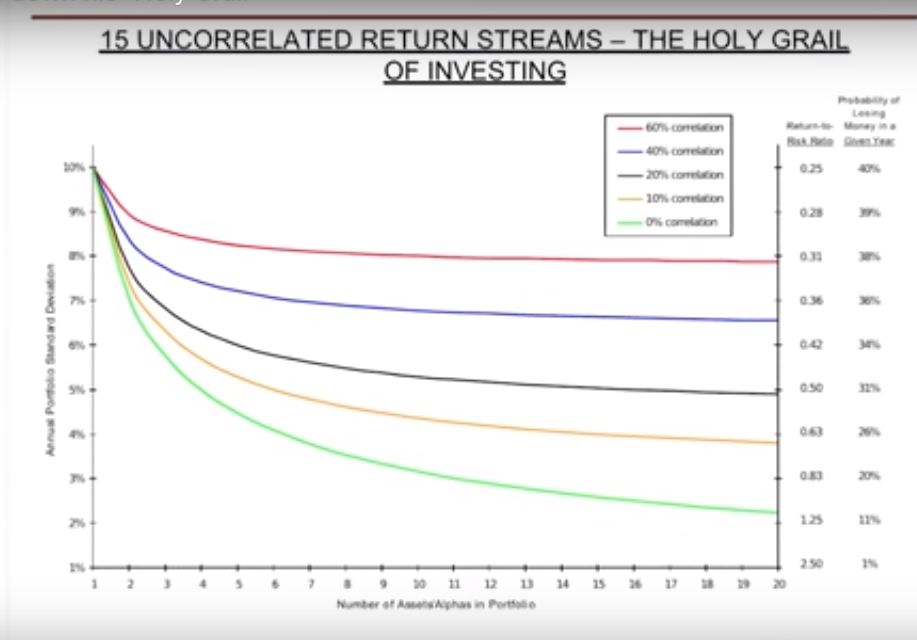

Here’s a great short video by Ray Dalio in which he explains the magic behind his ‘holy grail of investing’. The holy grail strategy consists of 15-20 uncorrelated investments that will provide the best return-to-risk-ratio. Here’s an excerpt from the video:

What that taught me is the magic is in… you only need to do the simple thing. The simple thing is to find 15 or 20 good uncorrelated return streams. Things that are probably gonna make money, but you don’t know. But they have a good probability of making money. That are uncorrelated. That have low correlation.

That told me that’s what I have to go after right. That’s the key. A lot of people think that the most important thing you could do is find the best investments. Okay that’s important but there is no great one best investment that can compete with something like this.

So look at this line when this comes down you can improve your return-to-risk-ratio by a factor of five. Five times the expected return for that unit of risk. You can’t pick any investments that it probably… nobody’s humanly capable in an efficient market probably to pick investments that are five times as good individually.

So that tells me about the power of diversification and balancing risk.

So this is the return-to-risk-ratio that happens for each one of those. Like if I can get zero correlation and I have 15 to 20, I’ll have an information ratio, a return-to-risk-ratio of 1.25. That means my probability of losing money in a year is only 11%, as distinct from 40% with any one of them.

So that’s the power of portfolio construction and the power of diversification. It tells me what I have to go after.

(Source: YouTube)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: