One of my favorite investment classics is Walter Schloss reminiscing about Benjamin Graham and Security Analysis. It’s a timeless piece from one of the world’s greatest super-investors. Let’s take a look…

How to Succeed in Investing, and Why You Shouldn’t Listen to Analysts – James Chanos

I recently read an interview with James Chanos, which was conducted by The Heilbrunn Center for Graham & Dodd Investing, in the Spring of 2012. James Chanos is the founder and Managing Partner of Kynikos Associates, a firm he founded in 1985. Throughout his career, Chanos has identified and sold short the … Read More

How do we hand-pick the 90 best Deep Value Stocks for our Screens

(Image Credit, www.123rf.com) One question we always get asked is, how to we hand-pick the 90 best Deep Value Stocks for our screens? Hand-picking the 90 best Deep Value opportunities from 1000’s of stocks is like trying to find a needle in a haystack but, we know that historically once they’re found, … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning August 8th, 2016” on Storify]

50 of the Best Value Investing Resources (plus a few more)

(Image Credit, whytoread.com) People always ask me, what are my favorite investing resources. Things like articles, videos, bloggers, books etc. So today I’ve put together a list of 50+ investing resources that I’ve found very useful on my investing journey. It’s by no means complete but, it will give you a … Read More

FreightCar America, Inc. trading at a discount to its tangible book value $RAIL

Last week FreightCar America, Inc (NASDAQ:RAIL) released its Q2 2016 quarterly report. FreightCar is a diversified manufacturer of railcars and railcar components. The company designs and manufactures a broad variety of railcar types for transportation of bulk commodities and containerized freight products primarily in North America, including open top hoppers, covered hoppers … Read More

The Psychology of Human Misjudgment – Charlie Munger (Audio & Transcript)

(Image Credit, danshipper.com) Here’s the timeless speech by Charlie Munger, given to an audience at Harvard University back in 1995. The speech is titled, “The Psychology of Human Misjudgment”. I never get tired of listening to this classic orator.

There are three central elements to a value-investment philosophy – Part 1 – Seth Klarman

(Image Credit, advisoranalyst.com) One of the best books on investing is Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor, by Seth Klarman. According to Forbes: Investing legend Seth Klarman runs Boston-based firm Baupost. With $27 billion under management, Baupost is one of the largest hedge funds. It posted small … Read More

Lame and boring value stocks outperform ‘glamour’ stocks – Patrick O’Shaughnessy

Another one of my favorite bloggers is Patrick O’Shaughnessy. Patrick is a CFA and portfolio manager at O’Shaughnessy Asset Management. He also has an awesome blog called The Investors Field Guide which is a must read for all investors. Last year he did an excellent piece on the comparative performance between value stocks … Read More

Does the current climate make markets vulnerable to a black swan event? – The Royce Funds

(Image Credit, www.mirror.co.uk) This month The Royce Funds Portfolio Manager, Charlie Dreifus discussed how the current climate of slow growth, high valuations, and interventionist monetary policy makes the markets potentially vulnerable to black swan events. Charlie Dreifus manages the firm’s Special Equity mutual funds that attempt to combine classic value … Read More

Dividends are making you poorer – Meb Faber

One of my favorite bloggers is Meb Faber. Meb has an awesome blog at mebfaber.com. Back in May this year Meb released the results of his study into dividend stocks. He wanted to research the ‘real’ returns of a dividend strategy when we consider tax. “Dividends are taxed every year … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning August 1st, 2016” on Storify]

Being contrarian is not enough, you must be very sure you are right – Philip Fisher

(Image Credit, youtube.com) One of my favorite investment books is of course, Common Stocks and Uncommon Profits and Other Writings, written by investing legend Philip Fisher. Philip Fisher was an investor best known as the author of Common Stocks and Uncommon Profits, a guide to investing that has remained in … Read More

G Willi-Food International Ltd trading at a discount to its NCAV $WILC

(Image Credit, www.investopedia.com) On July 29 we reported that, “The best value stock in the Small and Micro Screener is WILC G Willi-Food International Ltd (NASDAQ:WILC) on a multiple of -0.42 times operating income”. Willi-Food is a company that specializes in the development, marketing and international distribution of kosher foods. … Read More

If contrarian strategies do so well, why doesn’t everyone use them? – David Dreman

(Image credit – authors.simonandschuster.co.uk) I was recently re-reading one of my favorite investment books by David Dreman, Contrarian Investment Strategies – The Next Generation. David Dreman is the founder and Chairman of Dreman Value Management. He’s published many scholarly articles and has written four books. Dreman also writes a column for Forbes … Read More

What can Pokémon Go teach us about irrational investing?

(Image Credit: www.pokemon.com) A lot has been written about the irrationality of investors. To help them out, they can head over to the SEC website and read the nine investing behaviors that can undermine investment performance. The article’s titled, Investor Bulletin: Behavioral Patterns of U.S. Investors. “The Library of Congress report … Read More

Apple Inc jumps 6.5%, 23% drop in iPhone sales $AAPL

(Image Credit: www.theregister.co.uk) Apple Inc (NASDAQ:AAPL) released its 2016 third quarter results Wednesday. The company recorded revenue of $42.4 billion for the quarter, down 15% from $49.6 billion for the previous corresponding period. Net income was also down 27% for the quarter to $7.8 billion from $10.7 billion for the previous corresponding period. Clearly … Read More

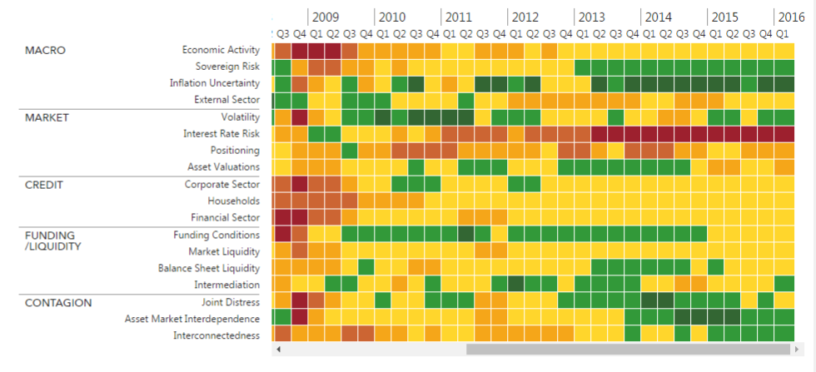

Is the CAPE Ratio providing a warning for investors – OFR

While no single tool, ratio or source should be used to evaluate the economy and its financial stability. The Office of Financial Research (OFR) provides a free bi-annual report, and a really cool heat-map, on their version of what’s happening in the economy. Its called the Financial Stability Monitor, here’s … Read More

Pendrell Corporation trading close to its NCAV $PCO

(Image Credit: http://pendrell.com/) Pendrell Corporation (NASDAQ:PCO) was the biggest mover in ‘The All Investable Screener’ yesterday, up a whopping 14.8%. Who is Pendrell Corporation? For the past five years Pendrell has invested in and acquired IP rights, and continues to monetize those IP rights. For example, during the second quarter of … Read More

The central principle of investment is to go contrary to the general opinion – Keynes

The year is 1543. Think about that! That’s 473 years ago. For most of us, something from the 1920’s is considered old! There was this guy called, Nicolaus Copernicus, Copernicus contended that the Earth revolved around the sun, rather than the other way around. At the time everyone thought he was … Read More