One of the new weekly additions here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, and Howard Marks. The top … Read More

Bill Ackman: How To Identify Great Businesses For Investment

Here’s a great interview by Advisor Perspectives with Bill Ackman. During the interview Ackman discusses his investment strategy, how to define a great business, how to construct a portfolio, the importance of an active approach to investing, and why maintaining a high public profile is important in the execution of … Read More

Prem Watsa: We Think This Will Be A ‘‘Stock Pickers’’ Market In Which A Value investor Like Us Can Thrive

We’ve just had a read through the latest annual shareholder letter from Fairfax Financial Holdings in which Prem Watsa is predicting a rosy future for value investors. Here’s an excerpt from that letter: I like to review all our annual reports before I begin writing the most recent one. I … Read More

Seth Klarman: What Is An Appropriate Margin of Safety Before Making An Investment

Margin of Safety, by Seth Klarman is one of the best books ever written on investing and a must read for all investors. One of the most important investing concepts discussed in the book is the ‘margin of safety’, popularized by Ben Graham. Seth Klarman describes the ‘margin of safety’ … Read More

Carl Icahn: The Genesis Of The Great Corporate Activist

One of the best books written about Carl Icahn is King Icahn: Biography of a Renegade Capitalist, by Mark Stevens. The book is the story of a man who rose from humble beginnings to emerge as one of the the most powerful activists in corporate America. Two passages in particular encapsulate … Read More

This Week’s Best Investing Reads

Here is a list of this week’s best investing reads: Goldilocks And The Liquidity Bears (The Felder Report) The Race to A Trillion (The Irrelevant Investor) What Really Fueled The Bull (The Reformed Broker) Half Life: The Decay of Knowledge and What to Do About It (Farnam Street) The Power of Narrative (A Wealth of Common Sense) Ironies of Luck (Collaborative … Read More

Acquirer’s Multiple Stocks Appearing In Dalio, Greenblatt, O’Shaughnessy Portfolios

One of the new weekly additions here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, and Howard Marks. The top … Read More

Mohnish Pabrai: How To Calculate DCF Simply And Compare Prospective Investments

One of the best books written on investing is The Dhando Investor, by Mohnish Pabrai. There’s one passage in the book in which Pabrai demonstrates how to calculate intrinsic value simply, and how you can use the calculation to compare prospective investments. Here’s an excerpt from the book: The advantages … Read More

Walter Schloss: What Kind Of Stocks Do We Look At For Investment

In 1993 Walter Schloss gave a great presentation called – Upper Level Seminar In Value Investing, at the Columbia Business School. Schloss’ notes for the presentation included a number of timeless investing lessons including the kinds of stocks he looks at for investment, how to scale into an investment, and … Read More

Jesse Livermore: 10 Investing Lessons From Reminiscences Of A Stock Operator

Reminiscences of a Stock Operator, by Edwin Lefevre, is a classic investing book that focuses on the character Larry Livingston. Which is really a depiction of Jesse Livermore, one of the most highly regarded traders of all time. The book provides a number of classic investing lessons to help investors deal with … Read More

This Week’s Best Investing Reads

Here’s a list of this week’s best investing reads: Now or Later? (The Irrelevant Investor) Fear and Greed are Undefeated (The Reformed Broker) Friction: The Hidden Reality of What Holds People Back (Farnam Street) Some Finance Phrases I Find Annoying (A Wealth of Common Sense) Spinoffs – A Favorite Of Joel Greenblatt (ValueWalk) How a volatile stock market turns investors … Read More

Acquirer’s Multiple Stocks Featuring In Dalio, Greenblatt, Miller Portfolios

One of the new weekly additions here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, and Howard Marks. The top … Read More

Ray Dalio: To Be Successful In The Markets You Have To Be An Independent Thinker

Here’s a great interview with Ray Dalio at Bloomberg in which he discusses China, Europe, US Inflation, and his investment strategy. Near the end of the interview (12:48) Dalio says, “In order to be successful in the markets you have to be an independent thinker”. Here’s an excerpt from the interview: … Read More

