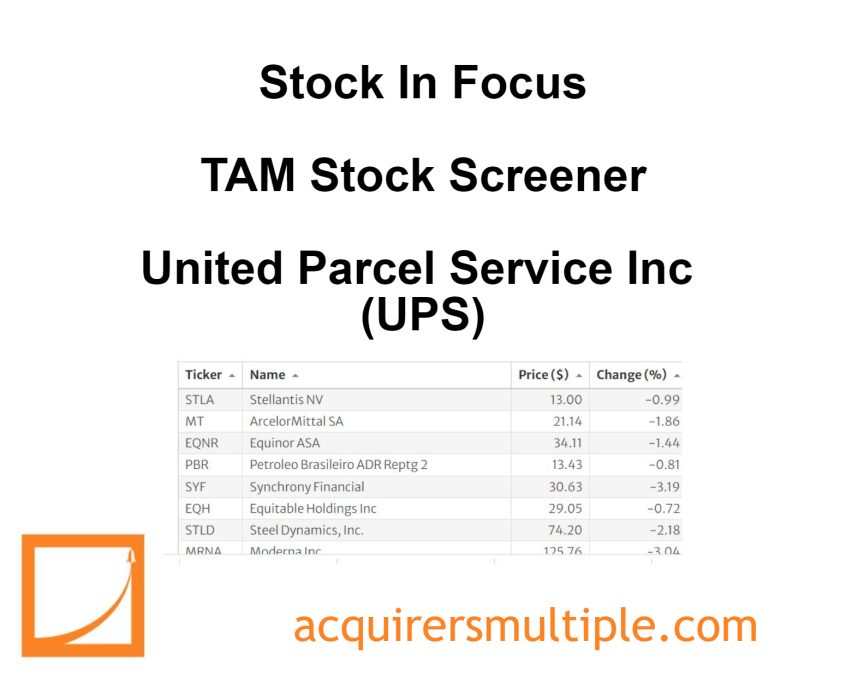

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners.

One of the cheapest stocks in our Stock Screeners is:

United Parcel Service Inc (UPS)

As the world’s largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 25 million packages per day to residences and businesses across the globe. UPS’ domestic U.S. package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder.

A quick look at the share price history (below) over the past twelve months shows that the price is down 13%. Here’s why the company is undervalued.

/a>

Summary

Market Cap: $164 Billion

Enterprise Value: $180 Billion

Operating Earnings

Operating Earnings: $13 Billion

Acquirer’s Multiple

Acquirer’s Multiple: 13.90

Free Cash Flow (TTM)

Free Cash Flow: $9.33 Billion

FCF/EV Yield %:

FCF/EV Yield: 3.93

Shareholder Yield %:

Shareholder Yield: 5.69

Other Indicators

F-Score: 6.00

Altman Z-Score: 4.365

ROA (5 Year Avge%): 18

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: