire commentary here:

Pzena Investment Management Q1 2022 Commentary

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: