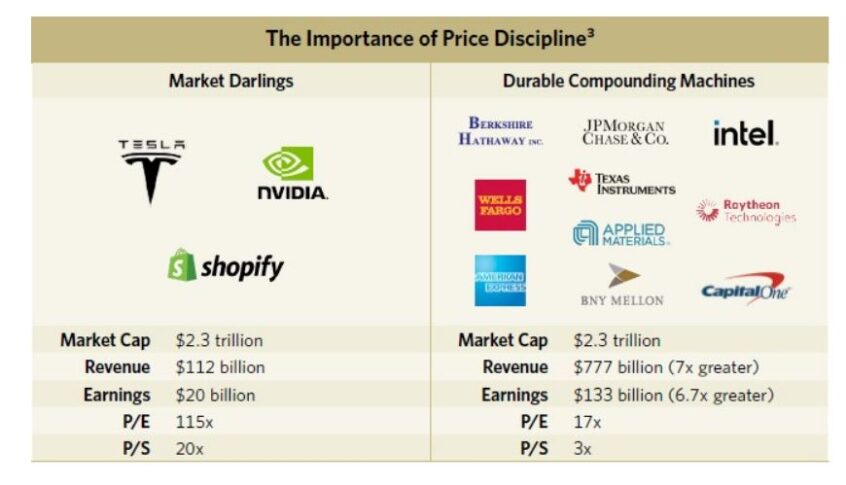

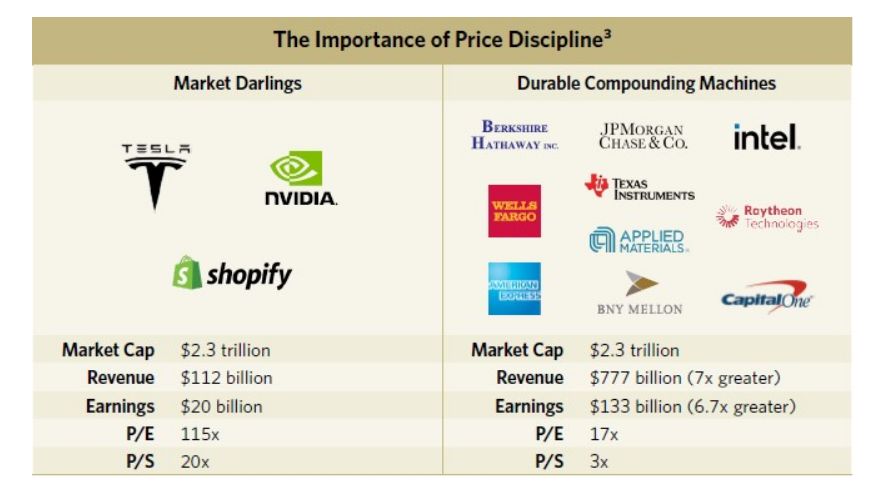

In his recent 2022 Annual Review, Clipper’s Christopher Davis discusses the importance of price discipline using a ‘Market Darlings Versus Durable Compounding Machines’ scenario. Here’s an excerpt from the review:

While the above discussion of broad investment categories provides useful context, we always emphasize the old adage that investing is the art of the specific. With this in mind, an example may be helpful. Tesla, Nvidia and Shopify are three of the hottest momentum stocks in today’s market, each having compounded at triple-digit-rates over the last three years.

Combined, these three have a market capitalization of roughly $2.3 trillion. In other words, should an investor happen to have a couple of trillion dollars lying around, one investment option, which we will call the Market Darlings portfolio, would be to buy 100% of these three remarkable growth companies and live off their current and future earnings.

An alternative option, which we will call the Durable Compounding Machines portfolio, would have the investor pay the same price of $2.3 trillion, but instead use it to buy 100% of Berkshire Hathaway, JP Morgan, Intel, Wells Fargo, Texas Instruments, Raytheon, Bank of New York Mellon and live off current and future earnings of these companies. Not coincidently, the Durable Compounding Machines portfolio represents a good cross-section of the holdings in Clipper Fund.

Because our hypothetical investor is going to live off the earnings of these businesses, both current earnings and future prospects are important investment considerations and should be carefully evaluated.

Let’s start with current earnings.

As can be seen in the table below, for roughly the same price of $2.3 trillion, the Market Darlings produce about $20 billion of current earnings, while the Durable Compounding Machines generate about $133 billion per year, almost seven times more. Consequently, from a current earnings point of view, it is no contest; any rational investor would choose the Durable Compounding Machines over the Market Darlings.

But how about if we incorporate the bright future prospects of the Market Darlings? After all, few would argue that the Market Darlings, Tesla, Nvidia and Shopify, don’t have bright futures. The question is, how bright would their futures have to be to earn the $133 billion that the durable compounding machines are earning today.

Mathematically, the answer is simple. These companies would need to increase their earnings almost sevenfold which, while not impossible, is no easy feat. For example, a company would need to grow profits almost 21% per year for a decade to achieve this outcome. However, even if they accomplish this spectacular growth, the fact that the earnings wouldn’t be generated for many years requires that investors discount them back to the present.

Using even a modest discount rate, the power of compounding reduces the present value of that $133 billion to a much smaller number. In the meantime, the owners of the Durable Compounding Machines are earning that amount today and given that these companies have had long records of growth through good times and bad, we believe they should have a bright future.

You can read the entire review here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: