In their latest insight titled – Wounds That Never Heal, GMO provides some great research that shows just how long it takes to recover when the bubble bursts. Here’s an excerpt from the insight:

WOUNDS THAT NEVER HEAL

Why so focused on bubbles?

The damage they inflict can last decades.

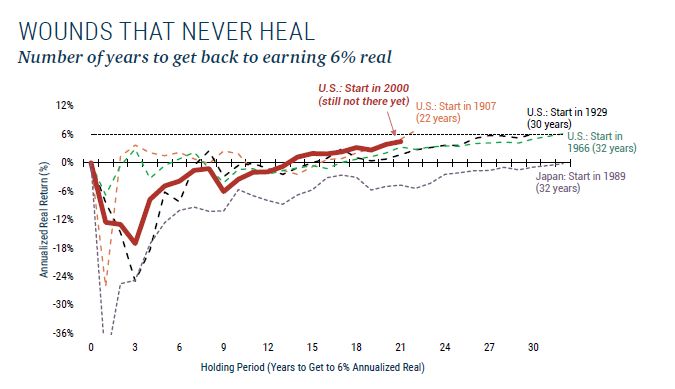

It Is Prudent to Pay Close Attention to Bubbles. The chart above highlights four major U.S. equity bubbles going back to 1929 (the 2008 bubble is included in the 1999 time series) and the Japanese equity bubble of the late 1980’s.

Each line measures the initial damage done when the bubble bursts, and then tracks how long it subsequently takes an investor to climb back to their “expected” 6% real1 return.

It’s typically decades. Even with the amazing returns U.S. stocks have delivered for the past ten years, the S&P 500 Index has still not climbed out of the hole created by the tech bubble of 1999 (the red line, above). Bubbles inflict deep and cruel wounds, and it is right and prudent to avoid them, exploit them, or dance around them as best we can.2

1. Note that 6% real (or roughly 8% to 8.5% nominal) is a common assumption for equilibrium equity returns. It also is (or historically was) a common long-term equity return assumption for investment consultants, actuaries, pension plans, sovereign wealth funds, endowments, foundations, health care systems, defined contribution systems, family offices, wealth managers, RIAs, CFPs, investment advisors, and individuals.

2. Bubbles are not just for avoiding. They can, and have been, spectacular money-making opportunities, as well. We have a long history of creating strategies that are designed to monetize the massive dislocation in pricing that typically characterizes bubbles. We have one such strategy today that is long a diversified basket of global Value stocks and short a basket of global Growth stocks.

You can read the original article here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: