(Image Courtesy, institutionalinvestor.com) Charles Brandes is the chairman of Brandes Investment Partners. He started the firm in 1974, and manages multiple portfolios including US equity and Global Equity. Brandes Investment Partners has $26.6 Billion in Assets Under Management, as of June 2016. He has described his value investing strategy as: “Guided by … Read More

Which Investing Style Is Better, Eddie Lampert or Seth Klarman? – Zeke Ashton

Zeke Ashton is the founder and managing partner of Centaur Capital Partners. Founded in 2002, Centaur Capital Partners specializes in value-oriented investment strategies. Prior to launching Centaur Capital, Ashton served as an investment analyst and featured writer for The Motley Fool, an investment media company. From 1995 – 2000, Ashton … Read More

How To Think About The Impact of Technlogy In Investing – Tom Gayner (Markel Corporation)

Tom Gayner is the Co-Chief Executive Officer at Markel Corporation, a holding company for insurance, reinsurance, and investment operations around the world. Markel has often been compared to Berkshire Hathaway in the way that it invests its insurance float in other businesses. Gayner has been a very successful value investor over the years. His equity portfolio … Read More

Undervalued Stocks | Argan, Inc. (NYSE:AGX)

Argan, Inc. is a holding company that conducts operations through its wholly-owned subsidiaries, GPS, APC, SMC and TRC. Through GPS and APC, Argan provides a full range of engineering, procurement, construction, commissioning, operations management, maintenance, development, technical and consulting services to the power generation and renewable energy markets for a wide range … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning September 19th, 2016” on Storify]

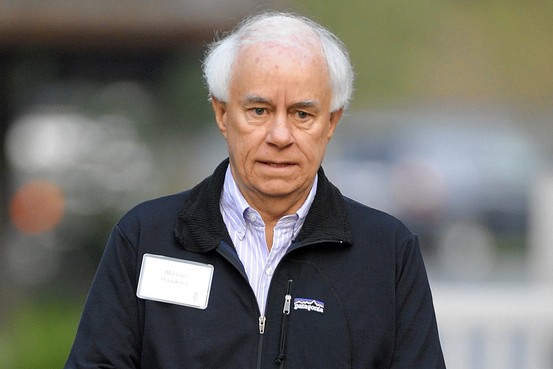

What Are The Three Components Of An Equity Investment’s Return – Mason Hawkins

(Image Credit, marcellusdrilling.com) Mason Hawkins has been Chairman and Chief Executive Officer of Southeastern Asset Management since 1975. Southeastern Asset Management is a privately owned, global investment management firm and the investment advisor to the Longleaf Partners Funds with over $20 Billion in Assets Under Management. Southeastern Asset Management have consistently … Read More

Deep Value Investing – Amit Wadhwaney

(Image Credit, youtube.com) Amit Wadhwaney is a Portfolio Manager and Co-Founding Partner at Moerus Capital Management LLC, and the founding manager of the Moerus Worldwide Value Fund. Wadhwaney has over 25 years of experience researching and analyzing investment opportunities in developed, emerging, and frontier markets worldwide, and has managed global … Read More

Value Investing Is Key Because We Can’t Predict The Market’s Booms And Busts – Forbes

We’re always on the look out for the latest in value investing news. Just found a recent article on Forbes titled, Value Investing Is Key Because We Can’t Predict The Market’s Booms And Busts. Let’s take a look…

GuruFocus Book Review – Deep Value – Tobias Carlisle

(Image Credit, returntome.info) Here at The Acquirer’s Multiple, we don’t like to ‘blow our own trumpets”. We like to let others do it for us! Our Founder, Tobias Carlisle, wrote an Amazon best-seller called Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations which describes the process of finding … Read More

What Does It Take To Be A Successful Contrarian Value Investor – John Rogers

(Image Credit, cnbc.com) John Rogers is a true contrarian value investor. In 1983, Rogers founded Ariel Investments headquartered in Chicago. Since its inception, Ariel Investments has grown from 2 to 88 employees with $10.7 billion in Assets Under Management (2015). In 2008, he was awarded Princeton University’s highest honor, the Woodrow … Read More

Going For Too Much Certainty Can Hold You Back – There Is No Certainty – Glenn Greenberg

Glenn Greenberg is the founder and portfolio manager of Brave Warrior Capital. Previously, Greenberg ran Chieftain Capital Management, which he founded in 1984. Brave Warrior Capital has $3.2 Billion in Assets Under Management. Mr. Greenberg holds an English degree from Yale and is a graduate of Columbia Business School. When he … Read More

Advisors And Fund Managers Ignore Value Because It Carries Higher Career Risk

Value investing requires a long term time horizon involving patience and discipline. Unfortunately for advisors and fund managers, their own performance is judged on much shorter time periods. As such, these ‘agents’ face a powerful incentive to minimize short-term drawdowns relative to peers and benchmarks. Here’s a great article that … Read More

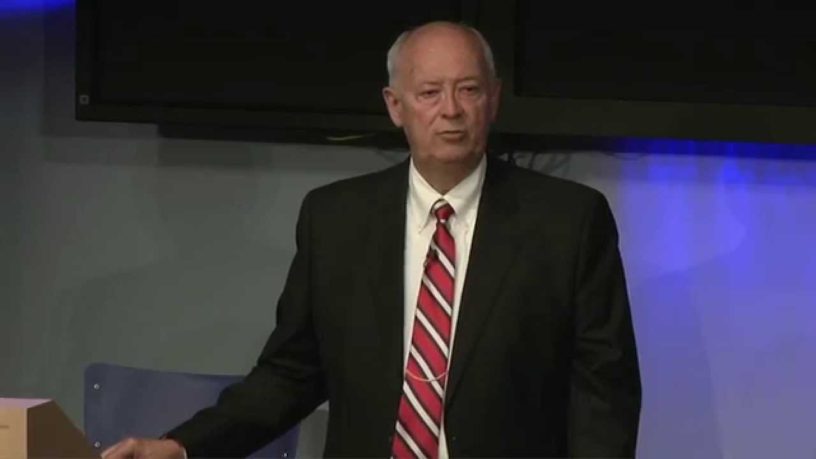

Look At Equities Like A Bond Buyer Would Look At Bonds – Donald Yacktman

(Image Credit, youtube.com) Donald Yacktman is the President and Co-Chief Investment Officer of Yacktman Asset Management Co. He’s also a Co-Manager for the Yacktman Funds. Yacktman Asset Management provides two no load funds, one diversified and one focused, aimed at providing a blend of growth and value investing. As of June … Read More

Human Nature Makes It Hard For Markets To Be Efficient – Seth Klarman

Seth Klarman is a value investor and Portfolio Manager of the investment partnership The Baupost Group. Founded in 1983, The Baupost Group now manages $27 billion in Assets Under Management, and has averaged returns of nearly 20% annually since their inception. Klarman is also author of the book “Margin of … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning September 12th, 2016” on Storify]

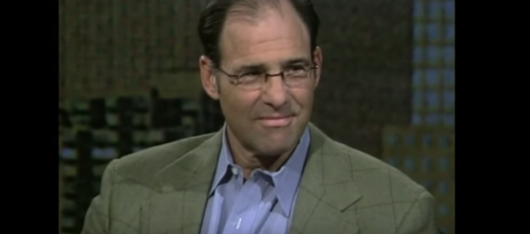

Which Is The Best Pond to Fish In – Donald Smith

(Image Credit, youtube.com) Donald Smith is the CIO of Donald Smith & Co. He began his career as an analyst with Capital Research Company and subsequently worked at Capital Guardian Trust Co. According to Whalewisdom.com, Donald Smith & Co. has $4.46 Billion in assets under management. Over 30 years since inception Donald Smith … Read More

Charlie Munger Told Mohnish Pabrai – An Investor Only Needs To Do Three Things (Video)

Mohnish Pabrai is Managing Partner of Pabrai Investment Funds. Pabrai started with $1 million in 1999, and the Pabrai Funds has grown to over $400 million in assets under management. Pabrai also wrote The Dhandho Investor: The Low-Risk Value Method to High Returns, which is a comprehensive value investing framework for the … Read More

How To Find Good Businesses Using A Three-Legged Milking Stool – Chuck Akre

(Image Credit, dailymotion.com) Chuck Akre is the founder of Akre Capital Management LLC. His firm has $4.8 Billion in Assets Under Management (Form ADV from 2015-11-01). Akre uses a classic value approach in selecting companies for his portfolio. He likes to buy companies with strong business model demonstrating consistent earnings growth, high … Read More

What Makes a Great Value Investor – Richard Pzena

(Image Credit, cnbc.com) Richard “Rich” Pzena is the founder and chief investment officer of Pzena Investment Management, a New York-based deep value investment firm with over $20 billion in assets under management. According to Graham and Doddsville, Pzena Investment Management’s Value fund has compiled an annualized compounded return of 16.3% … Read More

Jack Bogle: The Undisputed Champion of the Long Run

John ‘Jack’ Bogle is the founder and retired CEO of The Vanguard Group. He was also named one of the “world’s 100 most powerful and influential people”, by Time magazine in 2004. Bogle’s innovative idea was creating the world’s first index mutual fund in 1975. Bogle’s idea was that instead … Read More