In their recent article titled – Growth Investing Ain’t About The Rates, GMO explain why value investors should take a fresh look at quality growth companies. Here’s an excerpt from the article:

Rising rates hurt investors; claims on profits in the future are simply worth less if you discount them at a higher rate. As growth stocks deliver their cash flows deeper in the future, their worth is hit harder than the average stock.

In this note, though, we conclude that this effect is much less strong than one might think, as the growth rates of even the growthiest of growth stocks tend to decelerate over time. As a result, this year has presented an opportunity for value investors to take a fresh look at growth companies, especially quality growth companies.

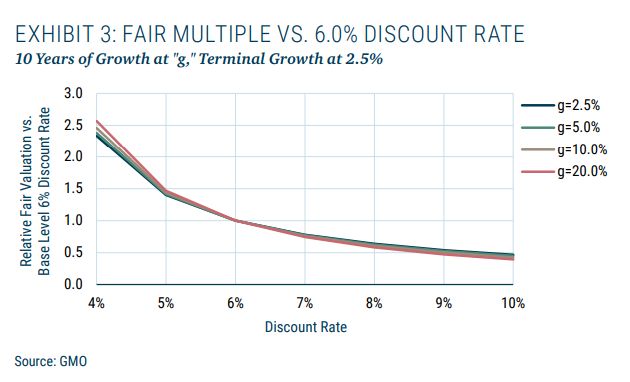

Exhibit 3 shows the final cut of our thought experiment. This time we show the impact on fair value on each of our four companies as the discount rate moves away from 6%. The highest growth company still gets bumped the hardest as rates rise, but in the scenario where rates rise sharply, investors probably have bigger concerns than the relatively modest divergence between high and low growers at that point.

What do we think this means? While rates have a big impact on equity valuations, we argue that the difference in theoretical impact on growth stocks versus the market has been exceeded by actual moves in 2022. This year’s gyrations in growth stocks have created an interesting opportunity for our Quality Strategy in which we have been able to acquire shares in high-quality growth companies at prices that have seemed to us to overplay the role of rates in determining investment results.

Of course, many factors have been at play this year. Nevertheless, we expect our results to be driven in the main by the ability of these Quality companies to allocate capital successfully over time (though we are happy to take revaluation gains when they present themselves too). We suspect that this year, investors leaned a bit too hard on something that “just ain’t so.”

You can find the entire article here:

GMO: Growth Investing Ain’t About The Rates

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: