One of our favorite investors here at The Acquirer’s Multiple – Stock Screener is Bill Miller. Miller served as the Chairman and Chief Investment Officer of Legg Mason Capital Management and is remembered for beating the S&P 500 Index for 15 straight years when he ran the Legg Mason Value … Read More

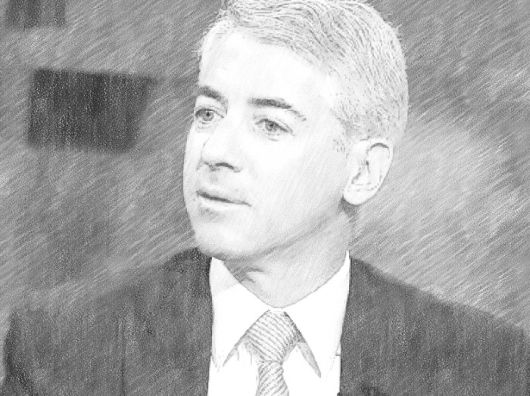

Bill Ackman – How To Apologize to Your Shareholders 101

One of our favorite investors at The Acquirer’s Multiple – Stock Screener is Bill Ackman. Ackman is the Founder and CEO of Pershing Square Capital Management, L.P. From 1993 to 2003, Ackman was the co-investment manager of Gotham LP, Gotham III LP and Gotham Partners International. One of the best … Read More

(Month 6) – Up 4.2% – TAM Deep Value Stock Portfolio

Today is the end of month six of The Acquirer’s Multiple $45,000 – Deep Value Stock Portfolio – Real Money Game, and the portfolio is up 4.2% since inception, compared to 8.85% for the comparative Russell 3000 (INDEXRUSSELL:RUA). The Deep Value Stock Portfolio – Real Money Game means I’m investing my entire superannuation … Read More

Undervalued Micro-Cap Goldfield Corp – Well Positioned For Continued Growth

One of the cheapest stocks in our Acquirer’s Multiple, Small & Micro Cap – Stock Screener is Goldfield Corp (NYSEMKT:GV). With a market cap around $136 million, few investors have ever heard of this great little micro-cap. Goldfield Corporation (Goldfield), is a leading provider of electrical construction and maintenance services in the … Read More

Cliff Asness – Investing Strategies Can Still Work Even If Everyone Knows About Them, Here’s Why

One of our favorite investors at The Acquirer’s Multiple – Stock Screener is Cliff Asness. Asness is the Founder, Managing Principal and Chief Investment Officer at AQR Capital Management. He’s also an active researcher and has authored articles on a variety of financial topics for many publications, including The Journal of … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning March 3rd, 2017” on Storify]

Marty Whitman – Value Investors Should Focus On Fundamental Finance, Here’s Why

One of our favorite investors here at The Acquirer’s Multiple – Stock Screener is Marty Whitman. Whitman is the Chairman and Founder of Third Avenue. He’s recognized as a legend in the world of value investing and has proven for more than 50 years that active, opportunistic investors can find … Read More

David Einhorn – The Ultimate Shareholder Letter When Your Fund Underperforms

One of our favorite investors here at The Acquirer’s Multiple – Stock Screener is David Einhorn. Einhorn is the founder and president of Greenlight Capital (Greenlight), a long-short value-oriented hedge fund. He started his fund in 1996 with $900,000 and generated 16.5% annualized return for investors from 1996 to 2016. As of … Read More

Seth Klarman – 30 Timeless Investing Lessons

One of our favorite investors here at The Acquirer’s Multiple – Stock Screener is Seth Klarman. Klarman is a value investing legend who runs The Baupost Group, one of the largest hedge funds in the U.S. He also wrote one of the best books ever written on investing called Margin of Safety. Such is … Read More

Barrons – Behavioral Obstacles to Successful Value Investing

We’re always on the look out for the latest value investing news here at The Acquirer’s Multiple – Stock Screener. I recently found a great value investing article at Barron’s by Robert Johnson, the President and CEO of the American College of Financial Services. Johnson writes, “In an ADHD world, patience is, … Read More

Undervalued and Undiscovered Flanigan’s Enterprises Inc. Well Positioned For Growth

One of the cheapest stocks in our Acquirer’s Multiple, Small & Micro Cap – Stock Screener is Flanigan’s Enterprises, Inc. (NYSEMKT:BDL). With a market cap around $46 million, few investors have ever heard of this great nano-cap. Flanigans Enterprises, Inc. (Flanigan’s) operates a chain of full-service restaurants and package liquor stores in South … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning March 27th, 2017” on Storify]

Seth Klarman – The Price You Pay Protects Your Downside – Here’s How

(Image Source, Investopedia, investopedia.com/news/who-seth-klarman, [Accessed 19 Mar, 2017]) One of our favorite investors here at The Acquirer’s Multiple – Stock Screener is Seth Klarman. Klarman is a value investing legend who runs The Baupost Group, one of the largest hedge funds in the U.S. He also wrote one of the best books … Read More

Howard Marks – Investors Develop Amnesia In The Sharemarket – Here’s Why

One of our favorite investors at The Acquirer’s Multiple – Stock Screener is Howard Marks. Howard Marks is Chairman and Co-Founder of Oaktree Capital Management, the world’s biggest distressed-debt investor. He’s known in the investment community for his “Oaktree memos” to clients which detail investment strategies and insight into the … Read More

Tweedy Browne – Focus On The Knowable While Protecting Mightily Against The Unknowable

One of the value investing firms we follow closely at The Acquirer’s Multiple – Stock Screener is Tweedy, Browne Company LLC (Tweedy Browne). Tweedy Browne, a successor to Tweedy & Co., was first established by Forrest Birchard Tweedy in 1920 as a dealer in closely held and inactively traded securities. … Read More

Undervalued InterDigital, Inc, Well Positioned For Growth In 5G And The IoT

One of the cheapest stocks in our All Investable – Stock Screener is InterDigital, Inc. (NASDAQ:IDCC). InterDigital Inc (InterDigital) designs and develops advanced technologies that enable and enhance wireless communications and capabilities. Since 1972, InterDigital engineers have designed and developed a wide range of innovations that are used in digital cellular and wireless … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning March 20th, 2017” on Storify]

Seth Klarman – Value Investing Doesn’t Apply Only To U.S. Companies

(Image Source, Investopedia, investopedia.com/news/who-seth-klarman, [Accessed 12 Mar, 2017]) One of our favorite investors here at The Acquirer’s Multiple – Stock Screener is Seth Klarman. Klarman is a value investing legend who runs The Baupost Group, one of the largest hedge funds in the U.S. He also wrote one of the best books … Read More

Warren Buffett – Wall Street Makes Billions From Wealthy Investors With A ‘Superiority Complex’

(Image Source, Huffington Post, http://www.huffingtonpost.com/john-g-taft/the-warren-buffett-effect_b_5577685.html, [Accessed 8 Mar, 2017]) One of our favorite investors at The Acquirer’s Multiple – Stock Screener is Warren Buffett, and one of the best resources for any investor are the Berkshire Hathaway Inc. Shareholder Letters. In his 2016 letter Buffett explains how Wall Street firms generate … Read More

Undervalued Vectrus Inc, FCF/Price Yield 15%, Solid Prospective Pipeline and Backlog

One of the cheapest stocks in our All Investable – Stock Screener is Vectrus Inc (NYSE:VEC). With a market cap of $240 million, this micro-cap remains undiscovered by a lot of investors and too small for investment by large institutions. Vectrus provides infrastructure asset management, information technology and network communication services, and logistics … Read More