Great video with Mohnish Pabrai speaking with the folks at Google. This whole presentation can be summed up at 27:05 when Pabrai says, “Spending time on [researching] companies is likely to make me bias”. In other words when you’re looking for investment opportunities they should hit you over the head … Read More

Charlie Munger Says The Investment Management System Is Bonkers – Here’s Why

One of my favorite investing tomes is Poor Charlie’s Almanack by Charles Munger. As an investor, it’s the one book you need to read on ‘rational’ investing strategy. A quick look on Amazon shows that there are fourteen used copies selling for $162.01 and one new copy for $50,000. That … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning June 26th, 2017” on Storify]

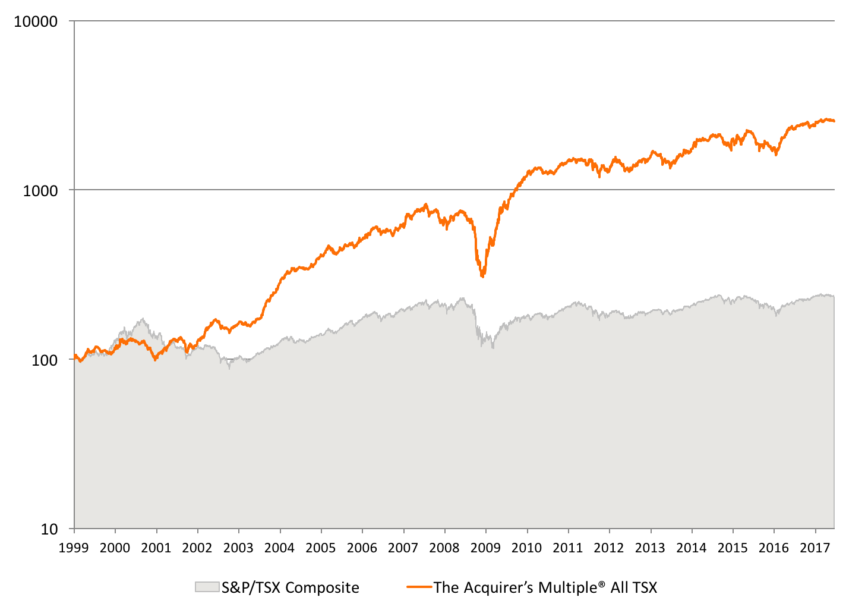

Our New Canadian Deep Value Stock Screener – (CAGR) 19.1% per year

Big news this week with the release of our new Canadian All TSX deep value stock screener, and the backtest results are astounding! Backtesting Results Canada All TSX Stock Screen We backtested the returns to a theoretical portfolio of stocks selected by The Acquirer’s Multiple® from the Canada All TSX stock screen. … Read More

This Week’s Best Investing Reads From Our Top 50 Investing Blogs 2017

Each week Tobias and I pick out the best investing reads from our Top 50 Investing Blogs 2017. Here’s what we’ve been reading: Acquirer’s Multiple & the Quest for Value (Old School Value) How to Invest in an Overvalued Market (A Wealth of Common Sense) Factor Investing: Evidence Based Insights (Alpha Architect) The Jeff Bezos Empire … Read More

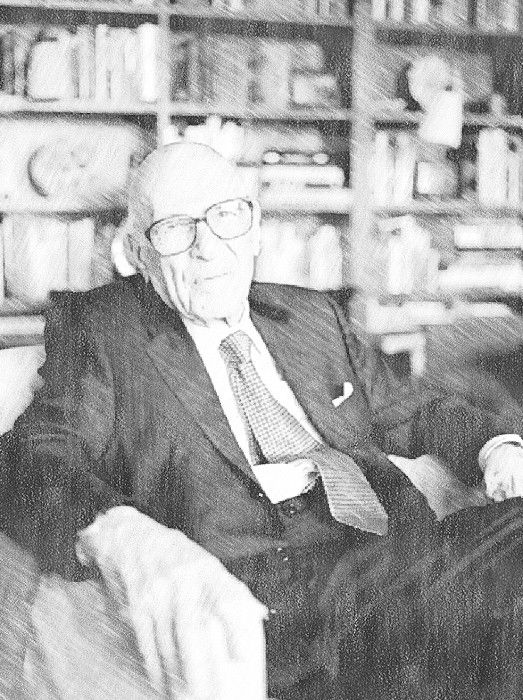

Just How Did Walter Schloss Achieve a 21.3% CAGR From 1956 to 1984

Walter Schloss was one of Buffett’s Superinvestors of Graham-and-Doddsville. He had an incredible track record of returns over his investing career, achieving a 21.3% CAGR over the period of 28 and a quarter years from 1956 to Q1 1984. And, he did it while keeping his own expenses to a minimum. … Read More

Seth Klarman – The Definitive Guide On Why Bottom-Up Investing Trounces Top-Down Investing

There’s a lot of discussion on which is the better investing strategy, bottom-up investing or top-down investing. The definitive guide can be found in Chapter 7 of Seth Klarman’s book, Margin of Safety. Here’s an excerpt from that book: There is no margin of safety in top-down investing. Topdown investors are … Read More

John Rogers Says Contrarian Investing Gives You The Confidence To Buy When Others Are Selling

Here’s a great interview with contrarian value manager John Rogers on WealthTrack who says if you don’t follow the crowd you’ll be a better investor. “Value investing is a contrarian approach. You’re going to be buying when others are selling. When there’s a lot of fear out there you’re going … Read More

How To Invest Like Sir John Templeton In 2017

One of the most famous contrarian investors of all time was Sir John Templeton. Templeton was remembered for a number of famous quotes including: “To buy when others are despondently selling and to sell when others are avidly buying requires the greatest of fortitude and pays the ultimate greatest reward.” … Read More

Mohnish Pabrai – How To Calculate Intrinsic Value

I’ve just been re-reading one of my favorite investing books of all time, The Dhando Investor, written by Mohnish Pabrai. In Chapter 7, Dhandho 102: Invest in Simple Businesses, Pabrai provides a very simple example of how to calculate intrinsic value using the real life example of Bed Bath & Beyond Inc … Read More

Howard Marks Says You Can Invest In The Worst Companies In America And Have A Good Experience

As a value investor it’s important that you always assess the downside risk of your investments, prior to purchase. Famed investors Buffett and Klarman are always speaking about the ‘margin of safety’ espoused by the grandfather of value investing, Benjamin Graham. One of the best articles on assessing the risk … Read More

James Montier – There Are No Silver Bullets In Investing (Just Old Snake Oil In New Bottles)

According to the Cambridge dictionary a snake oil salesman is: someone who deceives people in order to get money from them: He was dubbed a “modern day snake oil salesman” after he ripped off thousands of internet customers. So why is it that so many investors are continually happy to … Read More

Bruce Berkowitz Says I’m Investing In That Which Is Hated Or Deemed To Fail And That’s Where I Like To Be

Here’s a great interview on Bloomberg with Bruce Berkowitz. In terms of being a contrarian Berkowitz says, “The markets are not cheap, the markets are being driven by a handful of companies. As usual I’m investing in that which is hated or deemed to fail and that’s where I like … Read More

How Warren Buffett Turned $10.6 Million Into $221 Million While Others Were Embracing The EMT

As a value investor it is important that you read every word of every letter ever written by Warren Buffett in his Berkshire Hathaway Shareholder Letters. One great example of what you can learn comes from his 1985 Chairman’s letter in which he discusses his intrinsic value calculation of The … Read More

Investors Shouldn’t Compare Their Performance To Others – Here’s Why

Great article by Ian Cassell at MicroCapClub titled, Don’t Compare Yourself To Others. Ian covers two important issues that all investors can relate to. The first is how to sit still while others are making money, because you can’t find stocks that fit your strategy. The second is how to … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning June 19th, 2017” on Storify]

The Acquirer’s Multiple® Canada All TSX Stock Screen Backtest

Chart 1. Returns from January 2, 1999 to June 16, 2017 (Log.) We backtested the returns to a theoretical portfolio of stocks selected by The Acquirer’s Multiple® from the Canada All TSX stock screen. The backtest assumed the screen bought and held for a year 30 stocks selected from the All TSX universe … Read More

This Week’s Best Investing Reads From Our Top 50 Investing Blogs 2017

Each week Tobias and I pick out the best investing reads from our Top 50 Investing Blogs 2017. Here’s what we’ve been reading: My Friend is Beating Me (The Irrelevant Investor) 14 Things the Market Does Not Care About (A Wealth of Common Sense) Does Momentum Work With Value Investing (csinvesting) There are only … Read More

Howard Marks – Anticipate – And Avoid – Pitfalls That Others Will Rue After The Fact

With the stock market reaching all time highs, maybe it’s a good time to revisit Howard Marks’ memo of 2005 in which he discusses market trends being taken to excess – and the painful consequences that become clear in hindsight. Here’s an except from that memo: “The farther backward you … Read More

Seth Klarman – Beware of Value Pretenders

With so many articles dedicated to the debate on value stocks vs growth stocks I think it’s a good time to revisit what Seth Klarman calls ‘Value Pretenders’ in his best-selling book, Margin of Safety. Here’s an excerpt from that book: “Value investing” is one of the most overused and … Read More