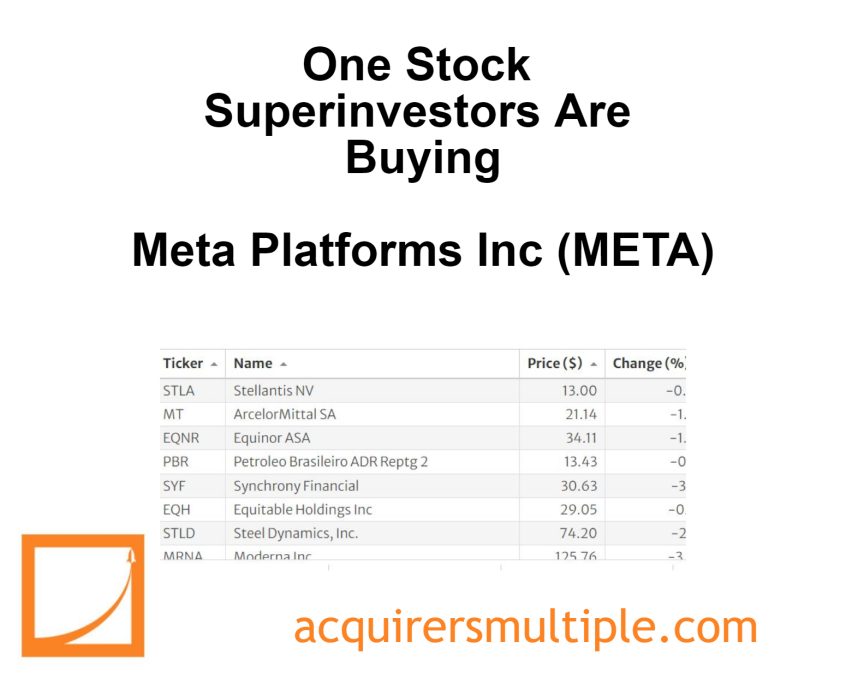

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Bill Nygren: Which Bank Stocks Are Safer Investments

In his recent Q1 2023 Market Commentary, Bill Nygren discussed which Bank stocks are safer investments. Here’s an excerpt from the commentary: Nygren: The failed banks were mostly funded by uninsured deposits that tend to move more rapidly than insured deposits. Further, the banks that failed invested those short-duration deposits … Read More

Joel Greenblatt: How To Compare Apples And Oranges With Potential Investments

During his recent interview with the Investors’ Chronicle, Joel Greenblatt discussed how to compare apples and oranges with potential investments. Here’s an excerpt from the interview: Greenblatt: If you’re going to buy a stock, the first hurdle you want to pass is: over time, are you going to beat the … Read More

Buy 1% Of Your Competitor’s Disruptive Business

During their latest episode of the VALUE: After Hours Podcast, Cochrane, Taylor, and Carlisle discuss Buy 1% Of Your Competitor’s Disruptive Business. Here’s an excerpt from the episode: Tobias: I don’t mind that. If you’re really well established in something and you see the competition come along, yeah. Like Blockbuster … Read More

10 Of The Best Investing Podcasts On The Planet (2023)

Here is a list of 10 of the best investing podcasts on the planet. This list is by no means complete and is certainly not in any particular order. If you’re an investor take some time to have a listen to the great podcasts on this list, they’ll provide you … Read More

Jeremy Grantham: The First Interest Rate Cut Is When The Second Half Of The Pain Will Start

During his recent interview on The Investor’s Podcast, Jeremy Grantham explained why the first interest rate cut is when the second half of the pain will start. Here’s an excerpt from the interview: Grantham: People make a big mistake to average bull markets and bear markets, that is not about … Read More

Ray Dalio – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S05 E13): Matthew Cochrane, History Of Insurance And Gambling, Value, And Recession

In their latest episode of the VALUE: After Hours Podcast, Matthew Cochrane, Jake Taylor, and Tobias Carlisle discuss: This Time Is Different And The Same Buy 1% Of Your Competitor’s Disruptive Business Can Amazon Be Beaten? The Insurance Industry Was Started By Gamblers Never-Sell Is Not A Religious Dogma Berkshire Hathaway … Read More

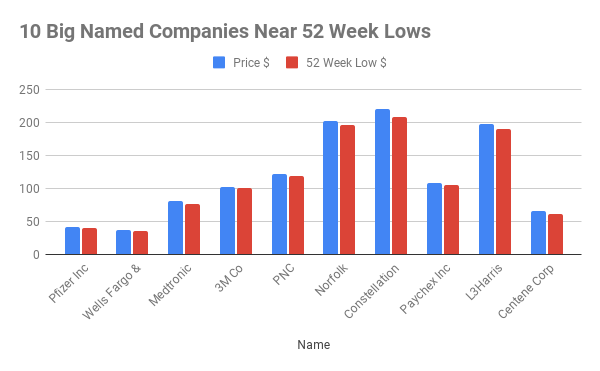

This Week’s 10 Big Named Companies Near 52 Week Lows

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ PFE Pfizer … Read More

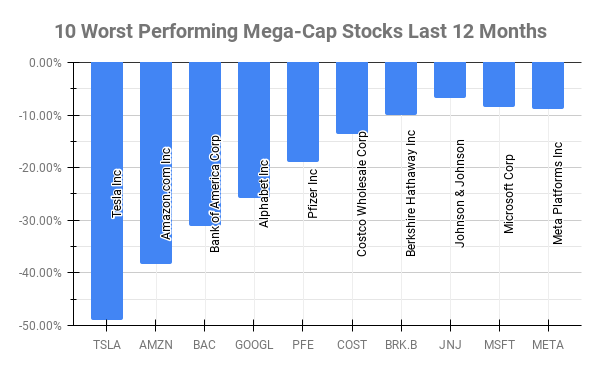

This Week’s 10 Worst Performing Mega-Cap Stocks Last 12 Months

Over the past twelve months ten Mega-Cap stocks have underperformed all others. Mega-Caps are defined by $200 Billion Market Cap or more. Here’s this week’s top 10 worst performing Mega-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) TSLA Tesla Inc -49.00% AMZN Amazon.com Inc -38.37% … Read More

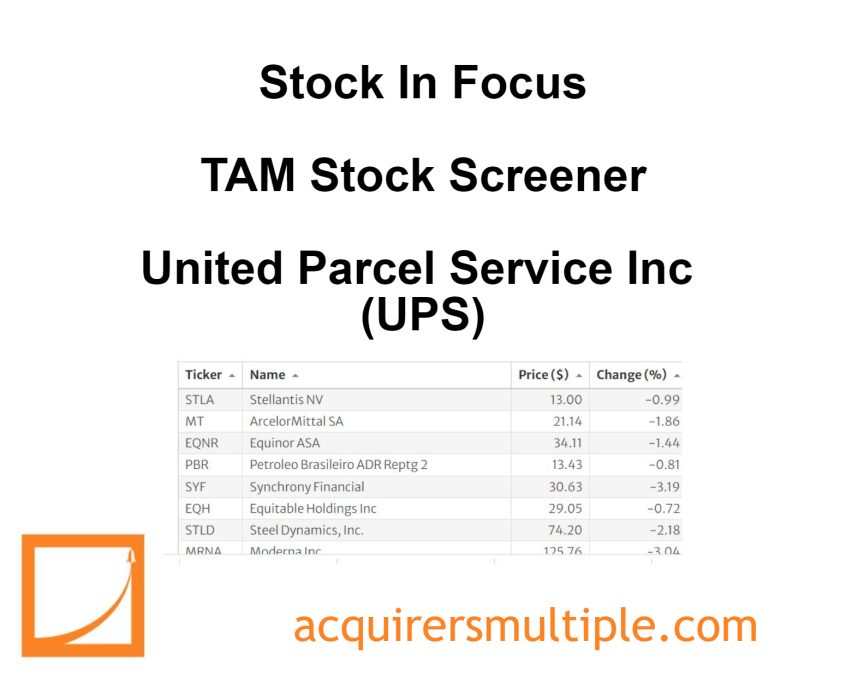

Stock In Focus – TAM Stock Screener – United Parcel Service Inc (UPS)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: United Parcel Service Inc (UPS) As the world’s largest parcel delivery … Read More

Bill Ackman: Stock Market Volatility Is The Friend Of The Long-Term Investor

In his recent 2022 Annual Letter, Bill Ackman explained why stock market volatility is the friend of the long-term investor. Here’s an excerpt from the letter: While our NAV declined by 8.8% in 2022, the volatility markets experienced in 2022 should set the stage for greater longterm outperformance for PSH. … Read More

The Best Investor Of All Time (According To ChatGPT)

Just for a bit of fun this week we asked ChatGPT who is the best investor of all time? Here is its response: The title of “best investor of all time” is subjective and can vary depending on various criteria, such as investment performance, influence, innovation, and longevity. Several notable … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (4/7/2023)

This week’s best investing news: Bill Ackman – Pershing Square Annual Letter 2022 (PS) Tom Gayner – Wealth, Wisdom, & Happiness (TIP) Ray Dalio warns everyone is losing money as the market faces a ‘terrible imbalance’ (Yahoo) Cliff Asness – How To Beat The Market With Boring Stocks (Forbes) Jim Chanos … Read More

Berkshire’s Proxy Proposals Are Like Whac-A-Mole

During their latest episode of the VALUE: After Hours Podcast, Bloomstran, Taylor, and Carlisle discuss Berkshire’s Proxy Proposals Are Like Whac-A-Mole. Here’s an excerpt from the episode: Tobias: Before we jumped on, Chris, you said that you had taken a look at the Berkshire proxy. Do you want to let … Read More

Charles Munger: Great Investing Means Being Aversive To The Standard Stupidities

During the 2016 Berkshire Hathaway Meeting, Charles Munger explained why great investing means being aversive to standard stupidities. Here’s an excerpt from the meeting: WARREN BUFFETT: But it’s not a very complicated economic equation at Berkshire. People didn’t — for a long time, they didn’t appreciate the value of float. … Read More

Nelson Peltz: The First Thing You Do As An Activist Investor Is…

During his recent presentation at Faena Forum, Nelson Peltz discussed the first thing you do as an activist investor. Here’s an excerpt from the presentation: Peltz: Our formula at Trian, and the formula that we invest is something I learned from my father who sold produce, and it’s on every … Read More

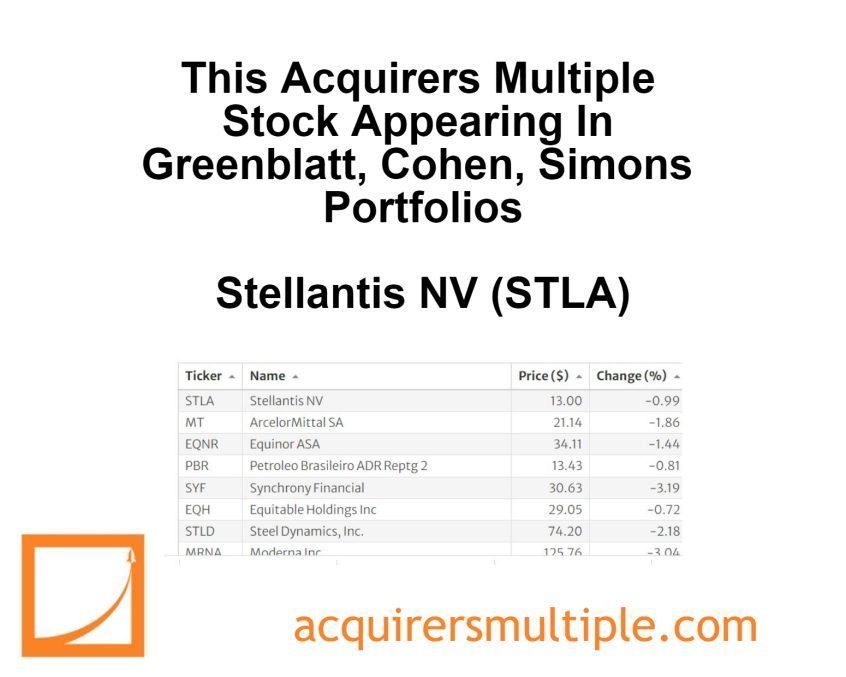

This Acquirers Multiple Stock Appearing In Greenblatt, Cohen, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Buffett’s BH Energy Provides Capital Allocation Training Wheels For The Next Guy

During their latest episode of the VALUE: After Hours Podcast, Bloomstran, Taylor, and Carlisle discuss Buffett’s BH Energy Provides Capital Allocation Training Wheels For The Next Guy. Here’s an excerpt from the episode: Jake: I have a secret hypothesis that the BH Energy represents this awesome capital allocation training wheels … Read More

Warren Buffett: It Is Possible To Become Fiscally Flabby Through A Steady Diet Of Speculative Bonbons

In his 1968 Buffett Partnership Letter, Warren Buffett explained why it is possible to become fiscally flabby through a steady diet of speculative bonbons. Here’s an excerpt from the letter: Last year I said: “A few mutual funds and some private investment operations have compiled records vastly superior to the … Read More