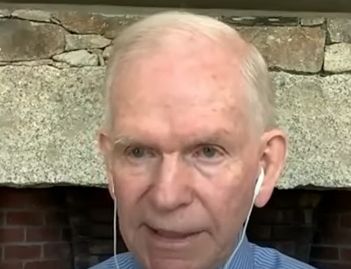

In his recent interview on The Investor’s Podcast, Jeremy Grantham discusses where this bear market might bottom. Here’s an excerpt from the interview:

In terms of the entire bear market, it would be unusual for it to bottom out anywhere near this high. I would expect that by the low that the S&P would’ve declined by 50% from the peak in real terms, so you do have to adjust the stock market for inflation and also the trend.

The trend in the market is a little over 4% a year and as time passes you should put that into the fair value. A year from now, when the bear market might end, the trend line value would be almost 3,000 on the S&P. Of course there’s no rule that says you stop at fair value.

Typically, in previous big bubbles breaking they go down below that. They went down below of course in the housing bust of ’09 and they went down… in every great bear market break they went below trend except Alan Greenspan’s specialty in 2000. In 2000 the S&P was heroically overpriced, it came down 50%, but at 50% decline it was only fair value.

It only hit the trend and then bounced as the Fed braced to re-stimulate. The Nasdaq went down 82. That’s a lot of pain, and it’s possible that would do that again but you do have to adjust for inflation. There was very little inflation around in 2000, but this time with inflation running at eight or nine it does move the nominal value of the S&P upwards and one shouldn’t lose sight of that.

You can watch the entire discussion here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

One Comment on “Jeremy Grantham: Where Is The Bottom Of This Bear Market?”

Excellent interview, really enjoyed your questions and topics that were chosen to interview Jeremy Grantham.