In their latest Insight, GMO explain why deep value offers a compelling opportunity within U.S Equities. Here’s an excerpt from the Insight: Investment committees around the world will soon meet to assess 2022 portfolio performance, often looking line by line at winners and losers. However, we believe the most attractive … Read More

GMO: ‘Emerging Value’ To Return 9% – 7 Year Asset Class Forecast

In their latest 7-Year Asset Class Forecast, GMO are predicting that ‘Emerging Value’ will be the standout for the next seven years, with a 9% return. The best returns in the bond market will come from ‘Emerging Debt’, which is forecast to return 3.5%. Here is a detailed analysis: Stocks … Read More

Jeremy Grantham – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Jeremy Grantham: It’s Par For The Course For Markets To Be Wrong

During his recent interview on the Conversations With Tyler Podcast, Jeremy Grantham explained why it’s par for the course for markets to be wrong. Here’s an excerpt from the interview: Grantham: Absolutely. I think it’s par for the course for markets to be wrong. On a horizon that’s over two … Read More

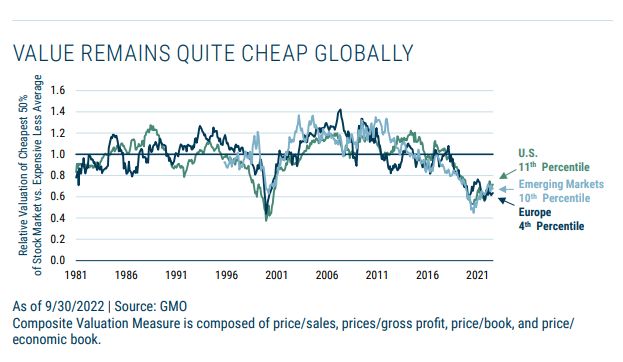

GMO: Value Is Poised To Outperform Growth

In their latest article titled – Value vs Growth – The Unwind Continues, the team at GMO explains why Value is poised to outperform Growth. Here’s an excerpt from the article: Crucially, what both of those arguments are failing to take into consideration is valuation. We believe that Value will … Read More

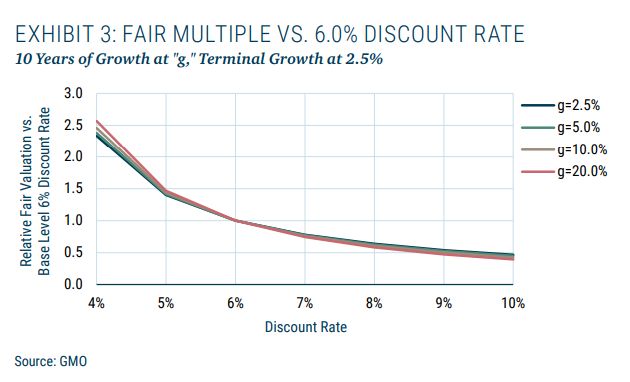

GMO: It’s Time For Value Investors To Take A Fresh Look At Quality Growth Companies

In their recent article titled – Growth Investing Ain’t About The Rates, GMO explain why value investors should take a fresh look at quality growth companies. Here’s an excerpt from the article: Rising rates hurt investors; claims on profits in the future are simply worth less if you discount them … Read More

Jeremy Grantham – Top 10 Holdings – Q2 2022 – New Buys ISRG, HES, GSK, BP, UBS

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Jeremy Grantham: Prepare For An Epic Superbubble Finale

In his latest article titled – Entering The Superbubble’s Final Act, Jeremy Grantham warns investors to prepare for an epic superbubble finale. Here’s an excerpt from the article: Previous superbubbles saw a much worse subsequent economic outlook if they combined multiple asset classes: housing and stocks, as in Japan in … Read More

Jeremy Grantham: The Stock Market ‘Termites’ Always Go For The Juiciest Speculative Things First

In his recent interview on The Investor’s Podcast, Jeremy Grantham explained how the stock market ‘termites’ always go for the juiciest speculative things first. Here’s an excerpt from the interview: I would argue that the termites got into action quite a bit earlier than that. You expect them to go … Read More

Jeremy Grantham: Where Is The Bottom Of This Bear Market?

In his recent interview on The Investor’s Podcast, Jeremy Grantham discusses where this bear market might bottom. Here’s an excerpt from the interview: In terms of the entire bear market, it would be unusual for it to bottom out anywhere near this high. I would expect that by the low … Read More

Jeremy Grantham – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

GMO: The Best Places To Fish In This Market

In their latest Q2 2022 Market Commentary, GMO discusses the best places to fish in this market. Here’s an excerpt from the commentary: You have heard us beat this drum before, but we are happy to repeat ad infinitum that valuation-driven investing works in the long term. Inflation, and policymakers’ … Read More

Jeremy Grantham: We Are Going To Have A Very Big Reversal From Growth To Value

In his recent interview on the Capital Allocators Podcast, Jeremy Grantham explains why we are going to have a very big reversal from growth stocks to value stocks. Here’s an excerpt from the interview: A few years ago I debated Jim Grant, who called me an ‘apostate’ amongst value managers … Read More

Jeremy Grantham: This Market Feels Like The 1970’s

In his recent interview on Straight Talk with Hank Paulson, Jeremy Grantham explained why this market feels like the 1970’s. Here’s an excerpt from the interview: Grantham: Phase Two, which I really worry about is this whole thing morphing into what I call the 1970s. Underlying inflation as an everyday … Read More

Jeremy Grantham: Sure Signs That This Market Breakdown Is The Real McCoy

In his recent interview with Bridgewater Associates, Jeremy Grantham discusses the sure signs that this market breakdown is the real McCoy. Here’s an excerpt from the interview: Grantham: I must say I’m… in my old age reaching a point where I have a little trouble convincing myself that the stock … Read More

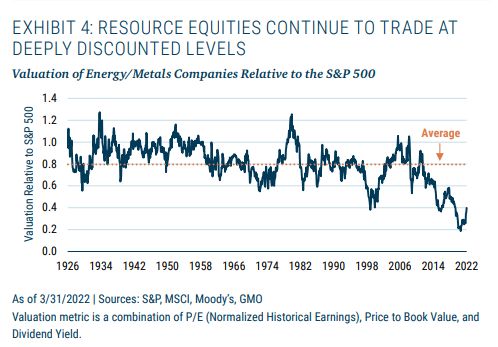

GMO: Protecting Your Portfolio from Inflation After the Fact

In their recent Q1 2022 Letter, GMO discusses one way to protect your portfolio from inflation after the fact. Here’s an excerpt from the letter: The long-term supply/demand dynamics in natural resource markets favor high and rising prices. The clean energy transition will take decades to play out and will, … Read More

Jeremy Grantham: The First Sign That A Bubble Is About To Pop

In his recent interview with CNBC, Jeremy Grantham discusses the first sign that a bubble is about to pop. Here’s an excerpt from the interview: Grantham: I only specialize in what I call the really great bubbles. If you go back to 1929, to 2000, to Japan and the housing… … Read More

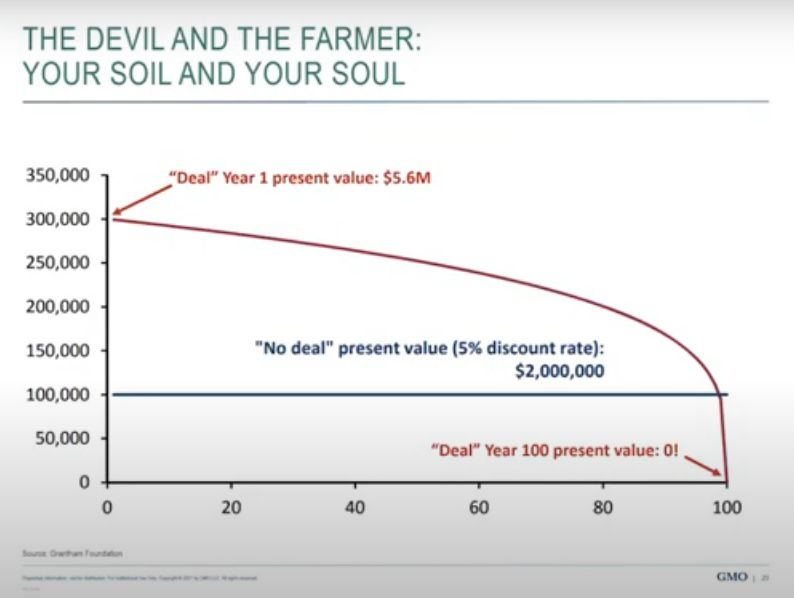

Jeremy Grantham: The Trouble With Capitalism – The Devil & The Farmer

In his recent Oxford Lecture, Jeremy Grantham illustrates the trouble with capitalism using his story of the devil and the farmer. Here’s an excerpt from the lecture: Grantham: This is my story of the devil and the farmer. The devil goes to a midwestern farmer and says, I will give … Read More

Jeremy Grantham: Spaceship Earth & It’s Finite Supply

In his latest article titled, Putin’s Invasion Reminds Us That We Live In A Finite World, Jeremy Grantham discusses the impact of all key commodities required by the modern economy being finite in supply. Here’s an excerpt from the article: Spaceship Earth, together with its local galaxies, is speeding through … Read More

Jeremy Grantham Top 10 Holdings – Q4 2021, Buys TSM, LRCX, V, CONE, DAR

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More