This week’s best investing news:

Charlie Munger speaks at the Daily Journal annual meeting (Yahoo)

Financial History: Flash Briefing (Jamie Catherwood)

Putting Ideas into Words (Paul Graham)

If by Bitcoin (Verdad)

Berkshire Hathaway Energy Presentation (BH)

Quitters (Epsilon Theory)

Is It ‘Monetization’ Yet, Dr. Bernanke? (Felder)

There’s No One Way to Make Your Investments Inflation-Proof (Validea)

The stock tips from your buddy? They really aren’t good (Klement)

Twitter and The Headwind of Shareholder Dilution (Mindset Value)

240: Constellation Software Q4 (Liberty)

Positioning for Rising Rates (Net Interest)

The Secret of Investing (Safal)

Lecture at Flame University (Fundoo Professor)

Understanding Netflix (The Diff)

Unreal Estate (Scott Galloway)

Q4 2021 Letters (Updated) (Reddit)

The Geography of Investor Attention (ssrn)

Carl Icahn: The Fed Can’t Keep Printing Money (Bloomberg)

Most Investors Should Ignore the Risk of Major Macro Events (Behavioural Investment)

Pershing Square Annual Investor Presentation (PS)

Back to Earth or Temporary Setback? Revisiting the FANGAM Stocks (Aswath Damodaran)

Canada Blockade (Brian Langis)

The Trouble With a Stock-Market Bubble (WSJ)

Apologies to Madonna…..We are Living in a Nominal World (Brinker)

Positioning for Rising Rates (Marc Rubinstein)

Tenets of Commodity Investing, Framework, Experience & Learnings (Jatin Khemani)

The Inflation Hedges Haven’t Hedged (Morningstar)

Will this truly, finally be ‘the year of the stockpicker’? (FT)

China’s Quant Hedge Funds Stumble After Breakneck Growth (WSJ)

Sequoia’s invisible hand: How Roelof Botha became one of the most powerful people in venture capital (Protocol)

Fed needs to hike rates 50 basis points in March if high inflation persists: Jeremy Siegel (CNBC)

Why Are Inflation-Protected Bond Funds Losing Money? (Morningstar)

First Eagle Investment Management: February Views from First Eagle Global Value Team (FE)

There are emerging opportunities in the market, says legendary investor Bill Miller (CNBC)

A Good Filter For Finding Winners (Woodlock House)

Greenhaven Capital Q4 2021 (GC)

Laughing Water Capital 2021 Year-End Letter (LWC)

This week’s best value Investing news:

Evidence Shows Value Has Beaten Growth For Longer Than We Thought (Validea)

COVID, Inflation, and Value Investing (Vitaliy Katsenelson)

Value funds fail to attract investors despite outperformance (AFR)

Value is Dead. Long Live Value! (Sycamore Capital)

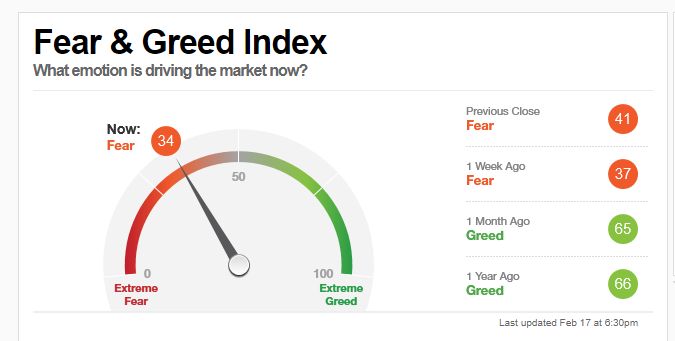

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

An Inside Look at the GameStop Story and the Revolution That Wasn’t (Excess Returns)

Lily Francus and Jesse Livermore — Understanding Financial Bubbles (EP.91) (Infinite Loops)

Joey Levin – Building an Anti-Conglomerate (Invest Like The Best)

356 – Investing Lessons We Can Learn from Peloton (Part 2) (InvestED)

TIP422: Frontier Market Investing w/ Maciej Wojtal (TIP)

The Bullish Case for Higher Inflation and Interest Rates (WealthTrack)

Vinesh Jha, ExtractAlpha – Alternative Data & Crowdsourcing Financial Intelligence (Meb Faber)

Ep. 214 – Why Investing in Cannabis is Still a Generational Opportunity (Planet MicroCap)

SPECIAL: Adam J. Schwartz on Designing a Business to Fit Your Investment Approach (Intelligent Investing)

Exposing Generational Myths (Barron’s)

Christopher Tsai, is investing an art? Insight from 20+ years of successful investing (Good Investing)

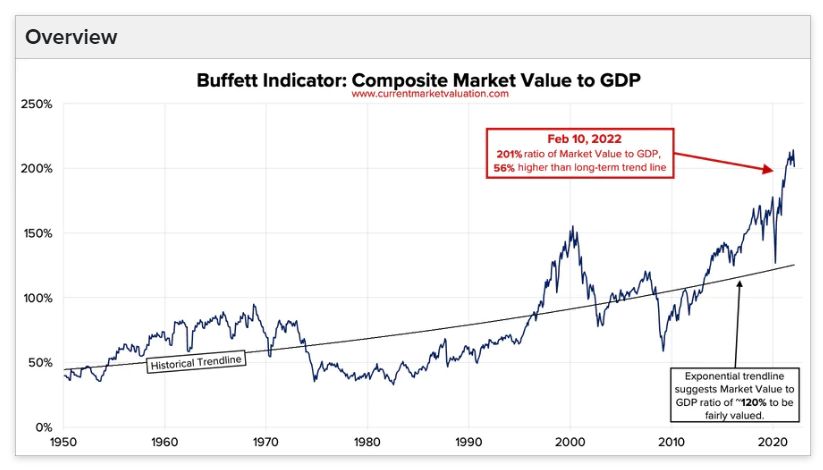

This week’s Buffett Indicator:

Overvalued.

