During their recent episode, Taylor, Carlisle, and Pieter Slegers discussed Cybernetics as a Mental Model: Understanding Systems and Control Mechanisms, here’s an excerpt from the episode: Tobias: We’re at the top of the hour, JT. You want to give us some vegetables? Jake: Yes, if you’re hungry for some vegetables. … Read More

Adapting Your Investment Strategy: Evolving with Market Changes

During their recent episode, Taylor, Carlisle, and Pieter Slegers discussed Adapting Your Investment Strategy: Evolving with Market Changes, here’s an excerpt from the episode: Pieter: Yeah, sure. So, I think, for example, once again compare value with quality investing, well, for value investors, the margin of safety is at a … Read More

How to Use Reverse DCF and EPS Growth Models in Quality Investing

During their recent episode, Taylor, Carlisle, and Pieter Slegers discussed How to Use Reverse DCF and EPS Growth Models in Quality Investing, here’s an excerpt from the episode: Jake: Let’s talk about the valuation component, because this is I think where it might get difficult for some with trying to … Read More

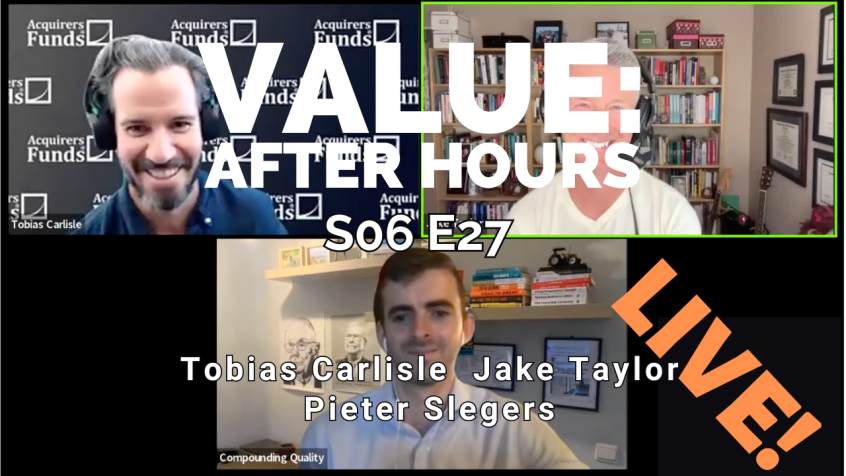

VALUE: After Hours (S06 E27): Quality Compounding’s Pieter Slegers on The Art of Quality Investing

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Pieter Slegers discuss: How to Use Reverse DCF and EPS Growth Models in Quality Investing Adapting Your Investment Strategy: Evolving with Market Changes Cybernetics as a Mental Model: Understanding Systems and Control Mechanisms The Power … Read More

Unlocking Investment Intuition: Lessons from Chicken Sexing

During their recent episode, Taylor, Carlisle, and Adam Mead discussed Unlocking Investment Intuition: Lessons from Chicken Sexing, here’s an excerpt from the episode: Tobias: JT has got closer to the router, so he’s going to have another go. JT. Adam: I’m dying to know. [Tobias laughs] We want to know … Read More

Regular Portfolio Cleaning Enhances Investment Focus

During their recent episode, Taylor, Carlisle, and Adam Mead discussed Regular Portfolio Cleaning Enhances Investment Focus, here’s an excerpt from the episode: Jake: I was just going to say, I know an investor who, if a position– He has a position, minimum, so if something falls below certain threshold, either … Read More

Watchlist Investing And The Neighbor’s House Analogy

During their recent episode, Taylor, Carlisle, and Adam Mead discussed Watchlist Investing And The Neighbor’s House Analogy, here’s an excerpt from the episode: Tobias: [crosstalk] When you’re constructing your portfolios, Adam, do you take that idea of taking the big bets? Do you like that idea of narrowing down to … Read More

Buffett’s Willingness To Be Wrong

During their recent episode, Taylor, Carlisle, and Adam Mead discussed Buffett’s Willingness To Be Wrong, here’s an excerpt from the episode: Jake: Anything appreciable on something we’ve talked about before is the idea of statistical time versus behavioral time. So, you can look at things on a chart, and it’s … Read More

VALUE: After Hours (S06 E26): Adam Mead on The Financial History of Berkshire and Warren Buffett

