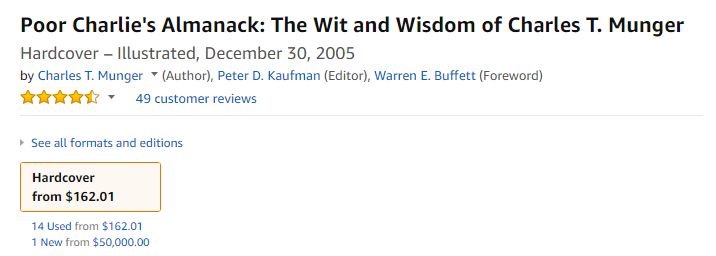

One of my favorite investing tomes is Poor Charlie’s Almanack by Charles Munger. As an investor, it’s the one book you need to read on ‘rational’ investing strategy. A quick look on Amazon shows that there are fourteen used copies selling for $162.01 and one new copy for $50,000. That can’t be right, can it!

One of my favorite parts of the book is Charlie’s discussion on the investment management business and why Berkshire Hathaway is able to do things that other investment managers cannot or will not. Here’s an excerpt from the book:

Most investment managers are in a game where the clients expect them to know a lot about a lot of things. We didn’t have any clients who could fire is at Berkshire Hathaway. So we didn’t have to governed by any such construct. And, we came to this notion of finding a mispriced bet and loading up when we were very confident that we’re right. So we’re way less diversified. And I think our system is miles better.

However. in all fairness. I don’t think a lot of money managers could successfully sell their services if they used our system. But if you’re investing for forty years in some pension fund, what difference does it make if the path from start to finish is a little more lumpy or a little different than everybody else’s. So long as it’s all going to work out well in the end? So what if there’s a little extra volatility.

In investment management today. Everybody wants not only to win but to have the path never diverge very much from a standard path except on the upside. Well that is a very artificial, crazy construct. That’s the equivalent in investment management to the custom of binding the feet of the Chinese women. It’s the equivalent of what Nietzsche meant when he criticized the man who had a lame leg and was proud of ìt.

That is really hobbling yourself. Now. investment managers would say,” We have to be that way. That’s how we’re measured”. And they may be right in terms of the way the business is now constructed. But from the viewpoint of a rational consumer, the whole system’s “bonkers” and draws a lot of talented people into socially useless activity.

And the Berkshire system is not “bonkers.” It’s so damned elementary even bright people are going to have limited, really valuable insights in a very competitive world when they’re fighting against other very bright, hardworking people.

And it makes sense to load up on the very few good insights you have instead of pretending to know everything about everything at all times. You’re much more likely to do well if you start out to do something feasible instead of something that isn’t feasible. Isn’t that perfectly obvious?

How many of you have fifty—six brilliant insights in which you have equal confidence? Raise your hands, please. How many of you have two or three insights that you have some confidence in? I rest my case.

I’d say that Berkshire Hathaway’s system is adapting to the nature of the investment problem as it really is.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: