In their latest episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Basket Investing vs Idiosyncratic Investing. Here’s an excerpt from the episode: Bill: Yeah. I think you’ve got to have a view on what short-form video does to the inherent nature of the platform. Tobias: Eh, … Read More

Edward Chancellor: The More Things Change The More They Stay The Same

In his book – Devil Take The Hindmost, Edward Chancellor discusses the excessive swings in markets that never change. Here’s an excerpt from the book: As the stock market itself is, like Hobbes’s Leviathan, composed of the actions of individual speculators, these neurotic traits can be found in the mass … Read More

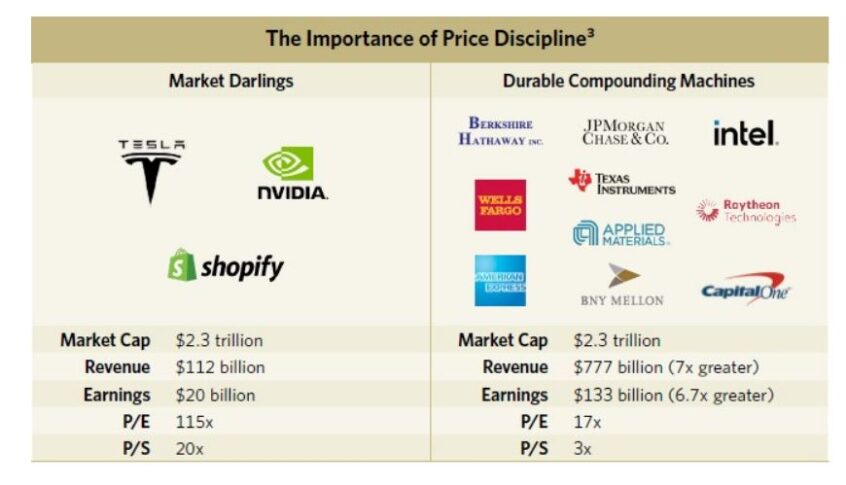

Christopher Davis: The Importance of Price Discipline

In his recent 2022 Annual Review, Clipper’s Christopher Davis discusses the importance of price discipline using a ‘Market Darlings Versus Durable Compounding Machines’ scenario. Here’s an excerpt from the review: While the above discussion of broad investment categories provides useful context, we always emphasize the old adage that investing is … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Managing Quotational Risk

In their latest episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Managing Quotational Risk. Here’s an excerpt from the episode: Jake: I think you did highlight an important point about– There’s quotational risk on anything. Do you want to ensure that quotational risk through CTAs, tail … Read More

Robeco: Human Instincts Drive The Value Premium

In their latest paper titled – Human instincts drive the Value premium, Robeco explain how human instincts drive the value premium. Here’s an excerpt from the paper: According to the behavioral school of thought, human tendencies are behind the existence of the value premium. Many investors are lured by the … Read More

Cliff Asness: Everything Is Extremely Expensive Versus History

In his latest interview on the FEG Insight Bridge Podcast, Cliff Asness explains why everything is extremely expensive versus history. Here’s an excerpt from the interview: So by and large, a stock and a bond portfolio, call it U.S. 60/40. You could do a million different versions of this, right? And … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Value Returns 1866 to Date

In their latest episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Value Returns 1866 to Date. Here’s an excerpt from the episode: Tobias: Who wants to kick it off? I’m going to take Jake’s paper away. Either way, it’s you, JT. So, let’s do the paper. … Read More

Wally Weitz: There’s Always Something In The News Headlines To Scare Investors

In their latest presentation titled – Stock Investing Amid Market Drawdowns and Rising Rates, Wally Weitz and team discuss the importance of sticking with your strategy regardless of scary news headlines. Here’s an excerpt from the presentation: Well, I hate to date myself so badly, but I can remember the … Read More

GMO: 4 Investing Mistakes To Avoid In A Rising Market

In their latest Q4 2021 Letter, GMO discuss four of the biggest investment mistakes to avoid in a rising market. Here’s an excerpt from the letter: None of us, regardless of our skill and experience in investing, can be spared the pain caused by making mistakes. While we can all … Read More

Seth Klarman Top 10 Holdings (Q4 2021) – Buys FISV, GTXAP, NLOK, QRVO, LSXMK

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S04 E07): Value Returns 1866 to Date, Certain to Win and Boyd’s OODA Loop

In this episode of the VALUE: After Hours Podcast, Jake Taylor, Bill Brewster, and Tobias Carlisle chat about: Value Returns 1866 to Date Managing Quotational Risk Basket Investing vs Idiosyncratic Investing Munger Using Margin To Buy Alibaba We’ve Had LBO’s For Seven Years Boyd’s OODA Loops Certain To Win Commodity … Read More

Charles Munger: We Have A New Bunch Of Emperors That Are Going To Change The World

In his latest Daily Journal Annual Meeting, Charles Munger discusses the new bunch of emperors that are going to change the world. Here’s an excerpt from the meeting: Munger: Oh Huge! That’s another thing that’s coming. We have a new bunch of emperors, and they’re the people who vote the … Read More

This Week’s Best Value Investing News (2/18/2022)

This week’s best investing news: Charlie Munger speaks at the Daily Journal annual meeting (Yahoo) Financial History: Flash Briefing (Jamie Catherwood) Putting Ideas into Words (Paul Graham) If by Bitcoin (Verdad) Berkshire Hathaway Energy Presentation (BH) Quitters (Epsilon Theory) Is It ‘Monetization’ Yet, Dr. Bernanke? (Felder) There’s No One Way to Make Your Investments Inflation-Proof … Read More

Stock In Focus – TAM Stock Screener – Dicks Sporting Goods Inc (NYSE: DKS)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Dicks Sporting Goods Inc (NYSE: DKS). Dick’s Sporting Goods retails … Read More

Why Deep Value Works

In their latest episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Why Deep Value Works. Here’s an excerpt from the episode: Bill: I think that that’s a really short-term focus on something that’s supposed to have a 30-year duration plus. I don’t care much what happens … Read More

Charles Munger: Why I Invested In Alibaba And Other Chinese Stocks

In his latest Daily Journal Meeting, Charles Munger was asked why he investing in Alibaba and other Chinese stocks. Here’s an excerpt from the meeting with the host asking questions she received from participants: Host: As a Daily Journal owner, do we own local shares of Alibaba? Does that actually … Read More

Laughing Water Capital: Real Diversification Means Part Of Your Portfolio Will Not Be Working

In their latest 2021 Year-End Letter, Laughing Water Capital discuss why real diversification means part of your portfolio will not be working. Here’s an excerpt from the letter: On size, I continue to think that we are best able to flex our competitive advantages as an investment partnership in the … Read More

This Acquirers Multiple Stock Appearing In Dalio, Grantham, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More