Philip Fisher: How To Avoid One Of The Biggest Mistakes Made By Investors

One of the best books ever written on investing is Common Stocks and Uncommon Profits, by Philip Fisher. The book is a must read for all investors. There is one passage in the book in which Fisher discusses one of the biggest mistakes made by investors due to their ego, … Read More

HBS – Activist Investors: The Untold Story

Here’s a great article at the The Harbus. The Harbus is the independent, non-profit news organization of Harvard Business School. The article provides some great arguments against the perception that all activist investors are short term focused, aggressive, and meddlers. Here’s an excerpt from that article: Ask many HBS students about the … Read More

Charles Munger – Sometimes We Sell Stocks Because We Feel Like It!

We’ve just been watching Tom Russo’s recent talk to the folks at Google. Just at the end of his presentation (52:39) Russo recalls a great story about Charles Munger getting a bit peeved when he was questioned by a member of the audience at a Wesco annual meeting about why … Read More

How To Apply Walter Schloss’ Successful ‘Approach’ To Investing In 2018

I know what you’re thinking. How could Walter Schloss possibly be successful in 2018 when his investment career was built on finding net-net stocks? While I agree that net-nets have all but disappeared if we substitute his net-net ‘metric’ for our own 2018 ‘metric’ there’s a lot more to Schloss’ … Read More

This Week’s Best Investing Reads

Here is a list of this week’s best investing reads: Questions For the Next Bear Market (A Wealth of Common Sense) The Falling Marginal Productivity of Debt (csinvesting) The ‘Index Of The Volume Of Speculation’ Hits A New Record High (The Felder Report) Why Doesn’t More Money Make Us Happy? (The Irrelevant Investor) The Next Warren Buffett Will Be … Read More

Acquirer’s Multiple Stocks Featuring In Dalio, Greenblatt, Simons Portfolios

One of the new weekly additions here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Ray Dalio, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, and Howard Marks. … Read More

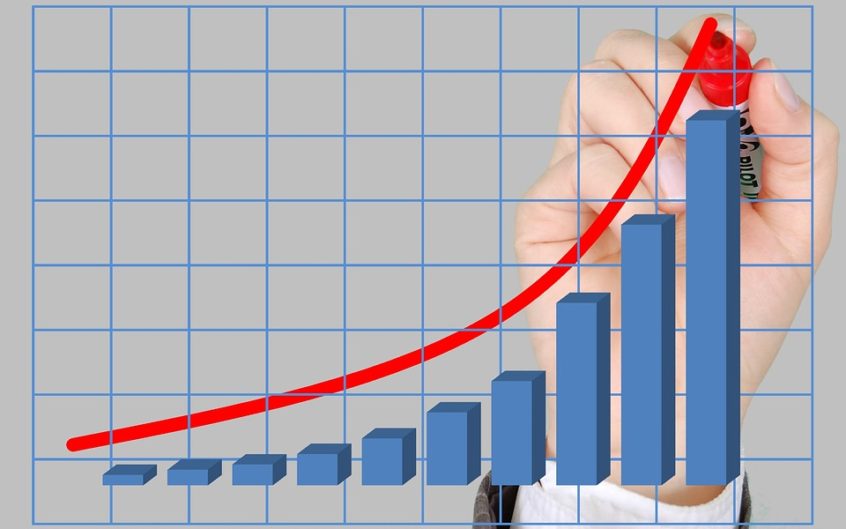

Outperformance Means Living Through Periods of Underperformance

In Berkshire Hathaway’s latest annual shareholder letter Warren Buffett provides a great illustration of how price randomness in the short term can obscure longterm growth in value. His following real-life example demonstrates that in order to achieve longterm outperformance investors must suffer through periods of significant underperformance. Here’s an excerpt … Read More