In his 2022 annual letter to shareholders, Jamie Dimon outlined all of the storm clouds ahead for the U.S economy. Here’s an excerpt from the letter: Until the collapse of Silicon Valley Bank, the current economy was performing adequately, both here in the United States and remarkably better than anyone … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Berkshire Hathaway’s Breathtaking Earnings

During their latest episode of the VALUE: After Hours Podcast, Bloomstran, Taylor, and Carlisle discuss Berkshire Hathaway’s Breathtaking Earnings. Here’s an excerpt from the episode: Tobias: He pinned their colors to the mask by putting that slide up, and making it public, and talking about that regularly. How do you … Read More

Ian Cassel: How To Find ‘Rising Stars’ In Small & Micro-Caps

During his recent interview with the Business Brew, Ian Cassel explained how to find Rising Stars in small and micro-caps. Here’s an excerpt from the interview: Cassel: The way I invest I kind of put things into two camps, you’re either going after Fallen Angels or Rising Stars. I kind … Read More

Howard Marks: AI Will Never Become As Good As Warren Buffett

During this interview with Talks at GS, Howard Marks explained why AI will never become as good as Warren Buffett. Here’s an excerpt from the interview: Marks: I wrote a memo called ‘Investing Without People’ in which I talked about what will happen with AI and so forth and machine … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Here’s Why Warren Buffett Loves OXY

During their latest episode of the VALUE: After Hours Podcast, Bloomstran, Taylor, and Carlisle discuss Here’s Why Warren Buffett Loves OXY. Here’s an excerpt from the episode: Tobias: Do you have any thoughts on Buffett in Oxy, Chris? Christopher: Well, I think he likes the management. They’ve done a great … Read More

Aswath Damodaran: We Have A ‘Trust Deficit’ Which Began in 2008

During his recent interview with Business Today, Aswath Damodaran explains why we have a ‘trust deficit’ that began in 2008. Here’s an excerpt from the interview: Damodaran: They can do that with the single institution, they can’t do it with institutions collectively. The reality is the regulators put together do … Read More

Tom Gayner: Investing Lessons From Jerry Seinfeld And The Downhill Luge

During his recent interview on the RWH Podcast, Tom Gayner discussed investing lessons from Jerry Seinfeld and the downhill luge. Here’s an excerpt from the interview: Gayner: Well, I think that’s true, and in fact the comedian Jerry Seinfeld has a great routine about the involuntary luge and just like … Read More

Bill Ackman – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S05 E12): Christopher Bloomstran, Berkshire Hathaway Review And State of Value

In their latest episode of the VALUE: After Hours Podcast, Chris Bloomstran, Jake Taylor, and Tobias Carlisle discuss: Why Buffett Loves OXY Comprehensive Drill-Down On Berkshire Hathaway BH Energy Provides Capital Allocation Training Wheels For The Next Guy Lessons From Berkshire’s Proxy Statement Investing Lessons From Rats & Bamboo Blooms … Read More

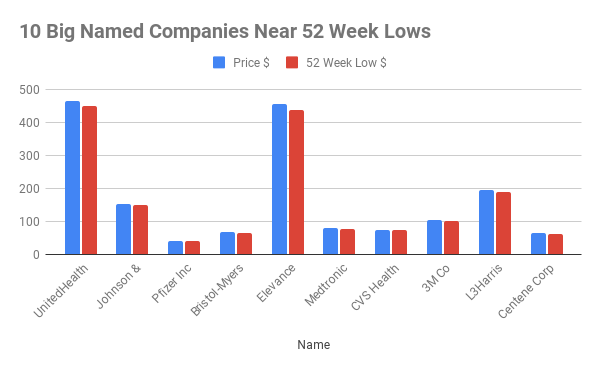

This Week’s 10 Big Named Companies Near 52 Week Lows

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ UNH UnitedHealth … Read More

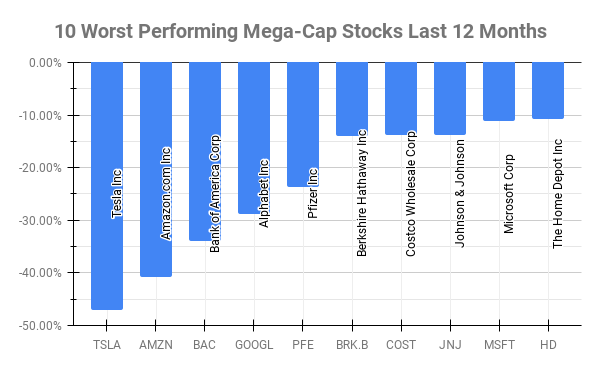

This Week’s 10 Worst Performing Mega-Cap Stocks Last 12 Months

Over the past twelve months ten Mega-Cap stocks have underperformed all others. Mega-Caps are defined by $200 Billion Market Cap or more. Here’s this week’s top 10 worst performing Mega-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) TSLA Tesla Inc -47.10% AMZN Amazon.com Inc -40.79% … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (3/31/2023)

This week’s best investing news: Charlie Munger in Conversation with Todd Combs | Singleton Prize for CEO Excellence (MSM) Ray Dalio – What happened with Silicon Valley Bank and what it means for the economy (Ray Dalio) Jim Chanos – Jim Chanos: A Short Thesis on Data Centers (Colossus) Cliff … Read More

Stock In Focus – TAM Stock Screener – Cisco Systems Inc (CSCO)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Cisco Systems Inc (CSCO) Cisco Systems is the largest provider of … Read More

Tesla Won’t Sell 20 Million Cars A Year By 2030

During their latest episode of the VALUE: After Hours Podcast, Dickson, Taylor, and Carlisle discuss Tesla Won’t Sell 20 Million Cars A Year By 2030. With electric vehicles (EVs) gaining traction, dealerships are increasingly diversifying their offerings to include a variety of brands and models. Dealerships are taking notice, with … Read More

This Acquirers Multiple Stock Appearing In Greenblatt, Druckenmiller, Dalio Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Markets Will Always Be Inefficient

During their latest episode of the VALUE: After Hours Podcast, Dickson, Taylor, and Carlisle discuss Markets Will Always Be Inefficient. Here’s an excerpt from the episode: Jake: Do you think the market’s more or less efficient than, let’s say, 15 years ago? Drew: Mm. Oh, Jake. Tobias: How would you … Read More

Ray Dalio: If You Mark-To-Market A Lot Of Entities Are In Financial Difficulty

During his recent discussion regarding SVB and what it means for the economy, Ray Dalio explained why if you mark-to-market a lot of entities are in financial difficulty. Here’s an excerpt from the discussion: Dalio: If you look ahead and you say how much money needs to be borrowed by … Read More

Charles Munger: There’s Nothing Mysterious About Great Investing

During his fireside chat with Todd Combs, Charles Munger explained why there’s nothing mysterious about great investing. Here’s an excerpt from the conversation: Munger: You’ve got to remember that Warren made a lot of money running his Geiger counter over the ’30s. He’d find something selling for 1/4 of the … Read More