In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Marathon Asset Management and Capital Account. Here’s an excerpt from the episode: Bill Brewster: I’m going to slip my topic in here real quick because it’s a long conversation. And Jake’s got to go. But like … Read More

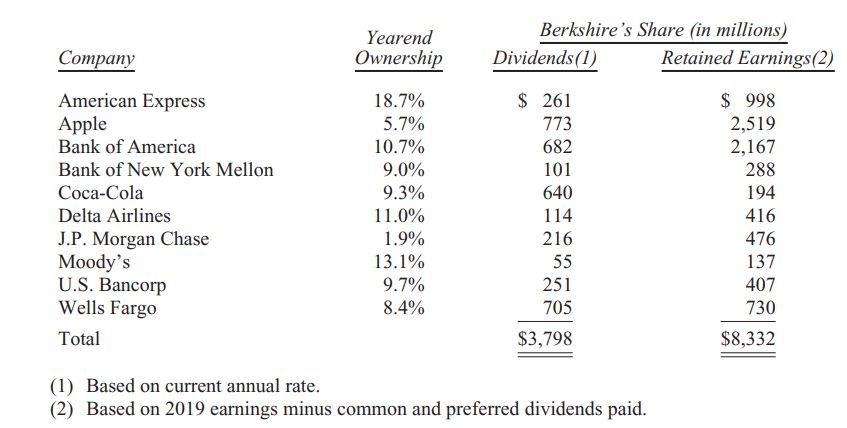

BRK 2019 Annual Report – The Power Of Retained Earnings

Warren Buffett recently released his Berkshire Hathaway Annual Report 2019. One of the key take-aways from the letter is Berkshire’s ongoing focus on the power of retained earnings from the companies in which Berkshire invests. Here’s an excerpt from the letter: At Berkshire, Charlie and I have long focused on … Read More

(Ep.54) The Acquirers Podcast: Mark Simpson – Danger Man, Avoiding Behavioral Errors, Investor Personality Types And Common Mistakes

In this episode of The Acquirer’s Podcast Tobias chats with Mark Simpson. He’s the author of Excellent Investing: How to Build a Winning Portfolio, and the manager of Danger Capital. During the interview Mark provided some great insights into: The Two Big Advantages For The Individual Investor Which Is The … Read More

TAM Stock Screener – Stocks Appearing In Greenblatt, Dalio, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

This Week’s Best Investing Articles, Research, Podcasts 2/21/2020

Here’s a list of this week’s best investing reads: Never Has a Venial Sin Been Punished This Quickly and Violently! (Cliff Asness) The Biggest Problem in Finance? (A Wealth of Common Sense) Prisoner’s Dilemma: What Game Are you Playing? (Farnam Street) Levered Long (The Irrelevant Investor) Predictability in Times of Crisis … Read More

Tom Gayner On Position Sizing And Strategy

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Tom Gayner on position sizing and strategy. Here’s an excerpt from the episode: Jake Taylor: I’ll go first. I’m going to be talking today about this video that circulated on Twitter where Tom Gayner was discussing different … Read More

Dan Loeb: Latest Activist Positions

As a new weekly feature here at The Acquirer’s Multiple, we’re going to take a look at the latest activist positions from some of our favorite superinvestors based on their latest 13D/13G filings. Activist investors like Warren Buffett, Carl Icahn, David Einhorn, Bill Ackman, Paul Singer, Howard Marks. John Paulson, … Read More

The Golden Age In Duration

During his recent interview with Tobias, Dylan Grice, co-founder of Calderwood Capital Research, and author of the Popular Delusion Reports, discussed the golden age of duration. Here’s an excerpt from the interview: Tobias Carlisle: Last question and then I’ll let you go, but it’s sort of a bigger one. It … Read More

VALUE: After Hours (S02 E07): Gayner’s Sizing, 700 Year Decline In Rates And Marathon’s Capital Account

Summary In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about: Tom Gayner’s Take On Position Sizing And Strategy Marathon Asset Management and Capital Account What Can We Learn From Capital Spectator’s – 700-Year Decline In Interest Rates Ram Bhupatiraju – If You Like Everything … Read More