This week’s best investing research:

Factor Investing: Is a Human Capital Factor on the Horizon? (AlphaArchitect)

Don’t Ignore Stress (AllStarCharts)

Building a Long Volatility Strategy without Using Options – Part II (AllAboutAlpha)

Book Review: How Novelty and Narratives Drive the Stock Market (CFA)

This week’s best investing tweet:

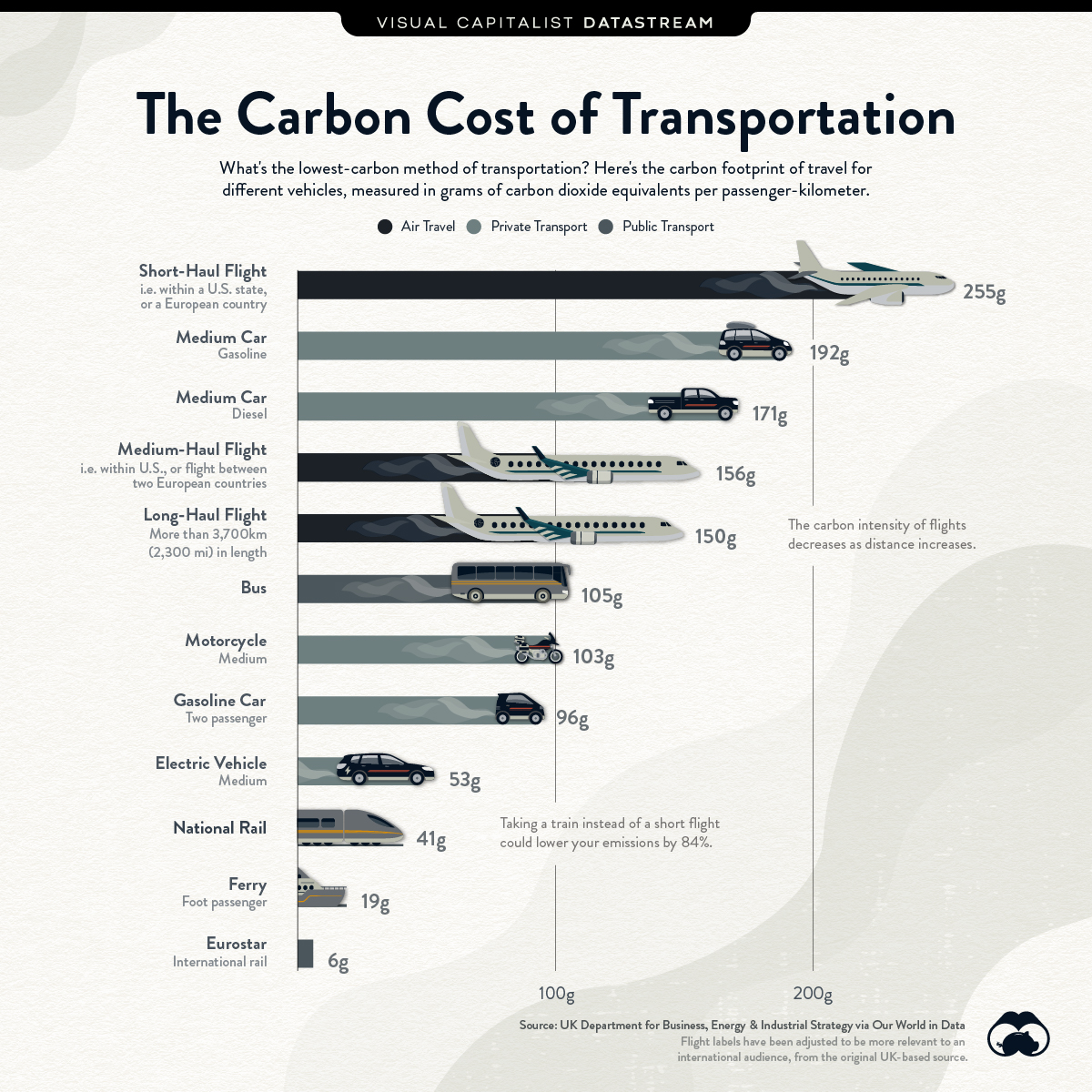

This week’s best investing graphic:

Comparing the Carbon Footprint of Transportation Options (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple:

2 Comments on “This Week’s Best Value Investing News (2/18/2022)”

Robeco Quantitative Investments did some research that i think some of your readers might enjoy reading and could have easily missed. Maybe you could include it in your daily or weekly roundup.

Robeco researched U.S. stocks from 1866 – 1926 and found, using dividend payouts as a proxy for growth vs. value stocks, that value stocks handily beat growth stocks during that time. The link is provided below.

https://www.marketwatch.com/story/this-never-before-seen-evidence-shows-value-stocks-outperforming-growth-rivals-for-a-lot-longer-than-anyone-knew-11644786560

Good one. Thank you.