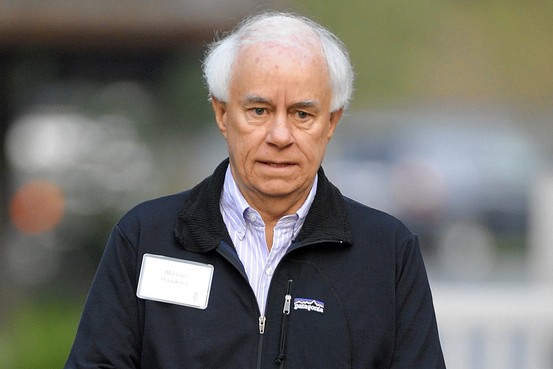

(Image Credit, marcellusdrilling.com)

Mason Hawkins has been Chairman and Chief Executive Officer of Southeastern Asset Management since 1975.

Southeastern Asset Management is a privately owned, global investment management firm and the investment advisor to the Longleaf Partners Funds with over $20 Billion in Assets Under Management.

Southeastern Asset Management have consistently employed a time-tested value approach to long-only equity investing for over four decades with a long-term time horizon in strong businesses with good people at deeply discounted prices.

Following is a great interview that Hawkins gave to The Graham & Doddsville Newsletter back in 2010.

You can learn a lot from value investors with over 40 years experience.

Let’s take a look…

Here is an excerpt from The Graham & Doddsville Newsletter, 2010. You can read the full interview here:

G&D: Could you tell us a little bit about how you developed an interest in investing?

MH: When I was in high school, my dad gave me the first edition of the Intelligent Investor and the second edition of Security Analysis. Like most teenagers, investing was not my primary focus, but I did read the Intelligent Investor and much of Ben Graham’s three main tenets resonated with me.

After high school, I was lucky enough to have Security Analysis as the core textbook in an undergraduate course, in an MBA program later, as well as in the three CFA courses. I’m grateful that the proper foundation was established in my early years. The most significant catalyst for me occurred in the bear market of 1970.

During my senior year at University of Florida, I went through the entire S&P stock guide and recorded companies selling below net-net, identified those selling below their net-cash and bought a few, literally buying dollars for fifty cents. That experience hooked me for my career. There were no computer screens at that point.

G&D: That sounds similar to what John Templeton talked about doing in some emerging markets. Were there any other influences on your investing style, in addition to Ben Graham?

MH: Chronologically, my Dad, Ben Graham, John Templeton, Warren Buffett and my partner, Staley Cates shaped my investment thinking.

G&D: When Buffett moved back to Omaha he said that escaping the hectic New York atmosphere allowed him to think more clearly. Do you think that has been a factor at Southeastern in Memphis?

MH: Yes. We depend almost exclusively on our appraisals and our assessment of our management partners and their companies’ competitive positions. We clearly remind our associates that you’re right because of your facts and reasoning, not because someone agrees or disagrees with you. And you do eliminate a lot of interference by being in Memphis as opposed to Manhattan.

G&D: That’s a very independent approach, sticking to your facts and reasoning and not being swayed by outside factors. One thing that sways a lot of managers is a desire to minimize career risk by hugging a benchmark. Your firm takes a completely different view on that. Could you talk about the benchmark you use and your attempts to track that benchmark?

MH: We try to hug good investments not benchmarks. We’ve established inflation plus 10% as our absolute investment goal and that’s been the case for our history. There’s not a lot of solace in being down 20% when the market is down 30%. Investing should lend itself to risk avoidance.

G&D: A lot of people talk about value investing, but what does value investing mean to you and how does that differentiate your firm?

MH: Graham provided the definition in the Intelligent Investor. An investment is one that promises safety of principal and an adequate return. By deduction, those that don’t are speculators. We believe that buying securities at large discounts to conservative appraisals provides the best route to above average compounding.

We’re focused on nailing down our evaluations so we can use them to make significant long-term investment commitments when sellers are under duress or traders are consumed with ephemeral short-term issues.

G&D: Where do you look to find these ideas?

MH: Value Line, new low lists around the globe, industry rags, computer screens, investee managements and boards, competitors of our investees, respected investors, US and international “best company” wish lists, and 35 years of appraisals help produce our investment ideas.

G&D: Obviously management is very important to you. How do you approach evaluating a management team?

MH: We strive to know as much as we can about our prospective CEO-partners. We want to understand their business acumen and their personal histories. As others have said, we believe it’s impossible to do a good deal with a bad person. We endeavor to read everything that’s available on management, but meeting them in person is critical.

It’s always important to hear their challenges and how they’re addressing them. Business is tough, and the more realistic the manager is the more likely he’ll be successful. We talk to their competitors, ex-employees, board members we’ve known, and community associates – to name a few of our checks.

G&D: When you’re setting an appraisal for a business, what process do you follow?

MH: We spend a lot of time on free cash flow generation after required capex and working capital charges and then assess the value of that free cash generation. If the company is not reasonably predictable and competitively entrenched, we are very careful about using DCFs.