Warren Buffett: Top Buys, Top Sells

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

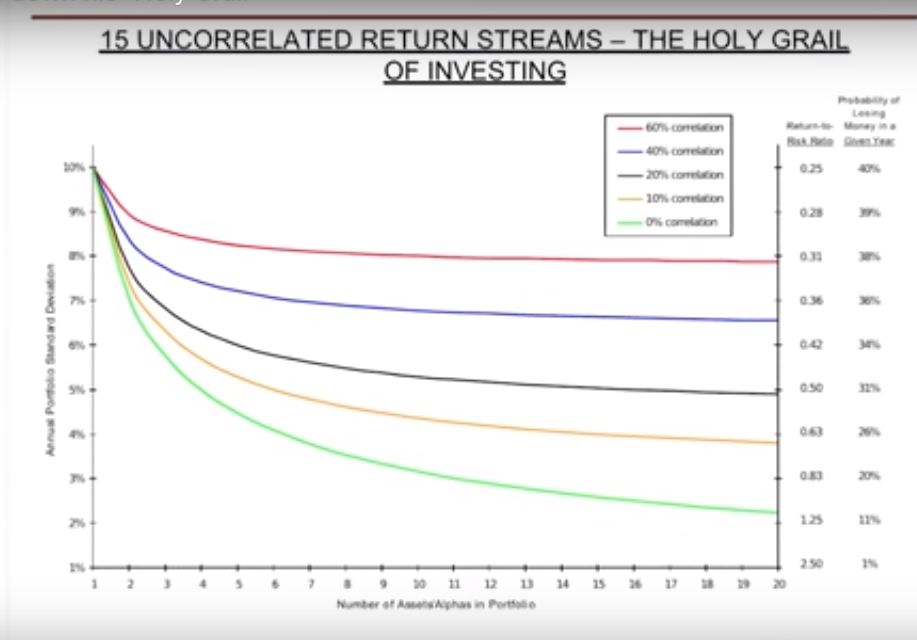

Ray Dalio: The Magic Behind The Holy Grail Of Investing Strategy

Here’s a great short video by Ray Dalio in which he explains the magic behind his ‘holy grail of investing’. The holy grail strategy consists of 15-20 uncorrelated investments that will provide the best return-to-risk-ratio. Here’s an excerpt from the video: What that taught me is the magic is in… … Read More

Richard Feynman on Economics – Cargo Cult Science

During his recent interview with Tobias, Dylan Grice, co-founder of Calderwood Capital Research, and author of the Popular Delusion Reports, discussed Richard Feynman on Economics – Cargo Cult Science. Here’s an excerpt from the interview: Tobias Carlisle: I think there’s been a lot of introspecting by Austrian economists and value … Read More

Bruce Greenwald’s Theory of Local Scale Advantages

In this week’s episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Bruce Greenwald’s theory of ‘local scale advantages’. Here’s an excerpt from the episode: Bill Brewster: All right. I’ve been noodling on Greenwald speeches lately, and it actually sort of goes to Jake’s point and maybe … Read More

Howard Marks: One Of The Most Essential Ingredients In Investing Is The Ability To Look Stupid

In this interview with Shane Parrish on The Knowledge Project Podcast, Howard Marks provides some great insights into the importance of looking stupid in order to become a successful investor. Here’s an excerpt from the interview: Some people don’t get contrarian thinking. And one of the things I say is … Read More

Warren Buffett: Top 10 Holdings (Q4 2019)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Origins Of High Performance Conglomerate Jack Henry $JKHY

In this week’s episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed the origins of high performance conglomerate, Jack Henry $JKHY. Here’s an excerpt from the episode: Tobias Carlisle: So I’m talking Jack Henry. It’s another high-performance compounder, because that’s one I’m obsessed with at the moment. … Read More

The Anatomy Of A Forecast Error

During his recent interview with Tobias, Dylan Grice, co-founder of Calderwood Capital Research, and author of the Popular Delusion Reports, discussed the anatomy of a forecast error. Here’s an excerpt from the interview: Tobias Carlisle: That’s a nice segue into one of the articles that I liked in your more … Read More

Charles Munger: Classical Moats Are Rapidly Disappearing

During the recent Daily Journal annual meeting (2/12/2020), Charles Munger was asked about the impact that technology is having on traditional moats. Here’s the question and his response: Question: I have a question for you related to technology. There is this common sentiment that technology is both accelerating the pace … Read More

(Ep.53) The Acquirers Podcast: Dylan Grice – Pop Delusions – The Golden Age Of Duration, Richard Feynman, Cargo Cults And Anatomy Of A Forecast

In this episode of The Acquirer’s Podcast Tobias chats with Dylan Grice. He is the co-founder of Calderwood Capital Research, and writes the Popular Delusion Reports. During the interview Dylan provided some great insights into: Popular Delusions Allocating To Different Managers Provides The Holy Grail Of Portfolio Robustness The Anatomy Of … Read More

TAM Stock Screener – Stocks Appearing In Greenblatt, Dalio, Tudor Jones Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More