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Adam Mead discuss: Buffett’s Willingness To Be Wrong Watchlist Investing And The Neighbor’s House Analogy Regular Portfolio Cleaning Enhances Investment Focus Unlocking Investment Intuition: Lessons from Chicken Sexing The Hidden Global Reach of Nasdaq-100 Companies … Read More

Why Society Needs More ‘Elon Musks’ with Better Risk Management

During their recent episode, Taylor, Carlisle, and Luca Dellanna discussed Why Society Needs More ‘Elon Musks’ with Better Risk Management, here’s an excerpt from the episode: Jake: I wondered if reading biographies might have some problematic nature to it, because biographies are all Alice’s. No one’s reading Bob’s biography. So, … Read More

Understanding Reproducible Strategies in Investment

During their recent episode, Taylor, Carlisle, and Luca Dellanna discussed Understanding Reproducible Strategies in Investment, here’s an excerpt from the episode: Jake: So, my segment this week, Toby, is asking Luca questions about the book. So, maybe I’ll keep going in this thread. How does this relate then to the … Read More

Value Investing and Ergodicity: A Framework for Long-Term Success

During their recent episode, Taylor, Carlisle, and Luca Dellanna discussed Value Investing and Ergodicity: A Framework for Long-Term Success, here’s an excerpt from the episode: Tobias: I think one of the things that value guys do, and probably the reason that Jake and I are so attracted to the idea … Read More

Ergodicity in Action: A Story of Ski Racing and Investment

During their recent episode, Taylor, Carlisle, and Luca Dellanna discussed Ergodicity in Action: A Story of Ski Racing and Investment, here’s an excerpt from the episode: Luca: Yeah. So, the trick is to avoid defining it and make an example first. Because when people hear the story, they understand it … Read More

VALUE: After Hours (S06 E25): Luca Dellanna on his books Winning Long-Term Games and Ergodicity

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Luca Dellanna discuss: Ergodicity in Action: A Story of Ski Racing and Investment Value Investing and Ergodicity: A Framework for Long-Term Success Understanding Reproducible Strategies in Investment Why Society Needs More ‘Elon Musks’ with Better … Read More

Some Stocks Trade Like Apartment Blocks And Others Like Rembrandts

During their recent episode, Taylor, Carlisle, and Brewster discussed Some Stocks Trade Like Apartment Blocks And Others Like Rembrandts, here’s an excerpt from the episode: Tobias: Speaking of big pay packages, what’s Musk’s chances of getting that across the line, do you think? What’s he got? Is it like $50 … Read More

Is AI Worth the Environmental Cost?

During their recent episode, Taylor, Carlisle, and Brewster discussed Is AI Worth the Environmental Cost?, here’s an excerpt from the episode: Bill: Got through unscathed. You know what bothers me about this AI stuff, Jake? I called Jake to talk about this to get his take on it. We’re supposed … Read More

The Case for a “Small-Cap Summer”

During their recent episode, Taylor, Carlisle, and Brewster discussed The Case for a “Small-Cap Summer”, here’s an excerpt from the episode: Tobias: It took me a little bit of time to read my writing here, but smalls have been hosed. Smalls are back to the 2020 lows relative to the … Read More

Can Berkshire’s Investing Lieutenants Carry the Mantle?

During their recent episode, Taylor, Carlisle, and Brewster discussed Can Berkshire’s Investing Lieutenants Carry the Mantle?, here’s an excerpt from the episode: Tobias: Let’s go to Berkshire. Berkshire has this huge cash. Didn’t deploy any in the 2020 drawdown. Just now packed to the gills with cash. Jake: It might … Read More

Exploring Fishbone Diagrams: A Visual Tool for Root Cause Analysis

During their recent episode, Taylor, Carlisle, and Matt Sweeney discussed Exploring Fishbone Diagrams: A Visual Tool for Root Cause Analysis, here’s an excerpt from the episode: Tobias: It’s the top of the hour, which means that it’s time for Jake Taylor’s veggies. Mark it down, 11:03 on the 33 minutes. … Read More

Why Biologic Drugs Are the Future: A Look at Industry Trends

During their recent episode, Taylor, Carlisle, and Matt Sweeney discussed Why Biologic Drugs Are the Future: A Look at Industry Trends, here’s an excerpt from the episode: Tobias: Do you see any demand destruction? The sales are impacted as a result of the rates or just the general–? Like, does … Read More