We also look at the net asset or liquidation values. We then compare DCF and net asset values to our comparable sales database. We’ve recorded most M&A, take-private, or liquidation transactions. We compare those comparable sale yardsticks against our assessment of the net-asset or free-cash values and we use the lower of the two.

It’s important to make sure that when you record a transaction, you note the interest rate environment under which it occurred. If you recorded a transaction in 1982 when the long treasury was 15%, you’re going to see a much lower set of metrics than if the comp occurred in 2007 when the long treasury was under 4%.

We’ve made a lot of money in net-asset investing. There are companies that have significant asset values that don’t produce any earnings. Burlington Northern in the early 1980’s became very cheap in relation to its land, oil, natural gas, gold, timber, and pipeline assets when the company operated at a loss.

G&D: What is the dynamic on your team when evaluating new positions?

MH: There are 9 and a half of us – I’m a half. Each analyst is opportunistically searching for a terrific investment. When somebody finds an idea, they write it up. They assess business, people, and price and then everybody gets a copy of the report which attempts to lay out the relevant facts and the investment case.

Seniority plays no role. We are all very mindful that the investment succeeds or fails based on the facts. Usually, if an important question can’t be addressed adequately, the idea fails. Furthermore, we assign a devil’s advocate to each investment idea.

G&D: What is a normal gestation period on a new idea?

MH: It can be 5 minutes, or it can be 5 months. If we’re buying a company that’s selling below the cash on its balance sheet, it can be done quickly. If we’re buying a normal operating business that has competitive challenges, you want to be able to assess it conservatively and explore all the potential threats. Usually, our best ideas are vetted quickly.

G&D: As you’re discussing appraisals and margin of safety, you’ve mentioned investing in net-nets. Do you find margin of safety in the quality of the business or just a cheap price?

MH: Valuable growth is the great eraser if you misprice your purchase. Buying good businesses is critical to profitable long-term equity investing. There are three components of an equity investment’s return.

One is the discount to intrinsic value.

The second is the growth in intrinsic value.

And the third is the rapidity at which the gap between price and value closes.

Mathematically, we know that if you buy a business at half of value, and value accretes at 12% per annum, and the price reflects intrinsic value in the 5th year, you get 29% per annum compounding. And you sleep very well at night knowing that the value is greater than the price.

Clearly, Ben Graham wrote a lot about the margin of safety and protecting your principal, but there was less emphasis on the benefits to returns from buying good businesses at cheap prices. If you bought this example at fair value and it stays at fair value, you just get the value accretion, 12%. However, if you bought it at half of intrinsic value, you pick up another 17 points per year of compounding. So, parsimony is extremely profitable.

The less elaborated aspect of value investing is the huge plus you get from stealing a good company.

G&D: So does that put more of a focus on developed markets as opposed to emerging, more volatile markets?

MH: It does. There’s another challenge if the currency is an issue. Many years ago, we found a terrific Coca-Cola bottler in Brazil, but the currency was going to cost us 20+% a year, and that prevented us from making the investment.

G&D: You’ve had a long career in investment management and seen the industry change over your career. What’s your outlook on the industry going forward? Do you have any thoughts on how the industry should be changing?

MH: We’ve never thought of our business as an industry. We think more about our existence as investors. We believe that if we deliver good returns with low risk for our partners, then the rest takes care of itself. We assume an owner operator mentality as you know.

If you work for Southeastern, you have to do all of your equity investing via the Longleaf Partners Funds. I believe that benefits us in two ways. It removes conflicts of interest, and it focuses everyone’s attention on the companies in the portfolio. When you see your boss in the mirror in the morning, you can assess your career risk solely on your investment results and not on politics or relative returns.

Our owner operator culture helps us focus on the investments and doing the right thing for our partners.

Another thing that advantages the Longleaf Partners Funds is our long-term time horizon. It’s very difficult to find a long-term investor today, and we believe that’s beneficial to us. The average holding period on the New York Stock Exchange has dropped to 6-months from 5 years, 30 years ago.

So, there’s a lot of “moving about” in the industry and that average NYSE holding period dropping is an indication of just how short-term everybody has become in their thinking. More participants are traders, believing that investing for long-term returns is not a worthwhile pursuit. We know it is.

Growth in corporate intrinsic value is often obfuscated by stock price movement, which does not appropriately track the accretion in business value. That’s good for all of us who are appraisers of businesses, because it means you get more mispricing and better opportunity to get a franchise at a cheap price.

G&D: One final question, what advice do you have for business school students interested in a career in investing?

MH: You want to pursue it for the intellectual challenge, for the reward of being correct about your investment decisions, and for the opportunity to help others. Those would be the three primary reasons I would counsel you to pursue a career in investing. If you start out just doing it because you want to make a lot of money, I doubt that you’ll be as successful.

G&D: Not many managers talk about investing in terms of helping others, but that’s an interesting perspective to have.

MH: Most of our partners at Southeastern come in daily for altruistic reasons, not only to help retirees and college students, but to produce the free cash flow coupon at Southeastern that can be reinvested to help those who are less fortunate.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: