In his latest interview on the Meb Faber Podcast, Jeremy Grantham discusses what happens when investors are short-term in their thinking and bit innumerate. Here’s an excerpt from the interview: Jeremy: And people are all focused as they always are on the next year or two. I get that. But I’m … Read More

GMO: Making Money And Reducing Risk In An Equity Superbubble

In their latest Insight titled – Making Money And Reducing Risk In An Equity Superbubble, GMO explain how investors can still make money while reducing risk in an equity superbubble. Here’s an excerpt from the Insight: Navigating the career risk associated with bubbles (especially superbubbles) has always been tricky and … Read More

GMO: 4 Investing Mistakes To Avoid In A Rising Market

In their latest Q4 2021 Letter, GMO discuss four of the biggest investment mistakes to avoid in a rising market. Here’s an excerpt from the letter: None of us, regardless of our skill and experience in investing, can be spared the pain caused by making mistakes. While we can all … Read More

Jeremy Grantham: Stock Price Manipulation

In his latest interview on The Long View Podcast, Jeremy Grantham discusses stock price manipulation. Here’s an excerpt from the interview: Grantham: Corporate buybacks have been the shining number one driver of this 11-year bull market and has changed everything. And then, with the stimulus program, of course, the individuals came … Read More

Jeremy Grantham: Let The Wild Rumpus Begin*

In his latest commentary titled – Let The Wild Rumpus Begin*, Jeremy Grantham explains why we are currently in the fourth superbubble of the last hundred years. Here’s an excerpt from the commentary: All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a … Read More

Jeremy Grantham: Our Children Will Be Talking About This Market In 50 Years Time. Here’s Why…

In an interview at the end of last year on the Citywire Podcast, Jeremy Grantham explained why our children will be talking about this market in 50 years time. Here’s an excerpt from the interview: Grantham: If I thought it was crazy in June/July of last year. Oh my God! … Read More

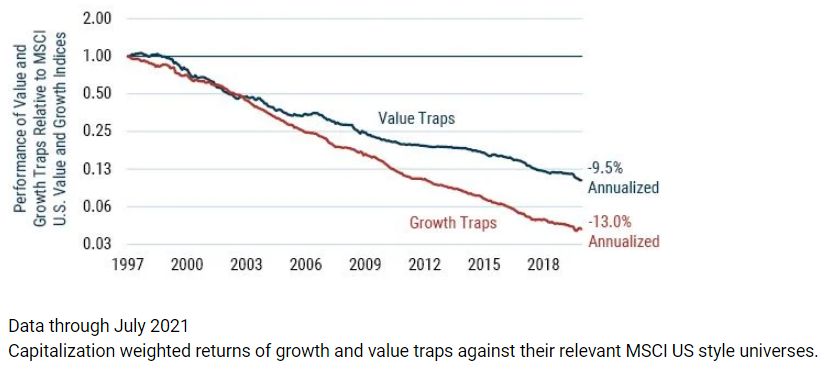

GMO: Growth Traps Are Worse Than Value Traps

In their latest insight titled – Value Traps vs Growth Traps, GMO explains why growth traps are worse than value traps. Here’s an excerpt from the article: When Value disappoints, markets are mad. When Growth disappoints, they are merciless. Value traps are facts of life for value managers. A stock … Read More

Jeremy Grantham: Bull Markets Are Like A Water Jet Under a Ping-Pong Ball

In his interview earlier with year on the Invest Like The Best Podcast, Jeremy Grantham provided a great illustration of what happens in a bull market. Here’s an excerpt from the interview: And the consequences will we might be approaching a rather similar Minsky moment in the not too distant … Read More

GMO: There’s Nothing More Frustrating Than Watching Your Neighbor Get Rich

In their latest Q3 2021 Market Commentary, GMO discusses the frustration of watching your neighbor get rich. Here’s an excerpt from the letter: The end of the quarter is also a time to breathe and take stock more broadly of the “mood” of the markets and our clients. While we … Read More

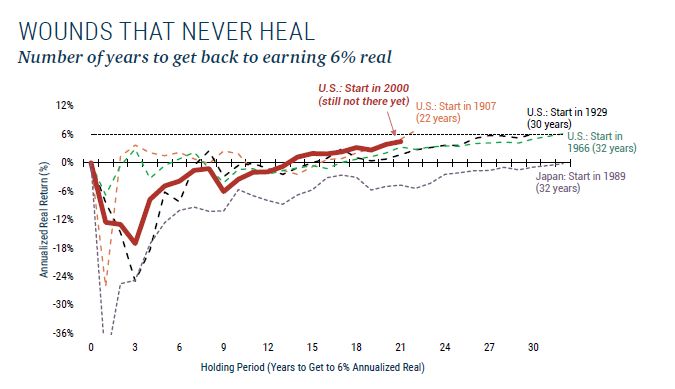

GMO: It Takes Decades To Recover When The Bubble Bursts

In their latest insight titled – Wounds That Never Heal, GMO provides some great research that shows just how long it takes to recover when the bubble bursts. Here’s an excerpt from the insight: WOUNDS THAT NEVER HEAL Why so focused on bubbles? The damage they inflict can last decades. … Read More

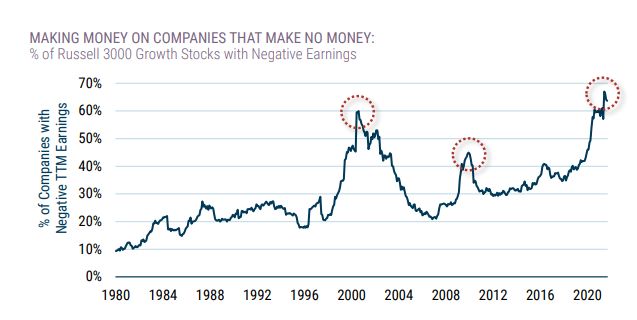

GMO: Making Money on Companies That Make No Money

In their latest market commentary titled – Making Money On Companies That Make No Money, GMO discuss the fact that today, 60% of the Growth stocks in the Russell 3000 Index make no money, yet these very companies have been generating huge returns in price movement over the past few … Read More

Jeremy Grantham: Value Stocks Outside The U.S Will Have A Positive Return Over The Next 10 Years

In his recent interview on CNBC, Jeremy Grantham discusses what to own in a broad overpriced world, which includes value stocks outside the U.S. Here’s an excerpt from the interview: I do hold some gold and it’s not… it’s not helping me much, I will say that. It’s a strange … Read More

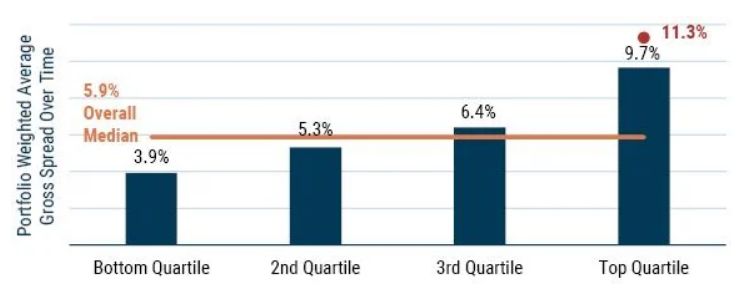

GMO: Merger Arbitrage Provides A Compelling Opportunity For Patient Investors

In their latest article titled – Merger Arbitrage Opportunity, GMO explains why merger arbitrage provides a compelling opportunity for patient investors. Here’s an excerpt from the article: Intense technical liquidation in Merger Arb deals improved prospective returns As of 8/4/2021 | Source: GMO Bars represent the median values by quartile … Read More

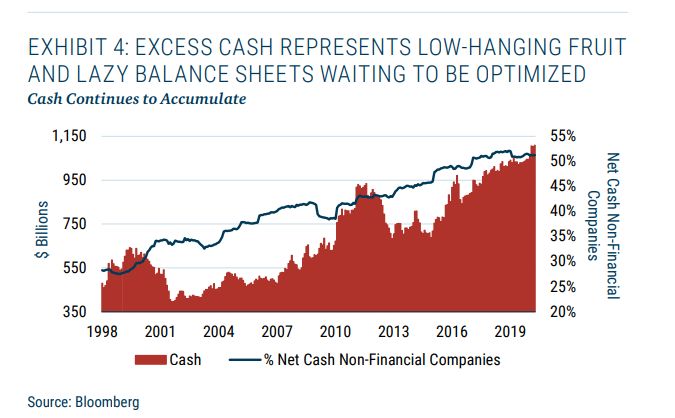

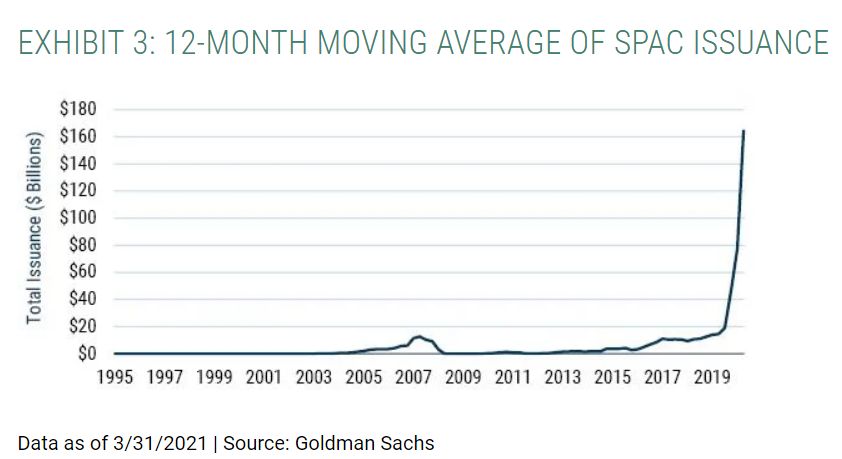

GMO: When The Ducks Are Quacking, Feed ‘Em – Stock Issuance Highest Ever

In their latest market insight, GMO illustrate further signs of today’s bubble with stock issuance at its highest ever. Here’s an excerpt from the insight: WHEN THE DUCKS ARE QUACKING, FEED ‘EM Stock issuance highest ever, as firms and Wall Street know when it’s time to sell to eager buyers … Read More

Jeremy Grantham: Beware The ‘Confidence Termites’

In his recent interview on The Moneyweek Podcast, Jeremy Grantham discussed what might bring this latest prolonged bubble to an end, and the role of the ‘confidence termites’. Here’s an excerpt from the interview: Grantham: The history books are pretty clear, there doesn’t have to be a pin. No one … Read More

GMO: Japan Value And Small Cap Value Stocks Are Cheap

In their latest paper titled – JAPAN VALUE An Island of Potential in a Sea of Expensive Assets, GMO explain why Japanese value and small cap value stocks are cheap. Here’s an excerpt from the paper: Japan Small Value Stocks Present a Robust Opportunity Set for Alpha Seekers Successful cost … Read More

Jeremy Grantham: The Link Between Value And Rates

In his latest interview on The Rules of Investing Podcast, Jeremy Grantham discusses the 1970s high inflation period and the link between value and rates. Here’s an excerpt from the interview: Grantham: There should be. Arithmetically or mathematically. The higher the rate, the more the dividend counts. And the lower … Read More

GMO: Why Today’s Highfliers Are So Likely To Fall Back To Earth

In their latest Q1 2021 Quarterly Letter, GMO say, “that speculation is a much bigger driver in the stock market today than is normally the case.” The result may lead to today’s high fliers being the most likely to fall back to Earth. Here’s an excerpt from the letter: While … Read More

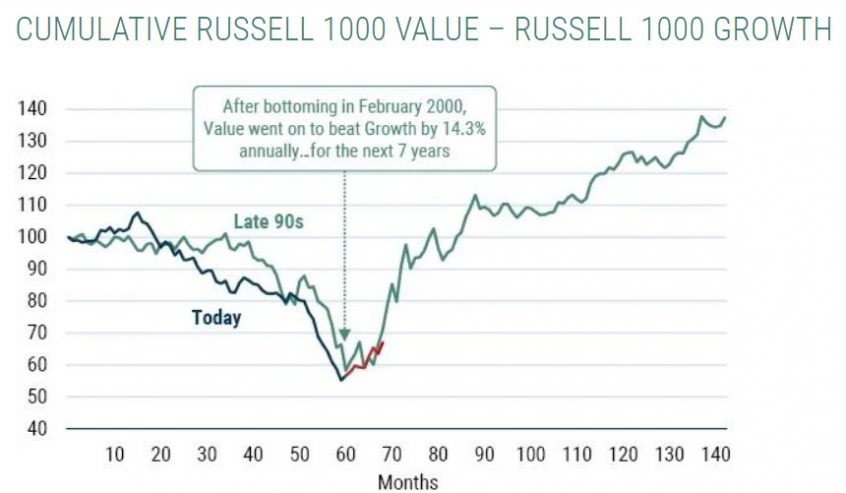

GMO: Value’s Turn: Eerie Parallels To 1999

In their latest Insight titled – Value’s Turn: Eerie Parallels To 1999, the team at GMO believe that value’s recent outperformance over growth is set to continue based on the eerie similarities between today and 1999 saying, “there are many eerie parallels between today’s Value/Growth relationship and what we witnessed … Read More

Jeremy Grantham: The Problem With Being Contrarian

In his recent interview on the Meb Faber Podcast, Jeremy Grantham discussed the problem with being contrarian. Here’s an excerpt from the interview: Grantham: Of course, I did want to add that I can say with a clear conscience that we were at our maximum bearishness in March of 2000. And … Read More