In this episode of the VALUE: After Hours Podcast, Jake Taylor, Bill Brewster, and Tobias Carlisle chat about: Elon Musk Twitter Activism Investing Lessons From The Science of Hitting Greenblatt On The Acquirer’s Multiple Grandma’s Portfolio Outperformed Walk-Rates Improve Your Returns Hit Investing Line-Drives We’re In A Rolling Bear Market … Read More

Stock In Focus – TAM Stock Screener – Smith & Wesson Brands Inc (NASDAQ: SWBI)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is: Smith & Wesson Brands Inc (NASDAQ: SWBI) Smith & Wesson Brands … Read More

Jeremy Grantham: Spaceship Earth & It’s Finite Supply

In his latest article titled, Putin’s Invasion Reminds Us That We Live In A Finite World, Jeremy Grantham discusses the impact of all key commodities required by the modern economy being finite in supply. Here’s an excerpt from the article: Spaceship Earth, together with its local galaxies, is speeding through … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (4/8/2022)

This week’s best investing news: What Now? Safe Assets, Correlations & Inflation (Jamie Catherwood) Jamie Dimon – Letter to Investors (JPM) Inflation & Lost Decades (Verdad) Howard Marks on Globalized Markets and the Impact of Russia’s Invasion of Ukraine (Wharton) The Fed Just Disengaged Its Volatility Suppression Machine (Felder) Cathie Wood – Why … Read More

Telsa Trading Sardines

In their latest episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Tesla Trading Sardines. Here’s an excerpt from the episode: Tobias: Yeah, that was funny that Tesla– You pointed this out to me, JT. You should probably talk about it. Jake: Oh, it was just my … Read More

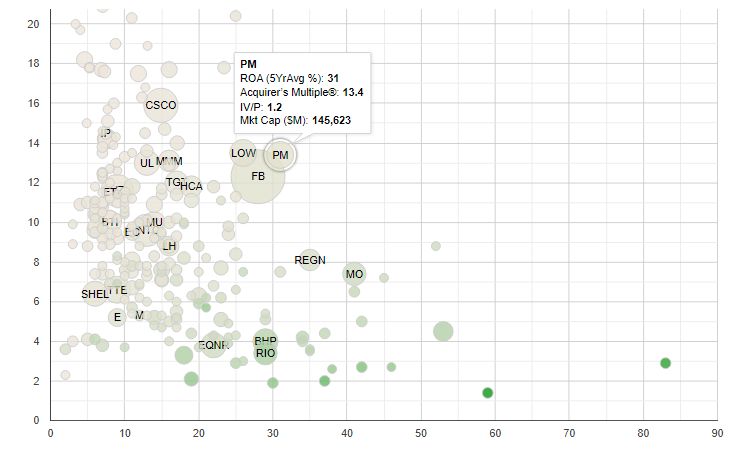

Here’s Why Philip Morris International Inc. (NYSE: PM) May Be A Value Stock

Based on the improved performance metrics, which we recently added to our stock screens, the following company may be a value stock: Philip Morris International Inc. (NYSE: PM) Philip Morris International is a leading international tobacco company engaged in the manufacture and sale of cigarettes and other nicotine-containing products in markets … Read More

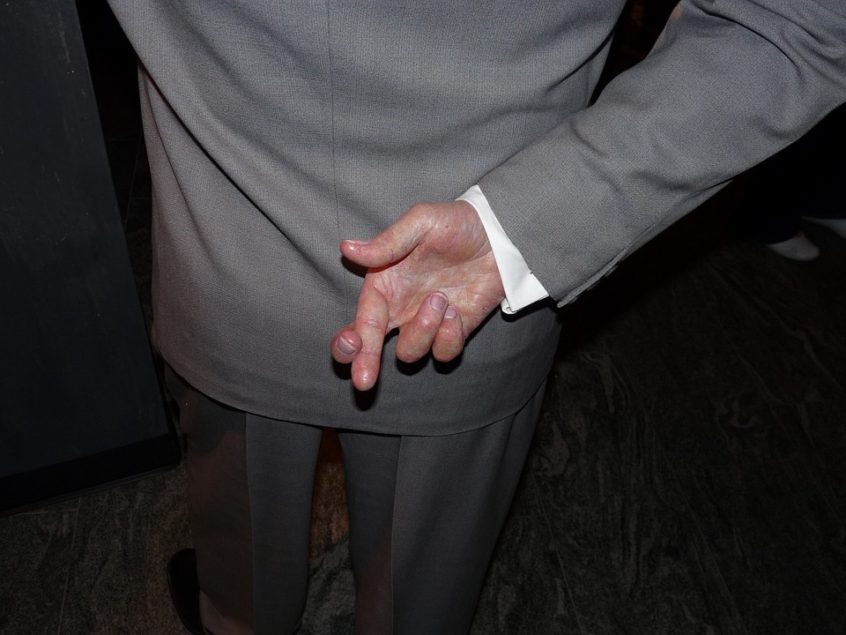

Josh Wolfe: Investors Should Be Wary Of False Optimism

In his latest discussion with Danny Crichton on the Securities Podcast, Josh Wolfe discusses the difference between complacent optimism and conditional optimism, as it relates to company executives and entrepreneurs who like to sell optimism to the public. Here’s an excerpt from the discussion: Wolfe: There really are two kinds. … Read More

Howard Marks: U.S Onshoring Investment Opportunities

In his latest interview on the Wharton School Podcast, Howard Marks discussed U.S investment opportunities if the trend moves from globalization to dependable onshoring, as he believes it will. Here’s an excerpt from the interview: Marks: I think that if people want to create their own raw materials, or intermediate … Read More

This Acquirers Multiple Stock Appearing In Simons, Greenblatt, Dalio Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Investing Is All A Mental Game

In their latest episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Investing Is All A Mental Game. Here’s an excerpt from the episode: Tobias: I think that’s very practical. The longer I do it, the more I think that that’s actually really true. I think there’re … Read More

Aswath Damodaran: Sticking To Your Investment Philosophy Means Leaving Money On The Table

In his latest interview with Micha.Stocks, Aswath Damodaran explains why sometimes sticking to your investment philosophy means leaving money on the table. Here’s an excerpt from the interview: So in January 2020 I sold Tesla and I told people look it’s been a great stock for me but given my … Read More

Chuck Akre: How To Calculate The ‘Real’ Rate of Return?

In his latest interview with The Value Investing Channel, Chuck Akre explains how to calculate the ‘real’ rate of return. Here’s an excerpt from the interview: So when I say what interests we talked about games or Facebook or tractors or the mall or all kinds of things. How do … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Should We All Just Invest In SPY?

In their latest episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Should We All Just Invest In SPY? Here’s an excerpt from the episode: Bill: I don’t even know why– I was writing somebody today. I was like, “I honestly don’t know outside of motivated reasoning … Read More

Bill Gross: Blackjack Taught Me About Risk Management

In his recent interview on Masters In Business, Bill Gross discusses how blackjack taught him about risk management. Here’s an excerpt from the interview: RITHOLTZ: Interesting. You know, we’ve gone this far into the conversation, and I just haven’t gotten around to ask you about your days as a card … Read More

Kenneth French – Chance Dominates Realized Returns

In his recent essay titled – Five Things I Know about Investing, Kenneth French explains why chance dominates realized returns. Here’s an excerpt from the essay: Perhaps because the evolutionary cost of false negatives – failing to see real patterns – was high relative to the cost of false positives, people … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Central Bank Still Pretending There’s No Inflation

In their latest episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discuss Central Bank Still Pretending There’s No Inflation. Here’s an excerpt from the episode: Tobias: But I think that the central banks default setting is lower interest rates and lots of money supply. The only reason … Read More

Jim Chanos: Short Sellers Are The Financial Detectives Of Financial Markets

In his latest interview with Really American, Jim Chanos says short sellers are the financial detectives of financial markets. Here’s an excerpt from the interview: There’s one more important point as it relates to short selling in the financial markets. I do think is really important and this is the … Read More

Joel Greenblatt: Investing Is About Living To Play Another Day

In his recent interview on the Richer, Wiser, Happier Podcast, Joel Greenblatt explains why investing is about living to play another day. Here’s an excerpt from the interview: Yeah. I have five kids, a couple of which I’ve taught investing or tried to teach investing too. I was trying to … Read More