In their latest Insight, GMO explain why deep value offers a compelling opportunity within U.S Equities. Here’s an excerpt from the Insight:

Investment committees around the world will soon meet to assess 2022 portfolio performance, often looking line by line at winners and losers. However, we believe the most attractive group of U.S. stocks today is one that is likely absent from most existing portfolios, or at least woefully underrepresented – the cheapest quintile or “Deep” Value.

■ After the longest cycle in which Growth massively outperformed Value, many portfolios dropped their underperforming Value managers or hung on to those that leaned a bit less into Value to survive. No exposure means no line item, which means most committee members and staff may not be thinking about Deep Value.

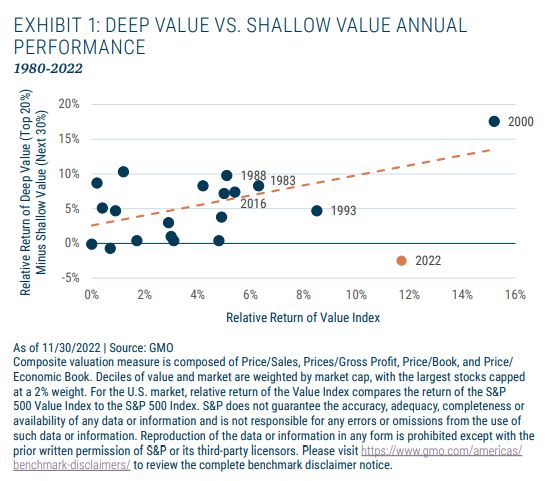

■ While Value outperformed Growth by a wide margin last year, 2022 marked an aberration in the relative performance of Deep vs. Shallow Value (the next 30% of cheapest stocks after Deep Value). Deep Value usually outperforms Shallow Value when Value outperforms; not so in 2022 (Exhibit 1).

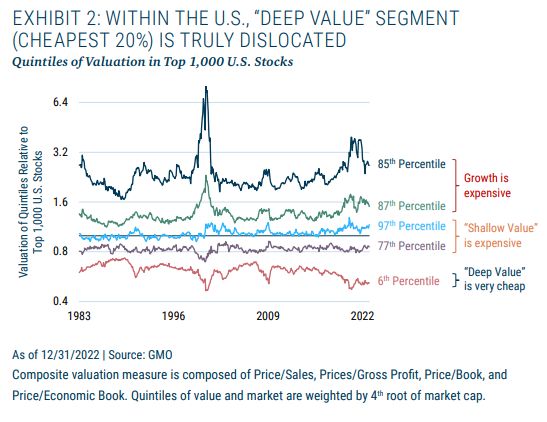

■ This dichotomy has left Deep Value trading cheaply relative to its own history as well as the rest of the market (Exhibit 2). We believe that it’s time to lean back into this attractive group of U.S. Value stocks.

■ Purely for illustrative purposes, we consider a hypothetical scenario where all five quintiles of the market revert to their historical median valuation (i.e., all percentiles in Exhibit 2 go to the 50th percentile). Based on our estimates, if all quintiles of the U.S. market revert to their historic median valuation (which is a strong assumption), we believe that U.S. Deep Value (the (the cheapest quintile) is priced to outperform the rest of the market by roughly 30%.

You can read the entire Insight here:

Memo To The Investment Committee: A Hidden Gem

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: