In their recent Q1 2022 Letter, GMO discusses one way to protect your portfolio from inflation after the fact. Here’s an excerpt from the letter:

The long-term supply/demand dynamics in natural resource markets favor high and rising prices. The clean energy transition will take decades to play out and will, in fact, be a major driver of commodity demand. The recent run in commodities has exposed some of the underlying dynamics in the sector, among them, resource scarcity, strong and inelastic fossil fuel demand, growing clean energy material demand, and underinvestment in supply in recent years.

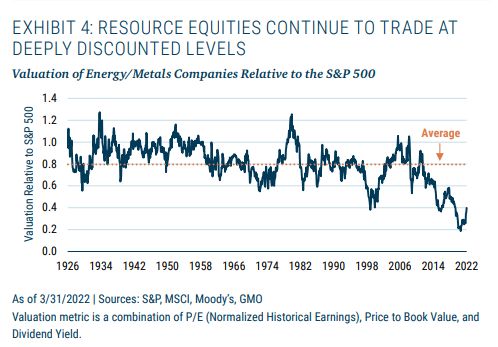

While commodity prices have risen, the resources sector continues to trade at extremely attractive valuation levels. However, investing in the resources sector is not for the faint of heart. There is a wide dispersion in the attractiveness of companies within the sector, investors need to keep an eye on capital allocation programs, and the volatility within the sector produces entry/exit points that must be navigated nimbly.

Despite the challenges, investors willing to wade into these waters are likely to be richly rewarded. With the recent spike, inflation has become a central issue for investors again. After decades of relatively low inflation, many investors were unprepared or had even allocated away from real assets over the past decade.

What if you could protect your portfolio from inflation after the fact? If commodity prices stay high from this point, resource equities are likely to produce outstanding returns given the depressed valuations in the sector. It’s not too late to protect your portfolio from inflation and invest in a sector positioned to generate strong real returns, potentially for many years to come. It’s time to take a look at an unloved sector.

You can read the entire letter here:

GMO – Who Needs TIPS When You’ve Got Friends Like This?

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: